Transportation capacity remains on a downward trajectory while prices and utilization are “increasing at an increasing rate,” according to a supply chain survey released Tuesday.

The transportation capacity subindex of the Logistics Managers’ Index (LMI) increased 560 basis points to 40.5% in August, meaning available transportation capacity was still shrinking during the month, just at a slower rate.

The LMI is a diffusion index wherein a reading above 50% indicates expansion and a reading below 50% indicates contraction.

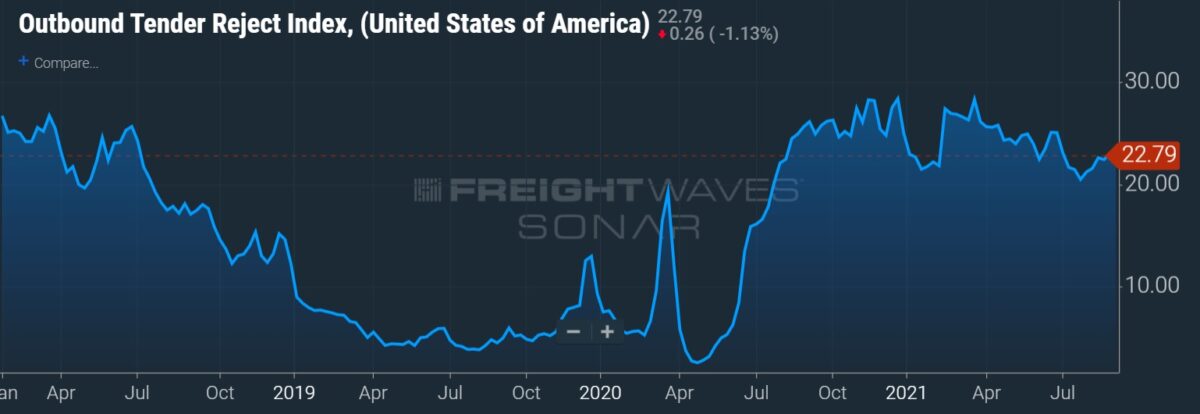

The LMI capacity index has contracted for 15 consecutive months. The data is similar to FreightWaves’ Outbound Tender Reject Index (SONAR: OTRI.USA), which shows truckload carriers started to reject loads under contract at a higher clip starting around the same time.

Overall, the LMI was down 70 bps to 73.8% in August, still well into expansion territory and the fifth-highest reading recorded in the history of the dataset.

“The LMI is a change index, not a measure of absolute growth,” the report read. “So the fact that the logistics industry still displayed this high rate of growth after expanding so rapidly in the two previous months speaks to the unprecedented stretch of growth we are currently observing.”

The index averaged 74.4% from June through August, the highest three-month period on record, and has now been higher than 70% since February.

“We have never before observed such an extended streak of growth in the LMI,” the report continued. “It will be interesting to see how much longer supply chains can take this type of pressure — especially given that peak season is just beginning.”

