Trucking carriers continue to exit the market, citing a variety of reasons including the regulatory environment, low rates, inflated wages and high insurance costs. To date, there is little to suggest that capacity has bled off enough to materially affect spot rates – most of the discussion with private and public third-party logistics providers this summer has been around very loose capacity.

That may be changing. Market data and anecdotes from freight brokers now suggest that enough trucking capacity has exited the industry to support a floor under the spot market. Price, of course, is a function of both supply (trucking capacity) and demand (freight volumes), and the supply side is the hardest to get a handle on.

FreightWaves is aware that capacity is continuing to leave the market, that the supply of trucks is decreasing, not increasing, both directly and indirectly. Publicly announced carrier shutdowns continue at a steady clip. Truckers are defaulting on fuel card payments at an accelerating pace.

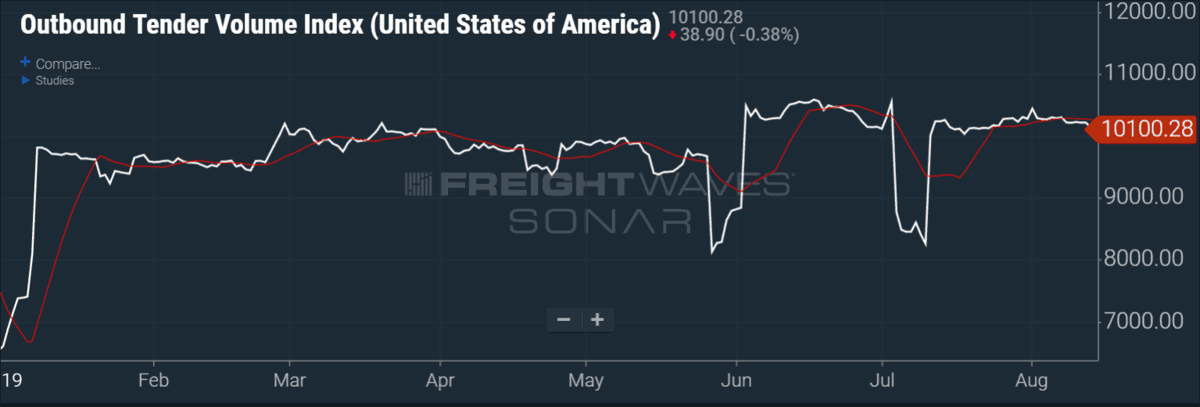

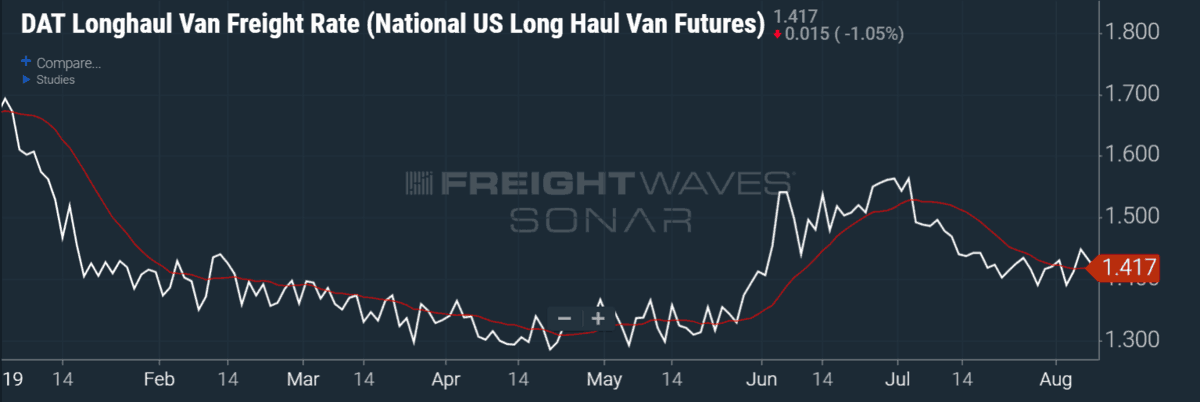

Meanwhile, volumes have softened slightly (OTVI.USA) — though are still up two percent year-over-year — while spot rates remain steady (DATVF.VNU). If demand has fallen incrementally but price has not, that’s an indirect signal that supply must also still be falling.

For those readers following our ‘freight recovery’ thesis, we first broached this idea on July 31 and found new evidence to support it on August 13 (link below).

Earlier this week, a freight brokerage executive reached out to FreightWaves with a vivid anecdote of exactly how contracting capacity supports higher rates.

