FreightWaves’ SONAR chart of the week (June 30, 2019 – July 6, 2019)

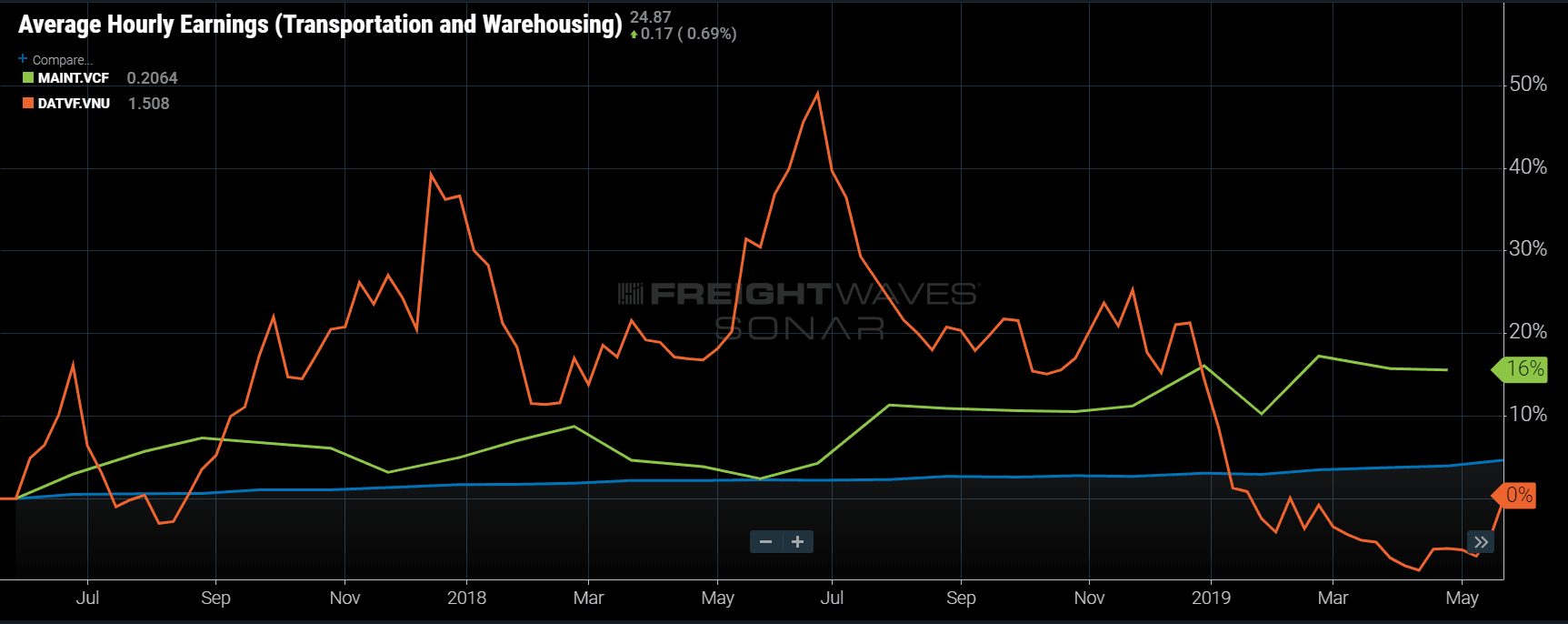

Chart of the Week: Average hourly wages – Transportation and Warehousing, Maintenance cost per mile, DAT Van Freight Rate Index – National (SONAR: EARN.TPWH, MAINT.VCF, DATVF.VNU )

The longest freight market bull-run in over a decade is over as spot rates have fallen back to where they were two years ago. The problem presented to many carriers is that many of their costs have not. In this week’s chart, comparing wage and maintenance costs to average daily national spot rate over the last two years, spot rates have fallen back to under June 2017 levels while costs have continued to grow on a more even keel.

Spot rates are not a one to one relationship with carrier revenues, but they do offer insight into general direction. The longer spot rates remain elevated the likelihood carrier revenues will follow increases and vice versa. The reason this happens is market pressure. If carriers can consistently get a higher price for performing the same job, they will increase contract rates to where the market will support them.

In many other industries, a steady increase of price is the norm, or stable inflation. There are instances, specifically in technology where the cost of an item falls as technology improves. Purchasing a top of the line plasma television set in 2004 could cost as much as $10,000, whereas a much higher quality ultra HD 4K TV of similar dimensions can be had for under $1,000 today. The price fell, due to decreasing costs. Rarely do prices drop without costs falling first. The highly fragmented trucking market does not follow this rule.

