Most of the truck drivers responding to a recent survey by the American Transportation Research Institute (ATRI) are happy with the type of organization they work for – whether they are a company driver, an independent contractor leased on to a carrier, or an owner-operator with their own operating authority.

But one sector of the commercial driver industry that was underrepresented in the survey – intermodal drayage – did not take into account the perspective from drivers dealing most directly with current supply chain disruptions at the nation’s ports, particularly on the U.S. West Coast.

Rebecca Brewster, ATRI’s president and COO, acknowledged the under-response from the intermodal drayage sector. She pointed out, however, that ATRI works to market their surveys to as many respondents across the industry as possible. “We have no control over who responds from the different sectors,” Brewster told FreightWaves.

Digging into demographics

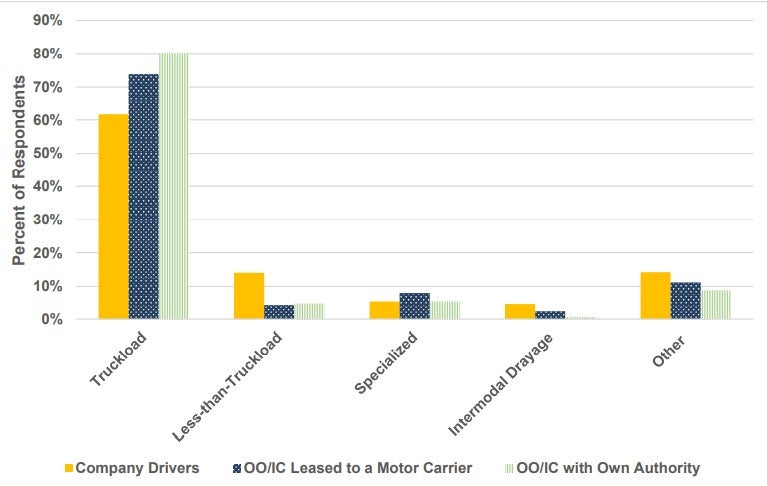

ATRI’s survey, “Owner-Operators/Independent Contractors in the Supply Chain,” garnered responses from 2,097 drivers, a majority of which (66.2%) were OO/ICs, with the remainder reporting as company drivers. Among OO/ICs, 49.2% were leased to a motor carrier and 17% had their own operating authority.

The majority of respondents (81.7%) worked in the for-hire segment of the trucking industry (as opposed to working for private carriers that haul their own cargo).

Among the for-hire respondents across the three categories – company drivers, OO/ICs leased to a carrier and those with their own operating authority – only 4.7%, 2.4% and 0.6%, respectively, were responses from drivers working in the intermodal drayage sector. That compares with 81%, 78.3%, and 85%, respectively, from drivers working in the truckload and less-than-truckload sectors combined.

The Owner-Operator Independent Drivers Association, whose members include intermodal drayage carriers, were asked to assist with survey outreach, according to ATRI. However, “a relatively small number of our members are port drivers,” an OOIDA spokesperson told FreightWaves.

Responding to driver classification

ATRI’s study was conducted in response to the prospect of legislation being considered at federal and state levels – such as AB5 in California – that govern the classification of OO/ICs and their employment status and the effect these laws could have on the industry.

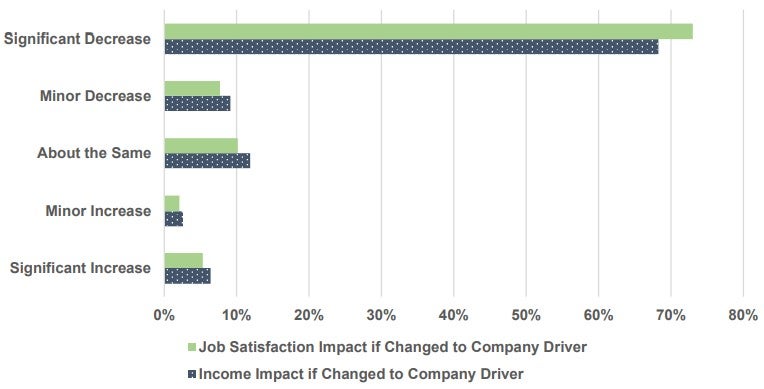

The majority of OO/IC respondents expect they would experience significant decreases in their job satisfaction (73%) and annual income (68.3%) if they were reclassified to a company driver, the survey found.

