Truck fuel economy improves, according to NACFE Fleet Fuel Study

On Monday, the North American Council for Freight Efficiency released its 2024 Fleet Fuel Study, which saw truck fuel economy participants gain 7.77 mpg compared to the national average of 6.9 mpg in 2023. The 14 fleets that participated in the 2024 Fleet Fuel Study operated 75,000 trucks and saved an estimated $512 million in 2023 compared to the average number of trucks on the road when accounting for fuel cost savings per tractor.

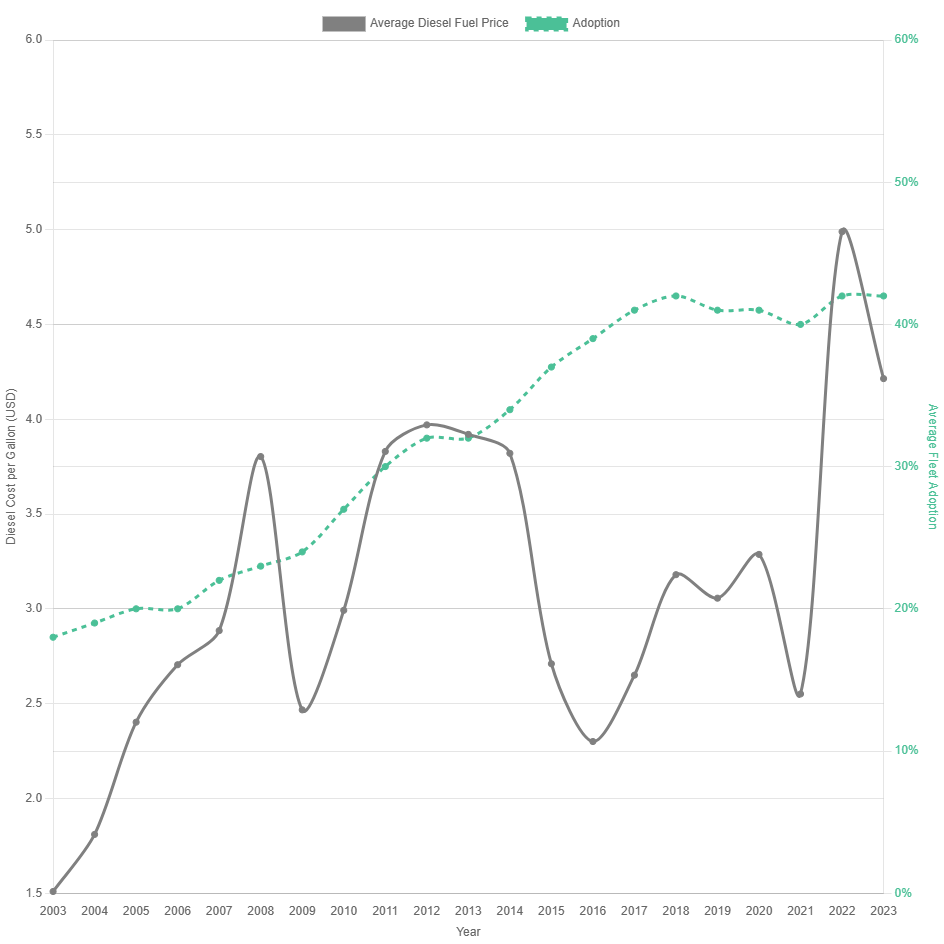

The NACFE study looks at the adoption rate of 86 technologies that improve freight efficiency, with fuel representing a large portion of fleets’ operating costs. Regarding those technologies, more fleets are adopting them than in decades past. Yunsu Park, director of engineering at NACFE and the study’s lead author, said in the release, “The overall adoption rate for the technologies studied in this report has grown from 17% in 2003 to 42% in 2023.”

Part of the reason for the efficiency gains comes from more fuel-efficient tractors. The report notes that fleets using newer trucks with better fuel economy came in part from more stringent greenhouse gas emissions regulations. A headwind for fuel efficiency is a shift in shorter routes and more regional hauls, as trucks spend more time during their trips driving on non-interstate routes and local roads.