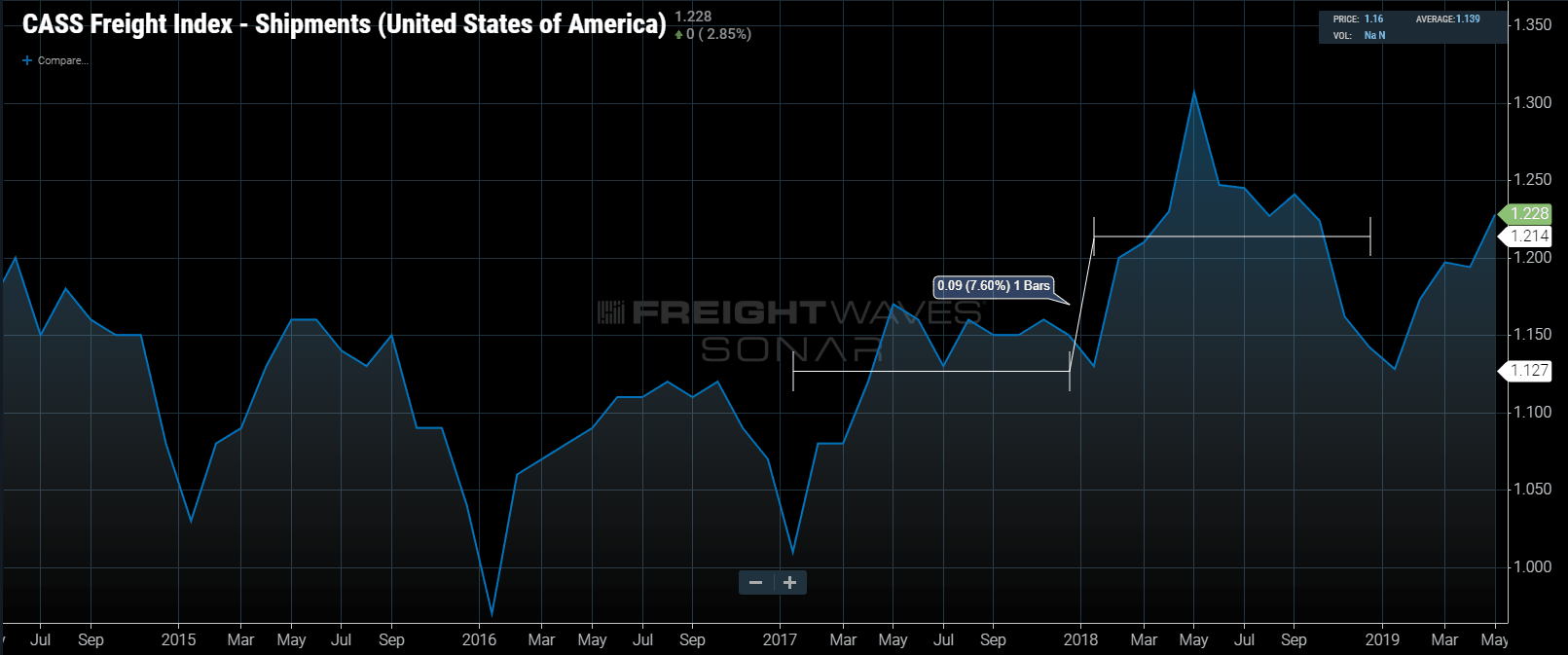

Most people involved in transportation over the past five to ten years would agree that 2018 was a bit of an anomaly in terms of volumes and increasing rates. Looking at the Cass Shipments Index and DAT national van freight rate index, this is apparent.

The Cass Shipments Index measures total freight volumes using invoices and has a strong correlation with total volume moved in the U.S. 2018 averaged almost 8% higher than 2017. Through the first five months of 2019 the index is averaging 2.5% lower than the first five months of 2018.

Looking at the weekly average of spot rates, 2018 averaged 17% higher than 2017. Rates are currently hovering around the same level they were in June of 2017.

Some might argue this is a good thing for carriers as 2017 was a decent year for freight. 2016 was a soft year and the summer peak produced one of the largest spikes in upward rate pressure in the previous 5 years. The difference is costs have now increased over the past two years as illustrated by the wage growth and maintenance costs.

The wage growth represented in the chart represents all transportation and warehousing jobs, including dock workers and back office. Driver costs, which are a large percentage of carrier costs depending on the size of the company, are estimated as being roughly 11-12% higher compared to 2017.

Many carriers increased the size of their fleets and now have more trucks to utilize, with less freight available. It is difficult for carriers to flex back down when volumes and rates fall as selling equipment is not easy when no one is buying. Their vendors and employees who have taken increases and raises typically do not roll back their newfound income. If this was the peak of freight season the back half may be even more challenging for carriers without a competitive advantage.

About Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week a Market Expert will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data-science and product teams are releasing new data sets each week and enhancing the client experience.

To find out more about SONAR or to setup a SONAR demo.