Just as the monthly data from the Bureau of Labor Statistics shows an indication that trucking jobs are finally starting to rise after months of mediocre growth, along comes the Council of Economic Advisers to toss a little cold water on the numbers.

In the BLS’ June employment report, released Friday morning, total jobs in truck transportation on a seasonally adjusted basis rose 6,400, to 1,486,500 jobs. That was the biggest increase this year and the largest since a string of big gains at the end of 2020 as the economy started to shake off the impact of the pandemic.

Meanwhile, the number for not-seasonally adjusted jobs saw enormous growth of 24,500 jobs for the month, to 1,501,600 jobs.

But the data came a day after the CEA said in a report that the volatility created by the pandemic made the data for the jobs report subject to big swings. It cautioned against drawing big conclusions.

“This volatility in job growth during the pandemic reflects both real volatility — economic reverberations of the pandemic shock — as well as heightened measurement error due to the challenge of collecting statistical data amidst a pandemic,” the CEA said in its report. “These considerations warn against placing too much weight on any single data point in assessing the current state of the economy, even as the worst of the pandemic in the U.S. fades away.”

The CEA also addressed the difference between seasonal and nonseasonal data. Economists almost always look at the former, but as the June data for trucking shows, there can be significant divergence. “Amid the pandemic … industries may have broken their typical seasonal employment patterns and instead, may have — and continue to let — their employment decisions be guided by other factors, such as local COVID-19 prevalence and risk aversion,” the CEA wrote. “If these extraordinary issues swamp normal seasonal variation, seasonal adjustments may instead temporarily exacerbate volatility.”

And the difference between seasonal and nonseasonal in the latest data is significant: 18,100 jobs. Jason Miller, an associate professor of logistics at Michigan State, who has long advised to keep an eye on the nonseasonal data, said the seasonal data in June “dramatically understates the number of jobs actually added, which is 24,500 based on the not seasonally adjusted data.”

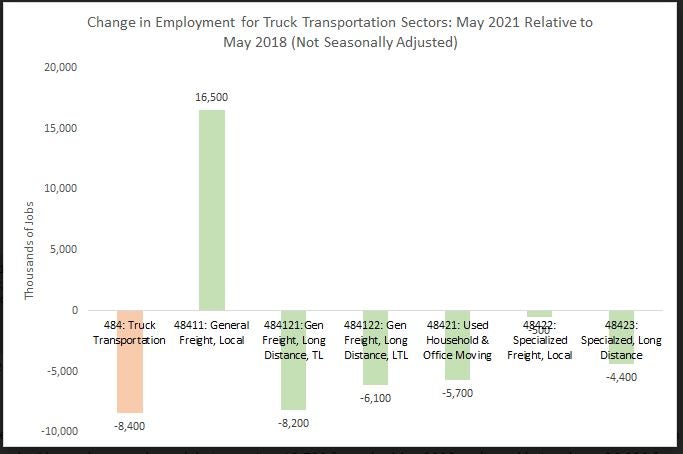

But Miller also cautioned that the data for individual sectors, which operates on a one-month lag, suggests that job growth is not coming in the over-the-road sector. Overall job totals are comparable to three years ago, Miller wrote in an email to FreightWaves, but the General Freight-Local category, which would not include over-the-road drivers, has been rising compared to what he said were “shortfalls” in the OTR category.

“While the headline figure for the entire sector is certainly encouraging, the data through May provide no evidence of long-haul carriers being able to ratchet up employment to meet demand that is at or near record levels,” Miller wrote.

Aaron Terrazas, director of economic research at Convoy, was not overly impressed with the data. “The scary thing is that hiring probably doesn’t get any easier from here,” he said in an email to FreightWaves. “Everyone expected a big bump in payrolls for June as states reopened and [extended unemployment insurance] ended in many states. We got that, so now what? The cold reality that this is what the future looks like is starting to sink in.”

Other highlights from the report include:

— Production and nonsupervisory compensation in the truck transportation sector rose to $25.18/hour in May, up from $24.57 a month earlier. While that may seem like a lot, Terrazas did not think so. “Hourly wage gains for frontline transportation industry workers have barely kept pace with core inflation over the first half of 2021,” Terrazas wrote on Convoy’s blog. “By contrast, at past freight market peaks, transportation industry wages have grown anywhere from 2.5 to 3 percentage points above core inflation.”

— But the cost of doing business in truck transportation continued to soar. The Producer Price Index for truck transportation rose to 164.2 in May, the latest month for which data is available. That is up from 158, a 3.9% increase, and it’s a record in the data going back to 2011. Total hours worked also set a record in that data history, rising to 42.8 hours from 42.4. That’s 24 minutes. But spread out over the size of the seasonally adjusted workforce, that comes out to about another more than 25,000 workers.

— Warehousing and storage, which also has been a laggard in adding jobs, posted sharp gains. Seasonally adjusted figures were up 9,600 jobs in June compared to May and are now up more than 26,000 jobs since March. Compensation for production and nonsupervisory employees in the warehouse sector took a significant jump, to $19.41 an hour from $18.88, just under the record high for the data series set last August. But the cost of doing business was up just 0.2%, to a PPI of 112.9 from 112.7.

— Courier and messenger numbers are dropping. Seasonally adjusted jobs in that category dropped to just over 1 million, a decline of 23,800 jobs. Jobs are down almost 84,000 from their peak in March.

More articles by John Kingston

Tearing down key interstate connection in Syracuse getting more likely

Latest Drivewyze offering speeds up inspection process at weigh stations

Mike

The ELD, all of that productivity stripped out of the market place. I now sit more than I drive. It has been like this since this BS was forced upon us. Thirty percent of my normal income, gone. There are more than a few of us out here that have 30 plus years out here, many have plenty left in us, but not under these conditions. Even if the pay was to improve, it is honestly no longer worth it, especially as the availability of healthy food, parking and the ever increasing costs to operate grow with impunity, time to find something else to do.

Stephen+Webster

Get rid of E logs or allow a 16 hour day with overtime on a base wage of 23.50 U S per hour after 10 hours and double time after 13 hours per day and the ( shortage of truck drivers and trucks will disappear)

We need minimum wage and freight rates and in Ontario need gov insurance for smaller fleets and new truck drivers.