“A very large shipper sent this to us yesterday, updating our spot on the routing guide,” the broker wrote in a text message, before quoting the message from the shipper. “‘The awarded carrier we had assigned to these lanes went out of business. You are the next provider in line,’” the shipper’s message said.

In other words, the shippers’ primary carrier priced the lane so aggressively it ran itself out of business. FreightWaves is not suggesting that running those specific lanes under operating cost caused the failure of the company, but it speaks to the kind of business results that can be experienced by transportation providers choosing to compete on price.

Regardless, the result is that the cheapest carrier went out of business and the shipper then had to move the secondary provider up the routing guide, presumably at the same rate that got the provider put into the second position. Capacity left the market and the price the shipper is paying, at least on those lanes, has increased. While it’s just an anecdote, it’s the first concrete example of a loss of capacity that has supported higher rates.

Other brokers are reporting that carriers are less willing to go into unfavorable markets and that they are taking losses on lanes they may have underbid. This week there has been data on $1,000 loser loads consistently going into the Northeast, Phoenix and Florida. What’s most instructive about that data is that those markets are well-known backhaul markets that are unattractive to carriers. Many carriers delivering into Phoenix deadhead into the more fertile pastures of Southern California’s Los Angeles and Ontario markets. Trucks hauling into Florida have to drive empty back north to the panhandle or Georgia to find good freight.

The structural set-up of those markets hasn’t changed, and in fact they have probably gotten a bit worse as produce harvests move into more northerly states. What has changed, apparently, is that carriers have discovered they have a little more pricing power when it comes to hauling freight into deep backhaul markets.

Notably, the capacity bleed-off or rate support reflected in tender rejections (OTRI.USA) has yet to be seen. For freight brokers, the buy side is tightening, not the sell side. Brokers are loathe to give back loads after a long period of soft volumes that lasted through May; they’re accepting the freight, but it’s taking them longer to cover the loads and they’re paying more than they want to.

The Trucking Freight Futures market on the Nodal Exchange still expects a healthy pop in spot rates going into the fourth quarter. On Wednesday, August 13, the setup for a strong volume surge out of the West Coast and the forward curve for trucking spot rates from Los Angeles to Dallas (FWD.VLD) was covered here. Since then, railroads have cut intermodal rates on nearly every major lane by an average of $0.09 per mile. That raises the prospect for solid intermodal volumes into the middle of the country.

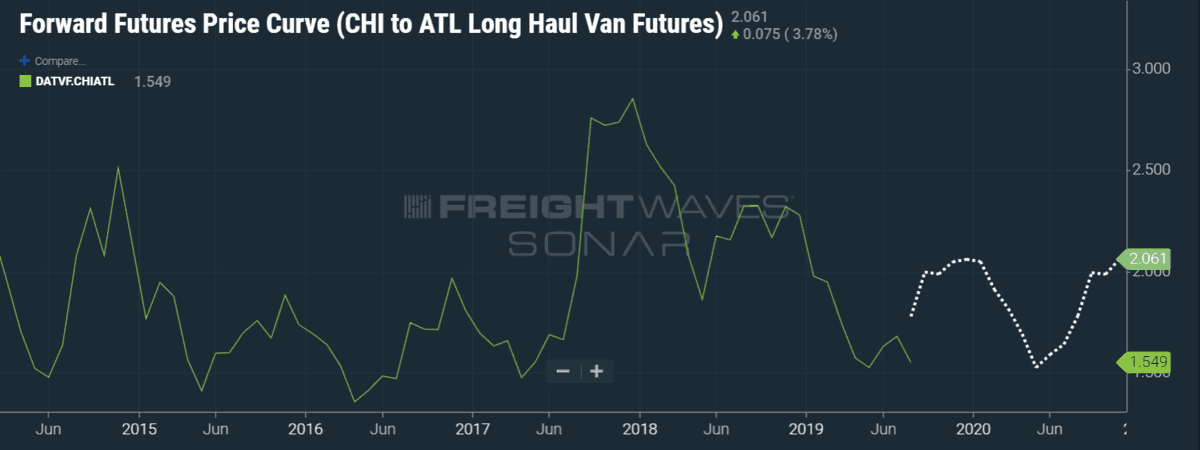

The chart for trucking spot rates from Chicago to Atlanta (DATVF.CHIATL) as well as the forward curve (FWD.VCA) are displayed on the chart below:

Current spot rates are at $1.55/mile, while futures contracts for the lane are being bid at $2.05/mile in November and $2.06/mile in December. Notably, intermodal rates for the same lane (INTRM.CHIATL) are well above current trucking spot rates at $1.86/mile.

