Data on producer prices shows that wholesale inflation pressure was nearly nonexistent in July. Industry detail showed broad-based declines in trucking rates, and yearly it is likely to turn negative in upcoming months.

The Bureau of Labor Statistics reported that the producer price index (PPI) rose 0.2 percent in July from June’s levels. This fell in line with consensus estimates and follows two consecutive months of 0.1 gains in May and June. Overall results during the month were helped by 0.4 percent growth in goods prices, led by a 2.3 percent rebound in energy prices. This helped offset a 0.1 percent decline in service prices for trade services, which ended a streak of five consecutive monthly gains in the sector. The core PPI, which excludes food, energy and trade services, fell 0.1 percent in July as year-over-year growth fell to a two and a half year low of 1.7 percent.

Market watchers and policymakers typically use the PPI to gain some insight into what the underlying pressures of inflation are in the economy. Federal Reserve officials have cited concerns over low inflation as one of the reasons why they lowered interest rates late last month. While the PPI is not the Fed’s preferred measure of overall price levels in the economy (that honor belongs to the core personal consumption expenditure deflator), this morning’s core PPI results would suggest that inflation pressures from producer prices are virtually nonexistent in the middle of the year.

Long-distance truckload rates slide again, near negative territory

The monthly PPI release also offers a tremendous amount of detail each month, allowing for insight into pricing trends for commodity, product and industry groups. Producer prices for General Freight Trucking fell 1.2 percent from June’s levels, more than erasing the gain from last month. Year-over-year growth tumbled to 1.2 percent as a result, which is the slowest pace of yearly increase in more than two years

Declines during the month were broad-based in the industry, as local, long-distance truckload and long-distance less-than-truckload (LTL) all fell in July. Long-distance truckload rates declined sharply, as rates fell 1.3 percent from June’s levels. Year-over-year growth fell to 0.3 percent as a result, which is also the slowest pace of yearly growth in over two years. LTL long distance rates fared even worse in July, falling by 1.5 percent, while local rates experienced a more modest 0.2 percent decline from June’s levels. Year-over-year growth in long-distance LTL and local rates fell to 2.5 percent for each, well below the rapid pace of growth seen in mid-2018.

Behind the Numbers

Headline PPI results have offered little in the way of excitement in recent months after some brief concerns near the end of 2018 that inflation was beginning to accelerate in the economy. Recent PPI results suggest that there is very little pressure for inflation coming from producer prices. This may change as we near the end of the year if the latest wave of tariffs on goods from China goes into effect as scheduled, but for now neither goods nor service prices have been accelerating in any meaningful way

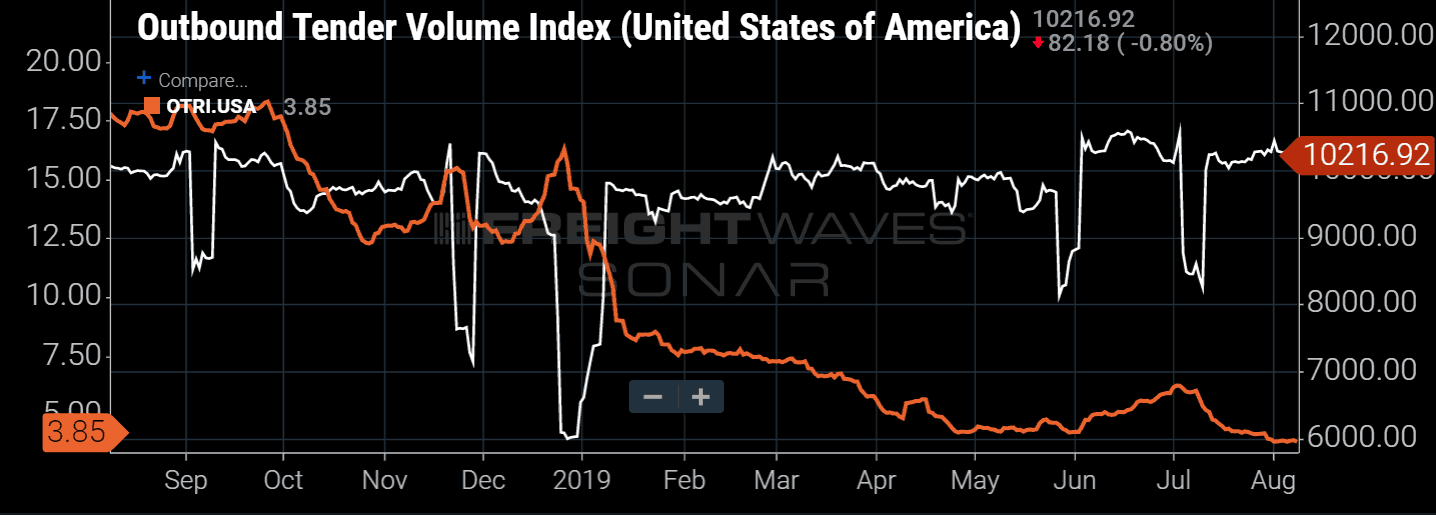

On the trucking side, July’s PPI results resume the general trend in rates after June’s likely seasonal surge. After hitting multi-year highs in the second and third quarter of 2018, rate growth has come down quickly as demand growth slowed. FreightWaves SONAR load tender volume data (OTVI.USA) suggests that volume growth is now positive on the for-hire side of the industry, but not strong enough to absorb all of the extra capacity that was added throughout 2018. Tender rejection rates (OTRI.USA) remain well below where they were at this point last year, suggesting that carriers still do not have much in the way of pricing power in the market.

This trend is likely to continue in upcoming months. Concerns over global growth and recent tariffs will probably restrain any significant acceleration in growth on the demand side, and as long as capacity remains loose, downward pressure on rates will continue in the industry. Comparisons to last year are fairly tough over the next few months, and it is likely that yearly PPI growth in the industry will turn negative, especially for long-distance truckloads.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.