The trucking apocalypse is upon us, and it has taken its latest victim. This time, it’s a 40-year-old carrier out of California. Timmerman Starlite Trucking Inc. of Ceres, California, announced it would be shutting down, placing 30 employees in the unemployment line effective immediately. Ceres is a suburb of Modesto, California, a mid-sized city 100 miles east of San Francisco. Starlite had a fleet of 30 trucks, 150 trailers and 28 drivers, according to Federal Motor Carrier Safety Administration data.

Owner Colby Bell cited a tough freight market and environmental regulations as the primary factors in the company’s failure, according to the Ceres Courier, which broke the story. Starlite also announced its closure on its Facebook page.

“We tried to provide a healthy work environment for our employees and give them the best wages and benefits we could,” Bell said. “But in the end, the rates that were available did not support the cost structure needed to compensate our employees appropriately.”

The company served clients through an 11-state region stretching from the Rocky Mountains to the Pacific Coast.

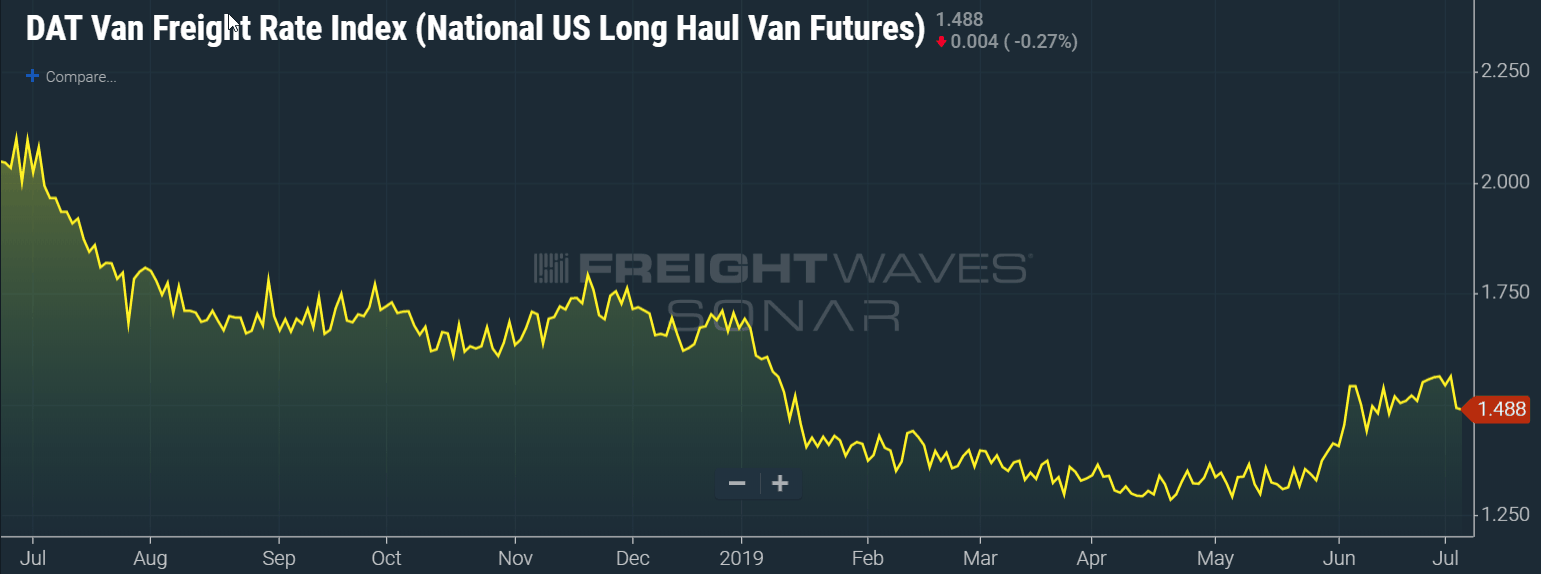

Long-haul trucking spot rates are at their lowest levels in the past few years, off by over 30 percent since last year’s peak.

