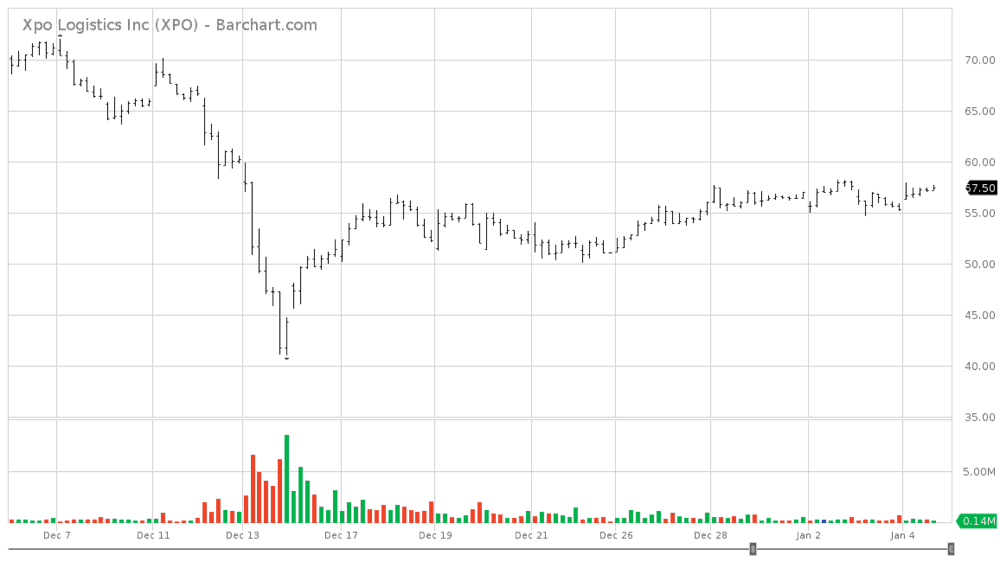

Although the price of XPO stock has rebounded from its mid-December short seller-related crash, the battle over its future hasn’t ended.

In an unusual conference call that mostly backed up his company’s published research, Deutsche Bank lead transportation analyst Amit Mehrotra today reiterated his criticisms of Spruce Point Capital Management, the short seller that set off a collapse of XPO (NYSE: XPO) stock, some of which has been recouped.

The call came three days after Deutsche Bank sent out a report entitled “Short report debunked… focus moving back to fundamentals.” That came out on January 1, not a day on which many Wall Street companies publish research reports.

“We’ve just received so many calls from investors about our work on XPO and we thought it would just be more efficient to do a call,” Mehrotra said. During the call Mehrotra did not take questions and referred back to points in the January 1 report. but also referenced several analyses made in other reports, like one of December 26, 2018, in which various points Spruce Point made about XPO were criticized by Deutsche.

Among the specific criticisms:

– Spruce Point said the number of bank drafts reported by XPO were a “warning sign.” “XPO has generated virtually no free cash flow since inception and is resorting to bank overdrafts, factoring receivables, and increased asset sales to bridge its capital needs,” the Spruce Point presentation on XPO said. In Deutsche’s view: “In actuality, this is a very common cash-management tool used by European transportation and logistics companies (basically an overdraft line of credit).”

– The issue of defining free cash flow was also addressed by Mehrotra. The Spruce Point presentation stated that XPO tries to “bolster” its free cash flow figures by using proceeds from asset sales. On the call, Mehrotra said such a practice is considered normal in the logistics business.

– Mehrotra criticized Spruce Point’s analysis of what are known as “doubtful accounts” that come after acquisitions. He said Spruce Point “does not recognize the realities” of purchase-price accounting that goes with acquisitions. That criticism was just one of many of Spruce Point’s criticism of XPO’s accounting, which it described as featuring “dubious tax accounting, under-reporting of bad debts, phantom income through unaccountable M&A earn-out liabilities, and aggressive amortization assumptions.” Ultimately, accounting is the basis for most short seller views.

– Deutsche said Spruce Point recently pointed to the bond market as a sign that XPO is in trouble, in contrast to the rebound in the company’s common stock price. But Mehrotra said XPO bonds are trading at par or higher and the one bond Spruce Point referred to was a legacy from the 2015 acquisition of Con-Way, is largely illiquid and hadn’t traded since November.

The January 1 report and comments made on the call by Mehrotra mostly focus on the outlook for XPO, which he describes as positive. While he conceded that there were concerns that a peak in the transport cycle may have been passed, “we feel that the vast majority of XPO cash flow is highly defensible during a recessionary scenario,” he said on the call. If the industrial economy slows, Mehrotra said, it is generally assumed that the less than truckload (LTL) trucking sector will be hit the hardest. But “pricing discipline” in that sector is “as good as it has ever been,” and non-unionized LTL carriers like XPO (LTL is just one part of its business) showed “remarkable resilience” during the industrial downturn of 2015 and 2016.

Additionally, XPO has “won” about $4 billion in new business over the last four quarters, Mehrotra said.

Deutsche, in both the report and on the call, took a shot at Spruce Capital’s track record. “We have assessed the author’s track record based on our analysis of over 30 short reports over the last four years; most of its short calls have not come to fruition, with almost two-thirds of companies targeted having positive returns on a six-month basis with an average return of +19 percent,” the report said.

The stock ride of XPO has been a wild one, even in an equity market that has put many companies on a roller coaster. On December 3, its intra-day high was $76.60 and it closed that day at $71.91. By December 13, after the short seller report came out, the stock hit a low of $41.05. At 1:45 p.m. today it stood near $57.20. By contrast, during that same period, Echo Global Logistics (NASDAQ: ECHO) closed at $24.96 on December 3, closed as low as $19.20 on the heavy Christmas Eve market selloff, and was trading today at a little under $21. So it’s down, but with nowhere near the volatility of XPO.