Growth throughout the supply chain slowed again in June, a monthly survey of logistics supply executives released Tuesday showed.

The Logistics Managers’ Index registered a reading of 65 during the month, a 2.1 percentage point decline from May and the lowest level recorded since July 2020. The latest reading was a quick descent from the all-time high of 76.2 recorded in March.

A reading above 50 indicates expansion while a reading below 50 indicates contraction.

“The steep decline is reflective of what we have seen in the overall economy in the last three months, moving from the record-setting expansion of the last 18 months to the greatly subdued level of growth observed throughout Q2,” the report read.

The data set showed that trends continued to cool in the transportation space.

Transportation capacity (61.7) continued to grow, albeit at a rate that was 3 percentage points lower than in May. The transportation prices index (61.3) fell by 4 percentage points. The prices index was well off the all-time average of 74, with the report noting that when the indexes invert, and prices are below capacity, “it often means a serious economic shift has taken place.”

This was the first month the capacity index was ahead of the price index since the early days of the pandemic.

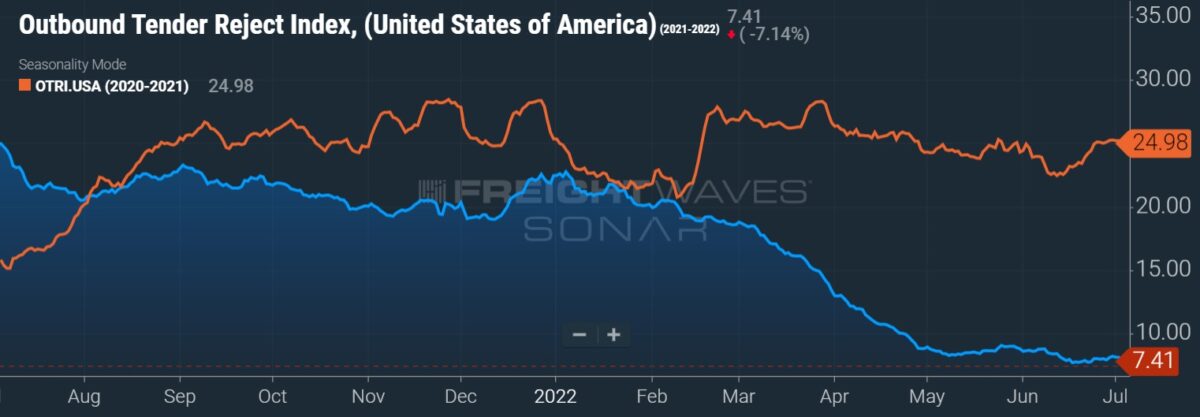

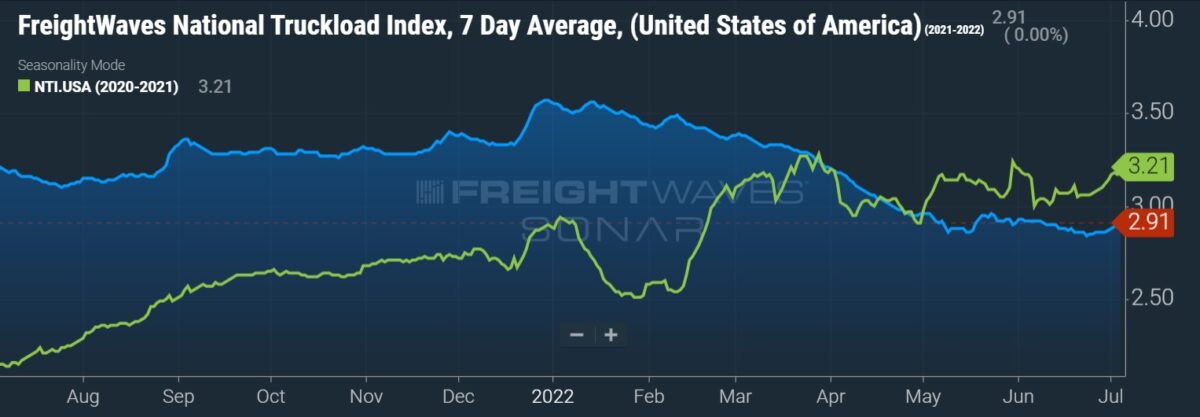

The changes in transportation capacity and pricing have also been captured in FreightWaves’ trucking data.

A proxy for truck capacity, the Outbound Tender Reject Index (SONAR: OTRI.USA), shows the number of loads being rejected by carriers. The index has fallen to just 7.4% compared to a year ago when fleets were rejecting roughly 25% of loads under contract. The National Truckload Index (SONAR: NTI.USA), a seven-day moving average of booked spot dry van loads inclusive of fuel across 250,000 lanes, has fallen significantly from highs recorded earlier this year.

The report noted the recent slowdown in transportation market dynamics still pales in comparison to the 2019 downturn.

“We are also a long way from 2019-type readings in Transportation Prices,” the report stated. “While this is the lowest this metric has been in two years, it is nowhere close to the streak of six consecutive months of contraction we observed from May to November of 2019.” Of note, however, higher fuel prices have helped to prop up transportation costs during the current cycle.

The transportation utilization index (58.4) fell to the lowest level captured in two years. The index was down 5.9 percentage points from May but remained in expansion territory. Readings on the utilization index dipped to the high 40s and low 50s during the 2019 downturn.

“Transportation Prices have always been a bellwether for economic activity. Transportation Prices are more dynamic than any of our other metrics and often lead the other cost metrics. However, we should once again point out that Transportation Prices have not yet dipped into contraction as they did in 2019,” the report said.

“Whether or not they eventually do enter a state of contraction and whether the other costs will continue to slow their rates of expansion as well remains to be seen.”

Inventories up, warehouse space tight

Inventory levels (71.8) were up 2.5 percentage points and above 70 for the fifth time this year. In comparison, there were only two readings above 70 between 2016 and 2021. The cost to carry inventory increased but at a slower rate. The inventory costs index logged a reading of 83.8, down 4.3 percentage points from May and the lowest reading since May 2021.

Increased merchandise levels have been met by high occupancy rates at warehouses and a lack of available storage space.

The warehousing capacity index stood at 41 during the month, 4.9 percentage points lower than in May. The index has contracted for 22 straight months.

“Warehousing capacity comes online much slower than transportation capacity, and it seems as though storage was not as overbuilt during the last two years,” the report said. “When combined with the continued strength of e-commerce and the high levels of inventory, we are not seeing the dramatic price drops for warehousing that we are seeing with transportation.”

Warehousing prices (78.4) and utilization (69.1) remained in growth mode but were both down from the prior month.

The LMI is a collaboration among Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University and the University of Nevada, Reno, conducted in conjunction with the Council of Supply Chain Management Professionals.

More FreightWaves articles by Todd Maiden

- J.B. Hunt to expedite delivery of new containers, customer freight

- E-commerce transportation provider TLSS adds JFK Cartage to portfolio

- Saia advances terminal growth initiative