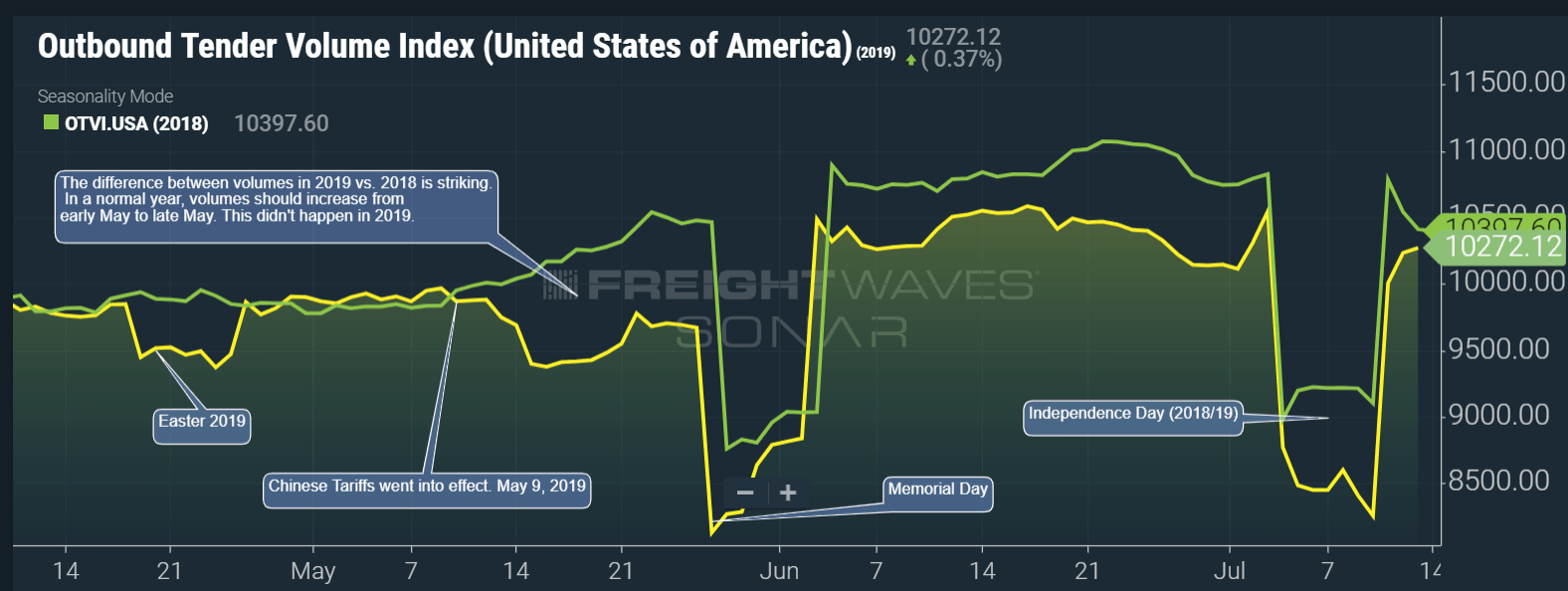

Even more challenging, trucking volumes have been running between 2 percent and 7 percent in equivalent days in 2018, starting with a large drop in mid-May.

While rates and load volumes reflect the demand side of the freight market and paint a picture of the revenue conditions for carriers, the profit story is much worse. In the past two years, carriers have seen significant cost inflation and operational pressure in almost every aspect of their businesses.

Wage increases for drivers have increased by double digits, insurance renewal rates have gone up and equipment is more expensive to maintain. Carriers have been forced to buy electronic logging devices, running their trucks with an inflexible clock.