A novel fuel-saving solution came from changing a tractor’s color. The Commercial Carrier Journal’s Jason Cannon wrote, “Dave Schaller, NACFE director of industry engagement, noted a shift away from dark tractor paint to white and grey was among the low- or no-cost solutions deployed by fleet participants. Researchers at the Berkeley Lab Environmental Energy Technologies Division (EETD) have shown that lighter colors reflect more sunlight and lessen the load on the HVAC system.”

ATRI releases trucking congestion cost data

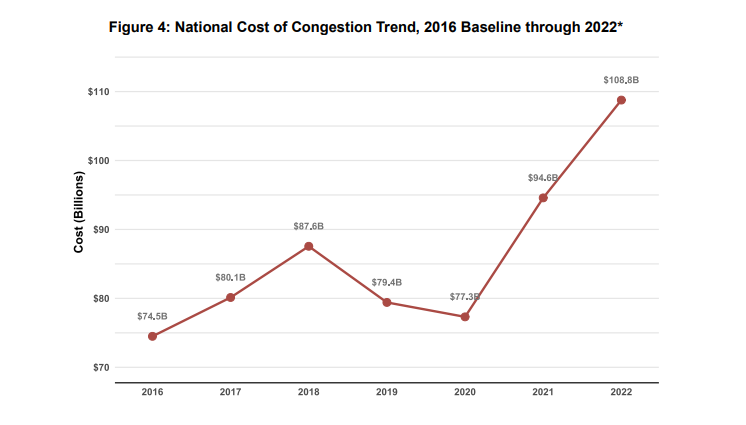

The American Transportation Research Institute recently released its 2024 update to its Cost of Congestion to the Trucking Industry report, which examined congestion using average truck speeds, truck volumes, and operational costs. According to the survey results, released Wednesday, highway congestion cost the trucking industry $108.8 billion in 2022, up 15% from $94.6 billion in 2021. The report said, “This level of delay is equivalent to more than 430,000 commercial truck drivers sitting idle for one work year and an average cost of $7,588 for every registered combination truck.”

More congestion also led to more fuel wasted. FreightWaves’ John Gallagher writes, “ATRI also estimated that the trucking industry wasted over 6.4 billion gallons of diesel fuel in 2022 due to congestion, resulting in $32.1 billion in added fuel costs, which released an additional 65.4 million metric tons of carbon dioxide.”

The federal government has attempted to address these congestion concerns through the passage of the Infrastructure Investment and Jobs Act (IIJA) back in 2021, which devoted $52 billion to highways through various programs. Local governments spent an additional $180 billion during that year, with a combined government spending approximately 0.92% of the Gross Domestic Product (GDP). The problem, the report notes, is that some of these programs were targeting the wrong things. The report notes, “It is not clear whether all this infrastructure investment was adequately targeted to traffic congestion hotspots and bottlenecks, which is where strategic investments are most needed.”

FMCSA speed limiter proposal pushed to May 2025

The Federal Motor Carrier Safety Administration recently released its latest regulatory agenda, which saw a proposal to require speed limiters on commercial vehicles pushed to May 2025. Mark Schremmer with Land Line writes, “With a new administration taking control in January, however, it is fair to say the rulemaking’s chances of survival appear low.”

Jay Grimes, director of federal affairs at OOIDA, is also optimistic, based on the first Trump administration’s shelving of the speed limiter proposal in 2016. Grimes told Land Line Now, “Based on the lack of action to push forward with a speed limiter mandate in Trump’s first administration, I don’t think it is going to be a high priority for them to advance the current supplemental notice of proposed rulemaking.”

