Trucking industry groups react hopefully to Trump win

In the wake of the 2024 presidential election, President-elect Donald Trump will return to the White House as the nation’s 45th and now 47th president. For the trucking industry, beset by looming and planned regulations from emissions controls to electric vehicle mandates to speed limiters, the incoming Republican administration presents an opportunity to shape the regulatory landscape. Compared to the outgoing Biden-Harris administration, whose focus was on stricter safety rules and carbon emissions, trucking lobbying groups see a chance to claw back some of the regulations they feel are negatively impacting the industry.

The American Trucking Associations in a statement focused on legislative priorities including replacing the Environmental Protection Agency’s electric truck rule with “national emission standards that are technologically achievable and account for the operational realities of our essential industry.” The ATA adds, “With the Tax Cuts and Jobs Act set to expire next year, ATA stands ready to work across the aisle on Capitol Hill to achieve pro-growth tax reform, including repealing the century-old, punitive federal excise tax on heavy-duty trucks and trailers that penalizes our industry for investing in newer, cleaner, and safer equipment.”

The removal of the excise tax has been a long-standing goal. David Taube and Colin Campbell of Trucking Dive write, “Trucking groups said Trump’s win bodes well for the potential repeal of a century-old federal excise tax, one of their top concerns. The tax represents a 12% sales tax on new equipment, and past legislative attempts to reform it have come up short.”

The Owner-Operator Independent Drivers Association also released a statement. President Todd Spencer said, “We look forward to working with the Trump Administration and congressional allies to advance a pro-trucker agenda, which includes expanding truck parking, stopping unworkable environmental mandates, and preventing a dangerous speed limiter mandate.” Spencer told FreightWaves that Vice President-elect JD Vance during his time as a senator has been a co-sponsor of the Truck Parking Safety Improvement Act and the DRIVE Act.

Disclosure: JD Vance is an investor in FreightWaves SONAR through the Rise of the Rest fund.