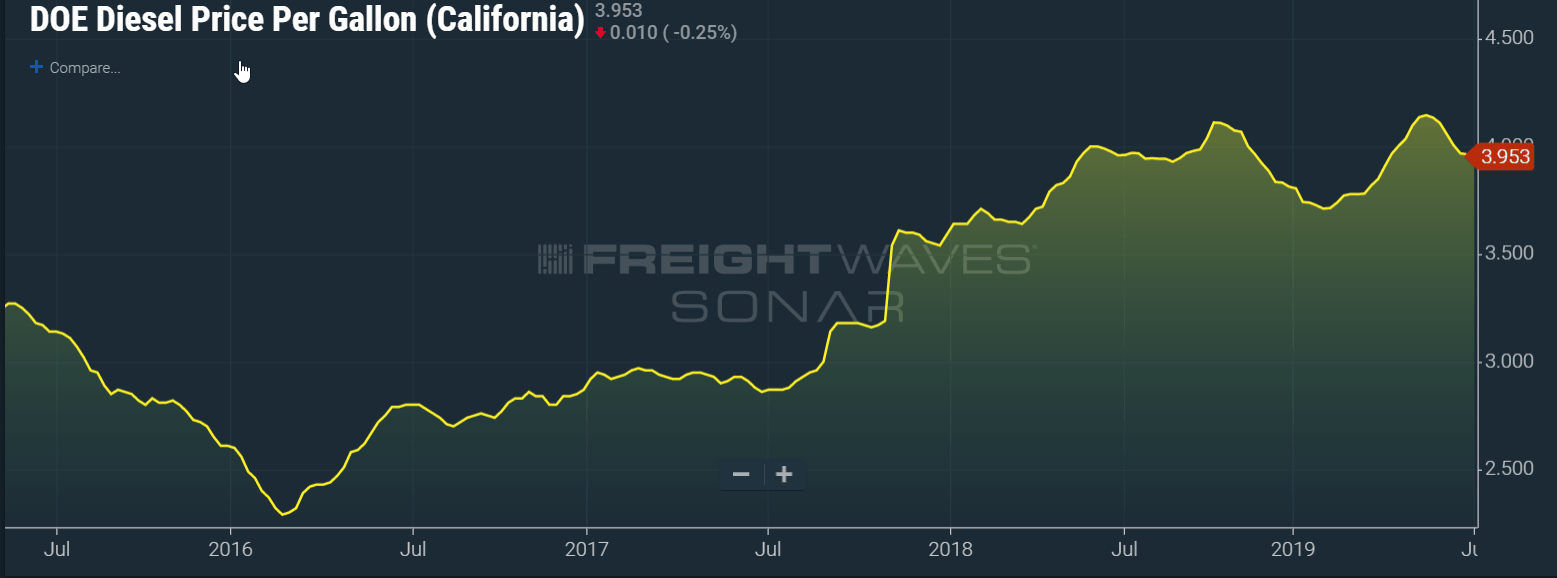

Fuel expenses, particularly in a tax- and regulation-heavy state like California, have also been way up in the past three years. Since February 2016, retail diesel prices in the state have increased from $2.29/gallon to $3.95/gallon, roughly equivalent to $.25 per mile. At $1.49 per mile, this will cost a carrier 17% of their operating profits if they aren’t on a fuel-surcharge program.

Larger carriers are able to recover most, if not all, of this in the form of a fuel surcharge. Unfortunately, Starlite was likely too small to have much leverage of their shipper relationships to do so.