Company drivers were asked if they aspired to become an OO/IC and if so, how they believed such a change would impact their job satisfaction and pay. Only 17.8% had a desire to become an OO/IC in the future, according to the responses. However, among those who did, 84.9% believe that “they would experience an increase in their income,” with 71.4% believing that their job satisfaction would improve if they became an OO/IC.

Because all the drivers reported a high level of job satisfaction, the survey logically concludes that legislation that would reclassify OO/ICs to company drivers could negatively affect those respondents.

Missing links

But without a significant level of response from the intermodal industry – port truckers in particular – a critical link between driver classification, worker satisfaction and the current supply chain disruptions may be overlooked.

Greg Regan, president of the transportation and trade department of the AFL-CIO, last week testified at a Senate hearing on port supply chain disruptions that misclassifying truck drivers disconnects them from their employer, making them “less attractive jobs and is a key part for why there’s such high turnover rate and why we’re having so much difficulty attracting people to do that work.”

The turnover rate at large truckload carriers (over $30 million in annual revenue) averaged 90% in 2020, down one point from 2019, according to the latest statistics from the American Trucking Associations. The annual average rate at smaller truckload fleets was 69%, down from 72% in 2019.

Mike Munoz, a research and policy analyst with the advocacy group Los Angeles Alliance for a New Economy, correlates driver misclassification with backups at the ports.

Watch now: Status of AB5 (11/22/21)

“The inability of the logistics industry to coordinate with thousands of actors in the port trucking industry creates an inefficient system that’s ripe for abuse,” said Munoz, speaking last week at a press conference on Los Angeles-Long Beach port congestion.

“Drivers wait for hours in long lines, and because they’re misclassified, those hours spent waiting are unpaid. Trucking companies have no incentive to fix the problem because all the costs associated with wait times are borne by the truck drivers – their time, diesel fuel costs, maintenance. When you have a 90% turnover rate at large trucking companies, that should tell us there’s a potential problem.”

Seeking benefits

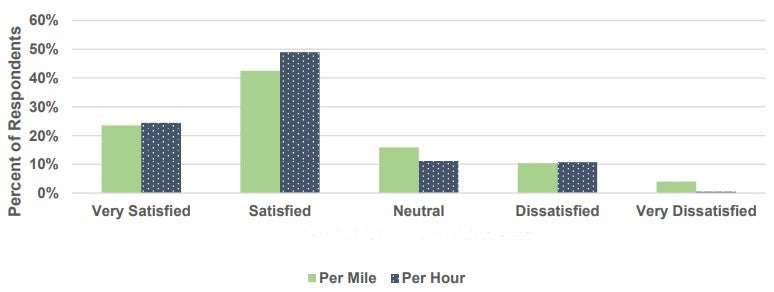

For port truckers, a major motivating factor for wanting to be classified as an employee is the opportunity for company-provided benefits, such as health care and retirement savings plans, and ATRI’s survey revealed that was one area where there seemed to be evidence supporting that.

Fewer than 40% of OO/ICs assigned a high level of importance to health care/retirement savings as a motivating factor to be independent. In addition, only 27% of OO/ICs responding to the survey reported being satisfied or very satisfied with their health care/retirement savings arrangements, compared with 60% of company drivers.

Johnna Crain

[ JOIN US ] My last pay test was 💵$2500 operating 12 hours per week on line. my sisters buddy has been averaging $15000💵 for months now and she works approximately 20 hours every week. i can not accept as true with how easy it become as soon as i tried it out.

copy and open this site .…………>> 𝗪𝘄𝘄.𝗡𝗘𝗧𝗖𝗔𝗦𝗛𝟭.𝗖𝗼𝗺