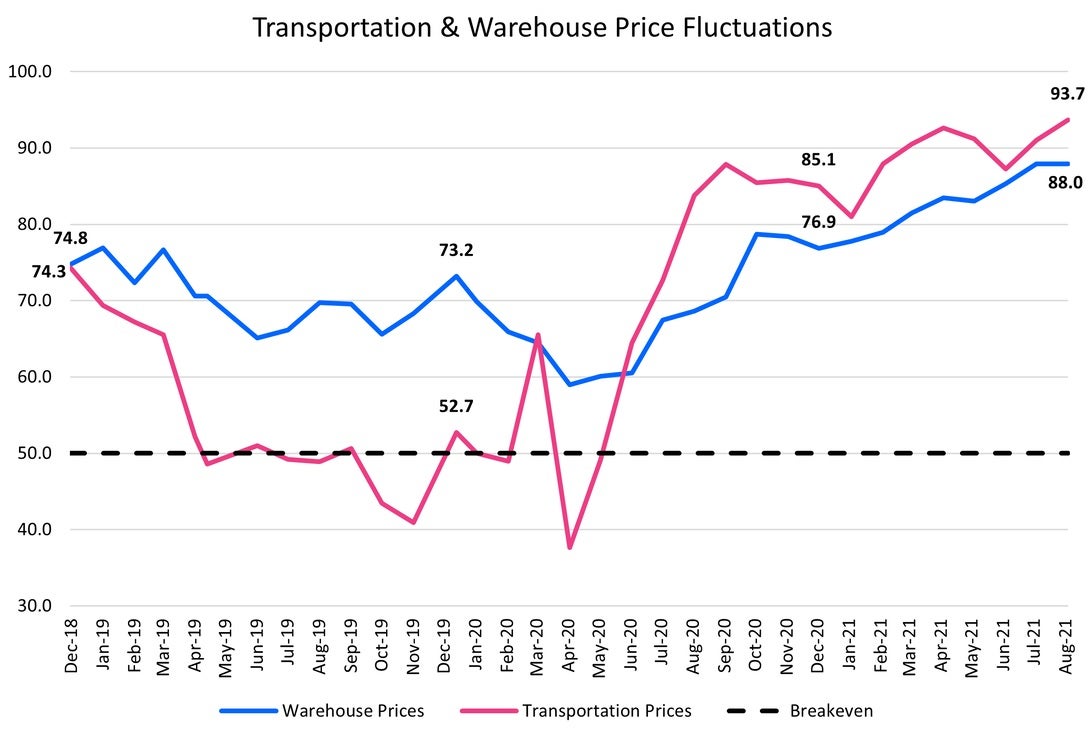

The LMI subset for transportation prices increased 270 bps to 93.7%, a high not seen since the 2018 freight cycle, while transportation utilization jumped 510 bps to 72.6% during the month.

“By any measure, this summer has seen unparalleled rates of expansion in the logistics industry — largely driven by rapid price growth and significant tightening of capacity.”

Survey respondents also indicated “the expectations of continued transportation price increases for the next 12 months remain very strong.” The forward-looking index for pricing was 87.4%, 660 bps higher than the July reading.

The LMI report pointed to several factors that continue to drive the growth.

A heavy flow of inbound containers, as providers try to catch up on depleted inventories and consumers remain active, is driving the demand side. Delays at the ports and on the rails, and a lack of equipment and trucks, is keeping capacity stretched and prices high.

Warehousing feeling the pinch

Warehousing capacity declined 200 bps to 39.1%, marking a full year that available warehouse space has been declining. A lack of labor was cited as an issue with capacity.

“More warehouse and logistics labor will be needed to deal with peak season,” the report stated, cautioning that “companies are less optimistic now about a rush of new workers coming in when the enhanced unemployment benefits expire in September, leading some firms to increase wages.”

Labor headwinds and parts shortages may be weighing on warehouse utilization, where expansion slowed 420 bps to 66.3%.

Companies closer to the consumer utilized space at a rate much higher than upstream manufacturers and suppliers. The difference between the two groups was 26.2 percentage points, suggesting “retailers are currently utilizing every inch of space available as they attempt to stage goods as close to consumers as possible, while also building up inventories in advance of Q4 to avoid shipping delays.”

The warehousing prices index remained at the all-time high of 88%.

“The continued tension in the warehousing market is reaching epic proportions, and the pressure is not relenting. In fact, given the decreased capacity, it may be getting worse,” the report stated.

Inventory up on an absolute comp but not sticking around long

Inventories are up but they are not keeping pace with retail sales.

Inventory costs (85.9%) remain near prior record growth rates but inventory levels (63.8%) are growing at a more subdued pace. The implication is that product is moving through the supply chain rapidly as retailers take on merchandise but it is being converted into sales more quickly as consumer demand remains high.

“We have a situation in tight capacity across all aspects of the supply chain combined with firms frantically attempting to build up inventories to avoid shipping-related stockouts during Q4,” the report added. The combination is “driving prices up exponentially.”

“Ironically, when firms order more inventory than normal to avoid shipping delays, they are actually overwhelming carriers and likely causing further shipping delays, creating a negative feedback loop.”

The report questioned how long the supply-demand dynamic will last.

“The rapid increase in container prices seems to suggest that supply chains have reached an inflection point in which the strain on capacity is now leading to sharp price increases which will eventually lead to a market correction in the form of significantly increased capacity. The key question firms now face is what to do while we wait for that additional capacity to come online?”

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.

Freight expediting LLC

**Expect to see capacity take a nosedive just as the demand is skyrocketing.. The Biden vaccine mandates are going to cause a huge loss of drivers in the industry again, just like the ELD mandate has done.

Gary hoffman

Where is the most money to be made at while driving truck. Is it company work or is it lease purchase

FLE+LLC

Neither. Buy your own or you’re still a company slave.

miced

I’m making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I

decided to look into it. Well, it was all true and has totally changed my life. This is where i started…….. www.jobs70.com

Stephen Webster

Last year the gov should have provided limited aid and insurance to smaller trucking companies and bus companies and paid upto the first 1 million dollars plus set minimum freight rates instead of wage subsidy to large trucking companies and we would not have a shortage. E logs have made 20 percent of the truck drivers leave the industry and made trench foot a big problem in Ontario Canada.

I noticed

Undercover agents claiming to be the FBI or police tell everyone to pull over for a vaccination check they come out at night in their fake owner operator trucks saying your not delivering to the receiver your delivering to a warehouse that will ship it overseas. We’re the Government we’re dismantling your distribution system. Let insurance pay for not delivering the load.

Larry

This is a great example of what can trigger a Reasonable Suspicion drug test.

WTF