The FMCSA revived the speed limiter rulemaking back in 2022 but has missed multiple target dates for releasing a notice of proposed rulemaking. Another potential roadblock for speed limiters is the DRIVE Act, a bill with 12 co-sponsors in the Senate and 42 in the House, all of whom are Republicans. Sen. JD Vance, the incoming vice president had also pledged support for the DRIVE Act, which would prohibit the FMCSA from, “promulgating any rule or regulation to mandate speed limiters.”

SONAR spotlight: Outbound tender rejection rates at the highest level since July 2022

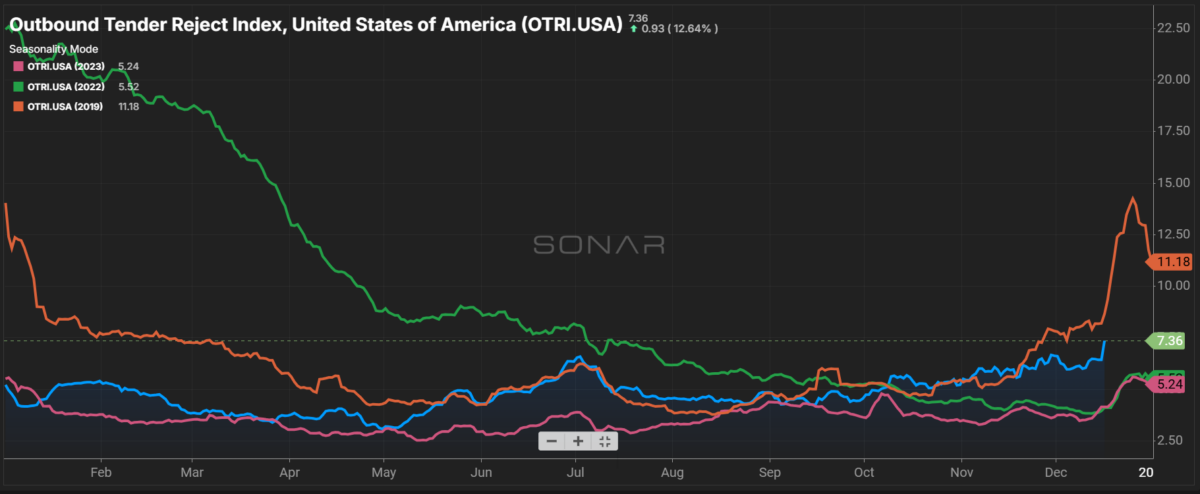

Summary: Nationwide outbound tender rejection rates continue to rise and have reached levels not seen since July 2022. Peak season paired with less truckload capacity and shipper fears of possible tariffs has created more positive conditions for carriers not seen in over two and a half years. In the past week, the OTRI rose 136 basis points from 6% on Dec. 9 to 7.36%. OTRI is 140 bps higher than last month and 321 bps higher than Dec. 17, 2023, at 4.15%. Broken down by segment, dry van outbound tender rejection rates rose 126 bps w/w from 5.39% to 6.65% while reefer posted a larger w/w gain of 395 bps from 12.95% to 16.9%.

Threats of tariffs and the uncertainty surrounding their implementation continue to weigh on shippers. Anecdotally one large truckload carrier noted in conversations with shipper and freight forwarder partners that some have started to pull forward some shipments, with others making contingency plans if tariffs come online. This carrier also noted shippers changing the length and duration of their RFPs as they attempted to lock in lower rates for longer.

Expect higher outbound tender rejection rates throughout the week as truckload carriers position their assets closer to their home locations for Christmas and New Year’s.

The Routing Guide: Links from around the web

New Data Implies Tighter Freight Capacity Than Official Job Numbers Suggest (Truckinginfo)

First-half 2025 dry van truckload outlook: Improving conditions ahead (Supply Chain Management Review)

Despite win on appeal, TQL wants Supreme Court to review broker liability issue (FreightWaves)

DAT acquires Trucker Tools, leadership speaks on tech goals for 2025 (FreightWaves)

Supreme Court won’t review Ohio case, boosting California’s emissions rules (FreightWaves)

New drug hair testing guidelines delayed until May 2025 (FreightWaves)