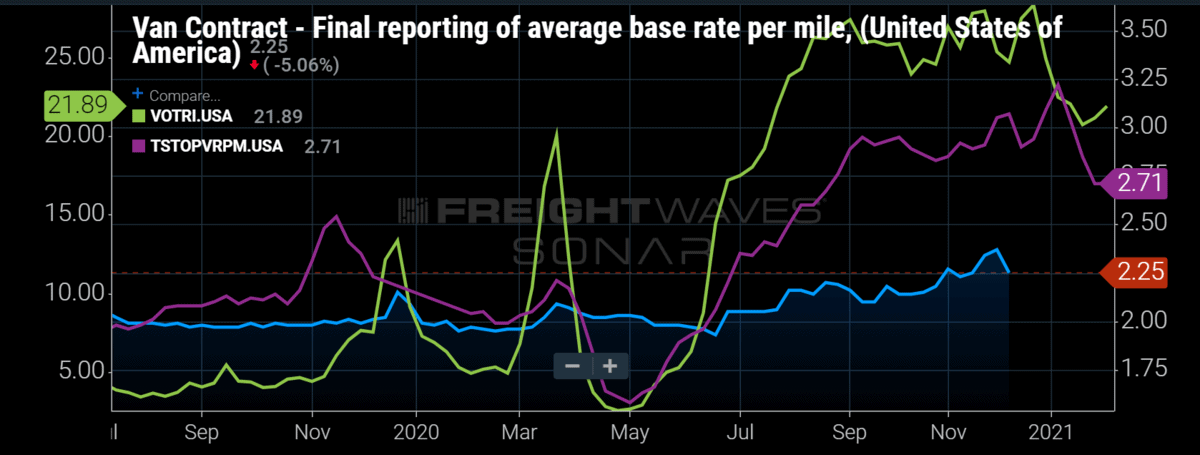

Chart of the Week: Van Contract Base Rate per Mile, Van Outbound Tender Rejection Index, Truckstop.com 7-day rate per mile Van– USA SONAR: VCRPMF.USA, VOTRI.USA, TSTOPVRPM.USA

Shippers spent 12% more per mile for dry van truckloads on average through most of the fourth quarter of 2020 than they did in 2019. That is according to FreightWaves’ newest dataset that measures trends in long-term rates (not spot rates) between shippers and van carriers, Van Contract Base Rate Rate per Mile (VCRPMF).

Trucking costs have been trending higher since late June, following a dramatic increase in the Van Outbound Tender Reject Index (VOTRI). The tender rejection indices measure the rate at which carriers reject shippers’ requests for capacity. Higher rejection rates indicate less capacity, which leads to shippers moving down their carrier lists — also known as route guides — looking for coverage. As they move down the list, rates tend to be higher and service deteriorates.

A large portion of these rate increases represented in the chart are the result of shippers moving down their route guide searching for coverage. Many of these loads do not appear on the spot market, which has long been the main barometer for measuring truckload rate fluctuations. Most loads that end up on the spot market are last resorts for larger companies that rely heavily on contracted agreements.

Spot rates, represented by Truckstop.com’s seven-day average in the chart, move wildly compared to the long-term contract rates and represent, by many estimates, less than 15% of the overall for-hire van truckload market in an average year. It can be difficult to discern how representative spot rates can be of the much larger underlying contracted market.

A wave of consumer demand fueled by an unprecedented stimulus package and a surprising economic recovery for durable goods strained trucking networks in the second half of 2020. Many companies reportedly went to carriers with self-implemented rate increases in attempts to lock down more capacity. This is not a standard practice as shippers typically hold the upper hand in negotiating with carriers due to the highly competitive trucking environment. Carriers bid for shippers’ freight in most cases, not the other way around.

The mechanic shippers use to establish long-term rate agreements, known as contract rates inside the industry, is called a bid or request for pricing (RFP). Companies send their bids out to carriers asking for them to offer their best price for each lane. Most of this activity occurs between Thanksgiving and March as budgets are being established.

Knowing many new contracts have not been implemented, it is safe to assume a large portion of the recent implied rate increase will stick. Tender rejection rates remain over 20% and spot rates are still well above contract by a large amount in what is typically considered the off-season.

Increasing contract rates should help encourage increasing carrier acceptances and lower spot rates, but there are still plenty of potential disrupting factors available.

Not out of the woods yet

On the demand side, the industrial sector is slowly making a comeback, which was largely absent from the volumes in 2020. A massive restocking event is taking place with shippers having sourcing issues thanks to COVID limiting production.

The maritime shipping industry is more out of balance than the domestic trucking space as container shortages and record shipping rates are persisting through the normally slow Chinese New Year holiday in Asia, where most of the U.S. consumer products are made. The result is a very uneven flow of freight into the country, which is difficult for carriers to manage.

The supply side of the equation is not as healthy as it was in 2018, when carriers placed record orders of equipment and quickly oversupplied the market in 2019. Driver schools remain half full and the recently implemented Drug and Alcohol Clearinghouse is doing its job by limiting the available pool of drivers who have drug and/or alcohol violations. Many who fail do not return.

The nor’easter that hit the East Coast this week pushed national rejections higher, illustrating just how fragile carrier networks are in the slower part of the year. There may be room to grow yet.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo, click here.

Stephen Webster

Trucking rates are about where they should be now. I do not like to see large number of new trucks being bought. Truck driver wages need to be at least $20.00 U S per hour for a experienced O T R truck driver on U S soil plus overtime after 10 hours per day off the E _log .

AJ

The driver wages are still horrendous.

Minimum wage is 15+ in many areas but they want CDL A drivers for $17-18 hr.

Might as well stay home on unemployment.

Part of problem are illegals depressing wages and freight rates.

Both parties are completely ignoring the impact aliens have on middle class workers and wages.