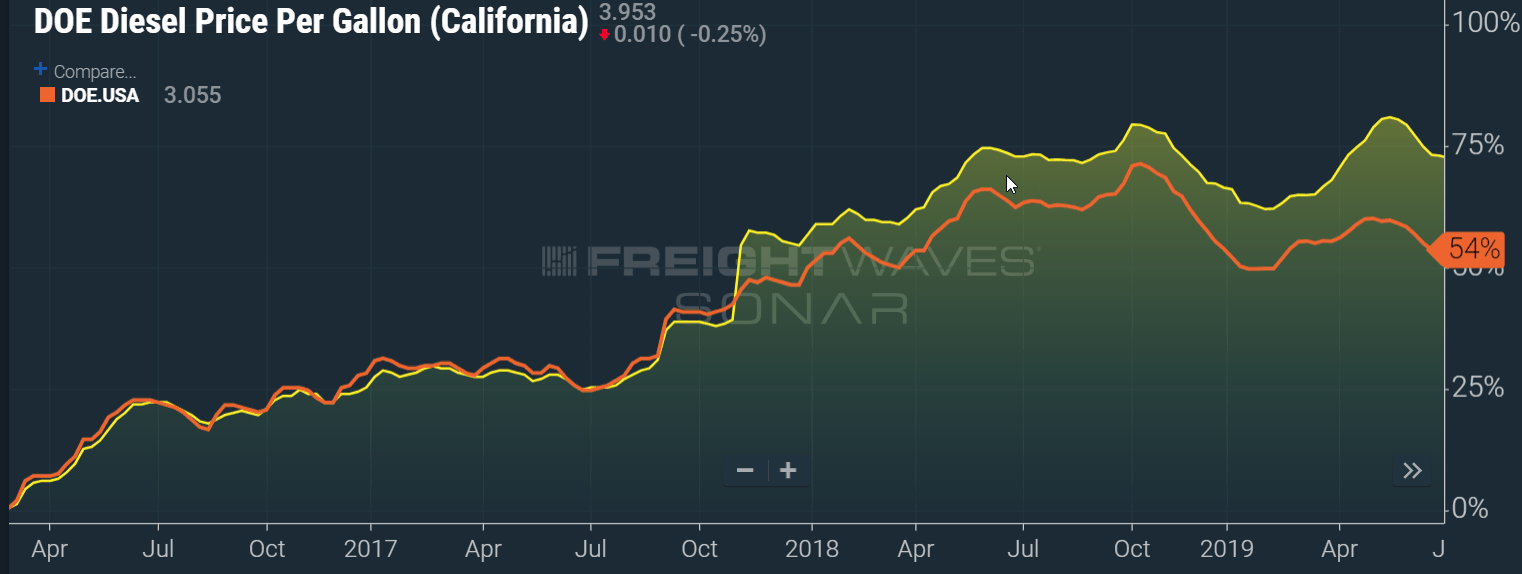

Retail average diesel fuel prices in California have shot up 75 percent since February 2016, while only jumping 58 percent on a national basis during the same period.

California has added two fuel and excise taxes during the period, first with a 20-cent-per-gallon increase in 2017 and another 20-cent increase initiated this July.

If taxes weren’t enough of a burden for California’s operators, the environment czar, the California’s Air Resources Board (CARB), creates its own set of challenges.

For the past decade, CARB has required carriers to buy and operate trucks that operate under a more stringent set of emissions regulations.

In describing the plight of environmental and business regulations on Starlite, Bell was quoted in the Turlock Journal:

“The air’s a lot cleaner today because of the work the industry has done — and we’re proud of that — but the rate structure is [holding arm flat] and the cost structure is like this [arm at an incline]. The family was just in a position where we could not continue to operate without risking financial devastation.

“If you’re an interstate carrier that operates in 50 states and you can make money in 49, you can lose a little in California while the pressure’s on, and over time you know that things are going to equalize. But, yeah, the smaller carriers are stressed. Most of them are family companies. They’re not capital rich and it’s a heavy capital industry to be in. They’re pulling $200,000 worth of equipment and that’s a lot of money when you think about almost a 40 percent increase in costs over the last 10 years but no change in the revenue.”

Few would deny that California has benefited from cleaner air, but tax increases, inflexible labor laws and a litigious court system have all made the operating environment for California-based trucking companies extremely difficult.

Last year, we wrote a commentary: “California’s Hostile Environment for the Trucking Industry.”

California, perhaps more than any other large state, is incredibly dependent on the trucking industry to keep the economy humming. It has a large agriculture industry, a sizable industrial sector and the biggest port in North America, and a third of all jobs in the state are in logistics-dependent industries. Trucking is still the largest logistics mode by far.

While it is too late for Starlite and Bell, chief executive officer of the California Trucking Association Shawn Yardon issued a statement about the closure: “I am saddened to learn of Starlite’s closure and this is further proof that California must take a very hard look at its business environment.”

