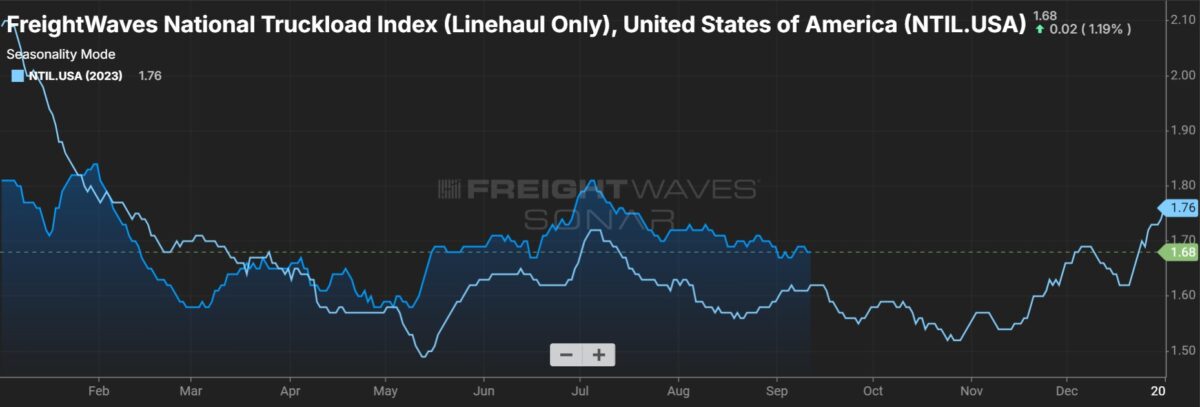

“Normal seasonality” was the best truckload carriers could muster when describing the current freight environment at an investor conference this week. While freight demand is seeing more typical ebbs and flows from month to month, which is an improvement from a year ago, the fluctuations are occurring at a low starting point – the trough of a prolonged freight recession.

“This is seasonality similar to what you would have seen in 2019 where it wasn’t a strong market but you at least saw seasonal trends and that’s what we’re experiencing right now,” said Jim Filter, Schneider National’s (NYSE: SNDR) EVP and group president of transportation and logistics, at Morgan Stanley’s (NYSE: MS) 12th Annual Laguna Conference in Dana Point, California, on Wednesday.

That compares favorably with last year when there was “no seasonality,” he added. Seasonality for Schneider returned in June and has held since, but Filter said it’s still too early to call an inflection in the market. He said that can only be confirmed during the company’s contractual bid season with customers, which starts at the beginning of every year.

He said peak season capacity indications from customers are “normal” but noted that some shippers that have been working with non-asset-based brokers are starting to transition back to asset-based carriers, which he believes is a tell that the market is turning.

Derek Leathers, chairman and CEO at Werner Enterprises (NASDAQ: WERN), pointed to a continuation of “normal seasonality” at the conference on Thursday.

“It seems like we’re finally past all these crazy highs, crazy lows,” Leathers said. But he cautioned that “it’s a little early to call it a full inflection.” He said peak season conversations with customers are “fairly positive at this point” but qualified the statement by noting that it had more volume in the 2023 peak season than it did in 2022, but the pricing was worse last year.

Leathers said recent carrier failures have taken some truck capacity out of the market, pointing to a 25-cent pop in spot rates during the annual safety blitz known as International Roadcheck in May. “That doesn’t happen unless you’re really close to equilibrium, cause it’s not like a third of capacity parks. You’re talking 3 to 5% maybe parks … and that was enough to inflect pricing pretty significantly.”

Both carriers have started the “pre-work” for bid season, with Werner saying a couple of 2025 bids have already opened but are nowhere near finalization. Leathers noted the early expectation calls for price increases as the industry tries to claw back several quarters of cost inflation.

“It is our intent and it is our belief that rates will need to go up as we go through the 2025 bid season,” Leathers said. “How much” will depend on “capacity attrition and the overall economy.”

Third-party logistics provider RXO’s (NYSE: RXO) CEO, Drew Wilkerson, said on Wednesday that “we’re still in a soft freight environment.”

He said load-to-truck ratios are currently 3.5-to-1 and tender rejections stand at 4.5%. He said those metrics need to be closer to 6-to-1 and high single to low double digits, respectively, before spot freight steps higher. He said peak season expectations from customers have been mixed, but with carrier operating costs still 25 to 30 cents (per mile) above spot rates, the next move for rates is likely up.

Wilkerson and Filter both noted a reduction in the number of brokers from the peak that formed during the pandemic. Wilkerson estimates 20% have shut down over the past few quarters as small and midsize brokers have seen their carriers go out of business and their customers (shippers) consolidate the number of 3PLs and carriers they work with.