Expect intermodal and trucking spot to converge over the next few months; spot prices have room to run up and intermodal should come down, depending on how much freight CSX and Norfolk Southern want to compete for.

Ray

Trump used truckers to get elected and then gave trucking companies our per diem tax deduction. After 5 years of trucking, I am looking for an exit strategy and looking forward to a new president in 2020.

As for the trucking industry, they need to do for drivers what they did for themselves during the 70’s fuel shortage. A national minimum wage surcharge of $1 a mile for the driver. Better and more intelligent drivers are part of the solution to a whole bunch of the industry problems.

James

The problem why truck companies are going broke is they still charge buck and half a mile to haul freight they were charging that thirty five years ago. Now fuel insurance is more expensive and you def to put into the tanks now. That’s an extra expense but there not charging more . They make up for it buy shafting the driver’s. Then you wonder why no one wants to be a driver.

Carter Edwards

Can’t wait til put all out of business then they will appreciate a truck next time they see one.

Mark

Inflated wages are in Chicago trucking companies. All off the Chicago still runs on Flexible APBRD. That’s more easier to cheat then paper. Drivers making 60+ cpm. And running 4000+ miles per week. That’s $100 K per year for a driver.

Chicago is different world for trucking.

Duilio

Not sure what sort of ELD and truck you’re using, but 4000+ miles per week is next to impossible. I pay my drivers $.60 per miles with a minimum of 2500 miles per week, guaranteed. They’re happy. We have managed to stay in business, Thank God!

Oh, and I’m a Miami carrier. Have a blessed day

Jonathon Richardson

I gotta,laugh cause thses brokers thought they were being slick getting habeeb and pedro and Paco to haul there 64 cpm freight no its biting them in the ass just like the elds are biting fmcsa,in the ass with low productivity wrecks and everything else I’m lmao what nit wits,

Art

Hundreds of brokers under cutting each other…then thousands of carriers under cutting each other.

The ultimate race to the bottom.

What harm will more brokers like Uber do?

LOL

Good bye fat margins for CH Robinson and Echo!

Beth

Inflated wages? Seriously?

Charles Campbell

A trucking company when

Out of business and wants someone buy it I know brokers but

But on a fixed income I can’t the trucks are there the trailers are

There but the money isnt.

T

Robert M Avila

Inflated wages???? We work 12 to 13 hrs everyday, 6 to 7 days a week, spotty hrs, extremely bad food, “jet lagged because of wide time shifts, our home life nonexistent, and if OTR out 6 to 14 weeks at a time. So tell me Author of this piece…just what the hell is your definition of “inflated”?

This country should be thanking these men and women for the sacrifices they make. Oh and we die by the hundreds, averaging 800 per year, the majority by other motorists. Four times more than police death where every death is considered a tragedy.

Art

Most drivers are earning around $20 per hr or less.

Definitely not “inflated wages” considering the danger and time away from home.

While management earns $100k+ to mostly attend meetings 40 hrs per week.

Overmanagement is killing the bottom line…

John Paul Hampstead, Associate Editor

Of course we appreciate what drivers do for the country and think they should be paid more money.

‘Inflated wages’ refers to the fact that in 2017 and 2018, driver wages rose about 12%, much faster than national average wage growth. This actually continued into the first quarter of 2019:

https://www.freightwaves.com/news/top-fleets-continued-increasing-driver-pay-in-first-quarter

With contract and spot rates lower than 2018, now fleets are paying drivers more on a lower revenue.

David Horecker

Wages that have been stagnant for 30 years are not inflated when they go up a paltry amount in the last two years. I graduated high school in 1992. That year half the trucks on the road were advertising 40 cents per mile on the back doors of their trailers. Most companies are still paying right around 40 cents a miles. Truck drivers are home less and make half the money of the average driver from 1981. When 90% of drivers were owner operators. You desk jockeys are all the same. You talk in double speak. “Exiting the market”, who told you to substitute that highly ambiguous term in place of companies “going bankrupt”. By my count 19 trucking companies each employing over 1000 people have gone bankrupt this year. And it has nothing to do with any of the jibber jabber you so called journalists have been espousing. It’s the tarrifs. No one wins a tariff war. Especially not truck drivers. Do your diligence before you write next time.

Billy

They are talking about raising minimum wage to what alot of local drivers make now. $15 hr to $20. They do that I’m not driving any longer. I’ll go flip a burger and not have all the responsibility of holding a CDL. And make the same cooking fast food. Just wouldn’t be worth driving a truck any longer and it’s almost at that point without a minimum wage raise.

Abdullah Ahmad

You are very right my broth. We deserve more respect and recognition.