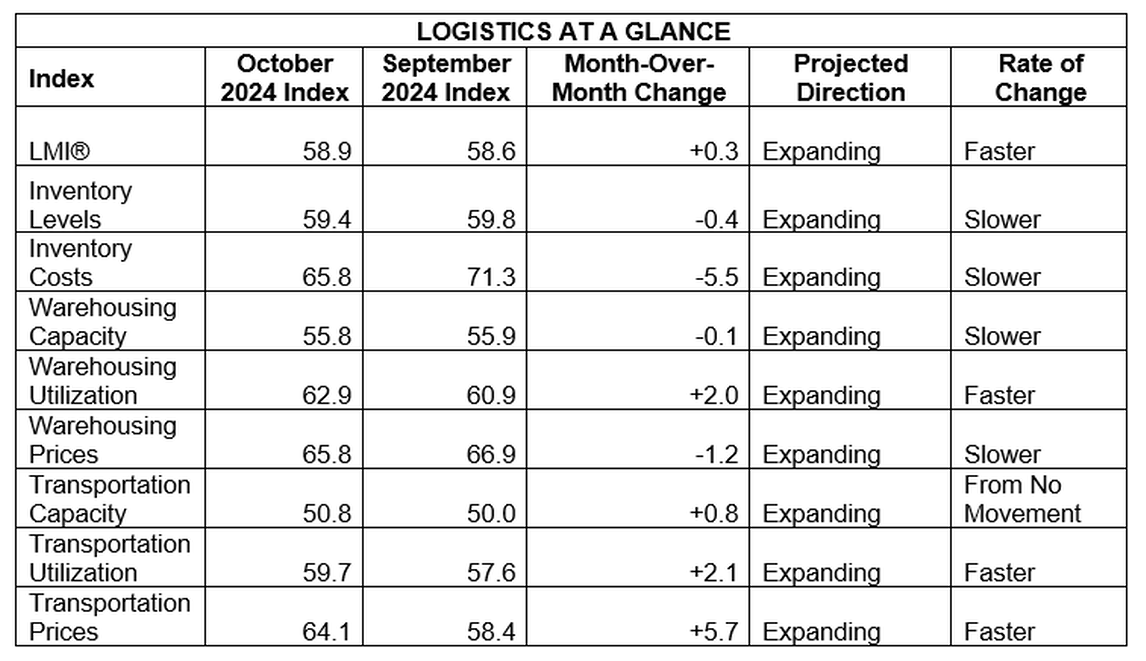

LMI October Index shows 11th consecutive month of expansion

The Logistics Managers’ Index recently released its October data, which saw the 11th consecutive expansion of the overall index – the highest level since September 2022. The overall index rose 0.3 points from September to 58.9 points, buoyed by expansion in transportation pricing, whose increase of 5.7 points from September to 64.1 was the largest rate of growth since May 2022. The LMI is a diffusion index, meaning a reading above 50 signals expansion, while a reading below 50 indicates contraction.

Compared to last month, transportation capacity was similar, up 0.8 points from September to 50.8 points for October. While the movement was slight, a more granular examination showed a larger swing between the first and second half of the month. The report notes, “Transportation Capacity actually contracted in the first half of October (45.8) before expanding again later in the month (54.3). It will be interesting to see if capacity continues to loosen in November or if it moves back towards no change.”

The report adds that it will be worth watching whether transportation capacity continues to loosen into November or if there is no change, as there is a scenario in which, if transportation prices continue to rise, “more idle capacity will come off the sidelines to take advantage of the increased opportunity, leading to the somewhat counterintuitive situation that we now find ourselves in where both Transportation Prices and Capacity are increasing.”

The report continues, “All of this suggests that the market is turning, just more slowly than carriers would prefer. The reason for this slower turn is that there is more excess capacity in the system than we would normally have.”

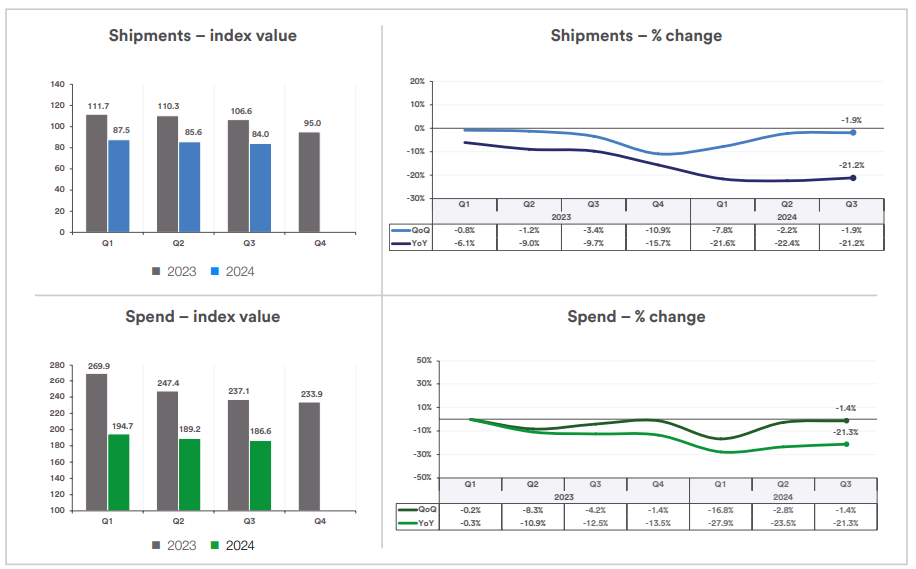

Market update: U.S. Bank Q3 freight index cautions slow freight market recovery

U.S. Bank recently released its Q3 Freight Payment Index, which saw continued downward pressure on shipments and spend volume. The report notes, “The declines in truck freight shipments and spend in Q3 were the smallest in the last six quarters, suggesting positive signs for truck freight, as well as indications that true market recovery will take time.” The shipments index fell 1.9% compared to Q2 and is down 21.2% compared to Q3 2023. Similarly, the spending index saw a decline of 1.4% compared to the previous quarter, down 21.3% year over year.

Part of the reason for the decline was U.S. manufacturing activity, which remained sluggish from July through September. One area of concern from Fed data was factory output contracting between 1% and 1.5% quarter over quarter. Durable goods were the other highlight, with big-ticket items usable for a minimum of three years falling 2% to 2.5% compared to Q2.