If you are keeping score, this is the sixth major trucking company failure of 2019. LME, a Midwest LTL carrier, also shut its doors last week.

Skaught

Fascinating article, and even a more fascinating headline.

“Regulations blamed.”

But the majority of the article ISN’T about regulations. Start from the top and read it. Look at the graphs, and read the captions below them.

I’m guessing the hope here is that a headline will be seen, agreed with, and circulated.

The author is “covered” since he provided the data and nobody could therefore claim otherwise. But the author’s obvious intent is to sway opinion on the issue….otherwise the headline would accurately reflect what the article details.

Union76Gal

I’m a former CARB employee who is looking to get involved with associations or companies fighting CARB, the bogus regulations they pass, and their unfair targeting of truckers in California. I watched CARB victimize the trucking industry for a decade, and as a trucker’s daughter, my stomach is still ill from what CARB has done to the hardworking men and women responsible for the transport of goods and services throughout our state. I know how to pull apart their “reports” and where all the holes are in their so-called “socially conscious” regulations. I know where their weak spots are. I’m not looking to hurt or offend anyone, but rather to help prevent hardworking people from having their industry destroyed by bogus science. If you have any leads, please post them and I will surely follow up. Thank you for your time and assistance, and as my daddy used to say, keep on truckin’.

Evil Dwarf Drago

All you whining crybabies have to do is band together and call a national 3 day strike. Just stay home for 3 days and watch America come to a screeching halt. But you’re all too busy squabbling for table scraps while the big carriers laugh all the way to the bank. You ignorant fools never learn. Oh well my Truck I bought new is paid for, along with my house and student loan so if things don’t improve real soon I am selling my rig and venturing off to other opportunities. Good luck chumps!

Luis

We are looking to hire a full-time driver for our company located in McAllen Texas who can run midwest and upper east routes mainly. We got 53 feet newly leased reefers waiting on a pilot. I’m sorry to here this happened and I would like to give an opportunity to someone who’s willing to work hard. We pay by the mile with the option of bringing loads back and get a percentage. Shoot me a text ig you are not willing to give up on work 956-414-3255

TheBloodNinja

Sounds like a typical socialist state. If you can’t seize the means of production by means of outright confiscation, seize it by means of legislating it to death.

MrSatyre

Last year, we wrote a commentary about California’s hostile environment for the trucking industry labeled “California’s Hostile Environment for the Trucking Industry.”

Brought to you by the Department of Redundancy Department. ?

BRUCE R Brown

This country needs to start supporting the trucking industry and lower the fuel cost for truckers. Lower their insurance costs lower their licence tabs lower the truckers costs so they can make a living do you want to loose all these trucking companies? Soon there will be no trucks to deliver the freight in this country and all the people in this country will be without anything Or without fuel for their cars and trucks. No more lumber to build home’s no more water to drink no more food no more car’s or truck’s no more heating oil to heat your home’s in the winter no more of anything. The store shelves will be empty the gas station’s will have no gas the drug store will have no more medication for you or your children the hospitals will have no place for you. The city you live in will not be able too plow your street’s in the winter. Farmers will have no way to grow their crops no way to get them to market if they can grow them. Soon this country will just die off. Is that what the people of this country want? Do you want no more off anything. Then stand up for these truckers and help get their costs lowered.

Rotund Rider

Or their revenue raised. You have a better shot at that. The big guys can undercut you and starve you out. Maybe time to think about a little re-regulation?

oralia ornelas

Think it’s time that the P.U.C. get back in the game and regulate the rates like they once did many many years ago. Until then it will only get worst. They can regulate the heck out of this industry and the only way the industry will survive is straight across the board the rate needs to increase and the only way we can achieve this is if it were regulated. Until then, especially in Ca. the trucking industry will suffer and many will be forced to go out of business. Come on America, get with the program P.U.C needs to get involved what is it gonna take to get with it and make it a great industry again.

Steven

Truckers eat each other alive!!!!

Just like sharks in that big ocean….

And those interested in this process knows that first hand.