Drilling down in more detail, the report noted that falling housing starts was another headwind, U.S. Census Bureau data reported total new housing units during Q3 at 5.5% to 6% lower than Q2. For flatbed carriers, this was reflected in FreightWaves SONAR data, with flatbed outbound tender rejection rates averaging around 6.49% for Q3 from July 1 through Sept. 30. Comparatively, FOTRI averaged 14.7% during Q2, according to SONAR data. Other modes outside flatbed may also have been impacted, the report adds: “Not only does home construction help freight volumes with construction materials (for example, lumber, shingles, drywall) but also furnishings, appliances, flooring and paint.”

One bright spot in Q3, according to the report, was retail sales excluding auto dealerships, gasoline stations and restaurant sales. Retail sales rose nearly 2.5% compared to the previous quarter and were 4% higher than in Q3 2023.

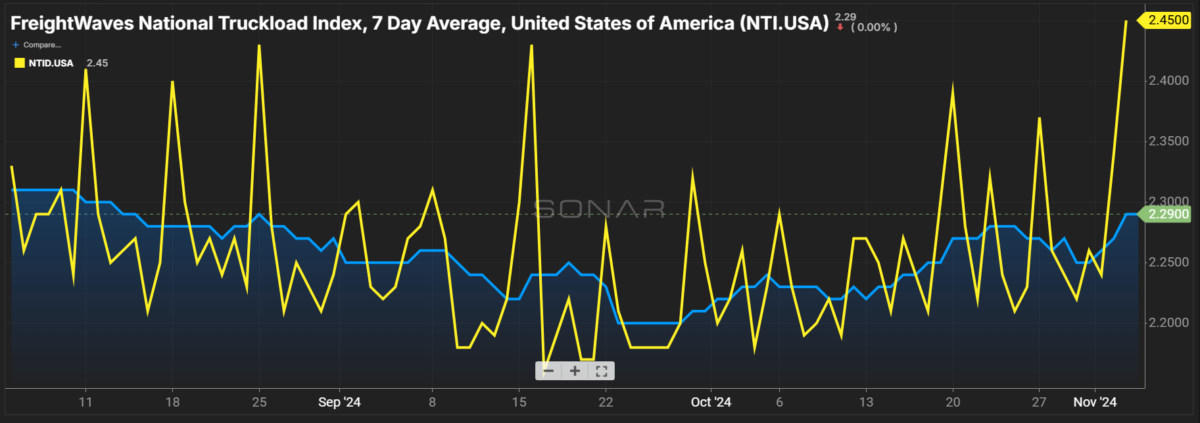

FreightWaves SONAR spotlight: November brings an uptick to dry van spot rates

Summary: Dry van spot rates are on the rise. The first week of November saw an uptick in spot market rates and greater volatility in the daily average. The FreightWaves National Truckload Index 7-Day Average rose 3 cents per mile week over week from $2.26 on Oct. 28 to $2.29. Looking at the daily movements of the NTI, which feed the seven-day average, they are trending above the weekly average, suggesting further increases in the short term. One example of this is the NTID reaching its highest recorded value in the past three months on Nov. 3 at $2.45 per mile all-in.

In the contract space, dry van outbound tender rejection rates saw a slight increase in the past week but remain below their month-over-month peak of 5.31% on Oct. 10. VOTRI rose 22 basis points w/w from 4.73% on Oct. 28 to 4.95%. This is a 191-bp improvement compared to this time last year, when VOTRI was at 3.04% on Nov. 4, 2023. Dry van tender rejection rates continue to follow a similar trend to 2019, when VOTRI was at 4.79% during this time.

The impacts and results of the presidential election deserve an honorable mention. The dry van truckload sector is heavily exposed to consumer goods consumption and manufacturing trends, whose ebb and flow correlate to truckload orders. Following the results of the election, the looming question of government policy will be a topic worth watching due to its trickle-down effects on the truckload space.

The Routing Guide: Links from around the web

Court data reveals extent of truck lease program abuse (FreightWaves)

October 2024 For-Hire Trucking Index (ACT Research)

Proposed Trump tax cuts expected to be a boon for freight (FreightWaves)

As downturn continues, industry sentiment turns pessimistic (Truck Parts Service)

Expectations of strong peak season keeping truckers employed despite overcapacity concerns (Land Line)

FMCSA to extend broker financial compliance deadline (FreightWaves)