Hey truckers, listen up! The freight market’s heating up, and it’s looking good for your wallets. Let’s break down what’s happening and what it means for you out on the road.

Spot rates are soaring

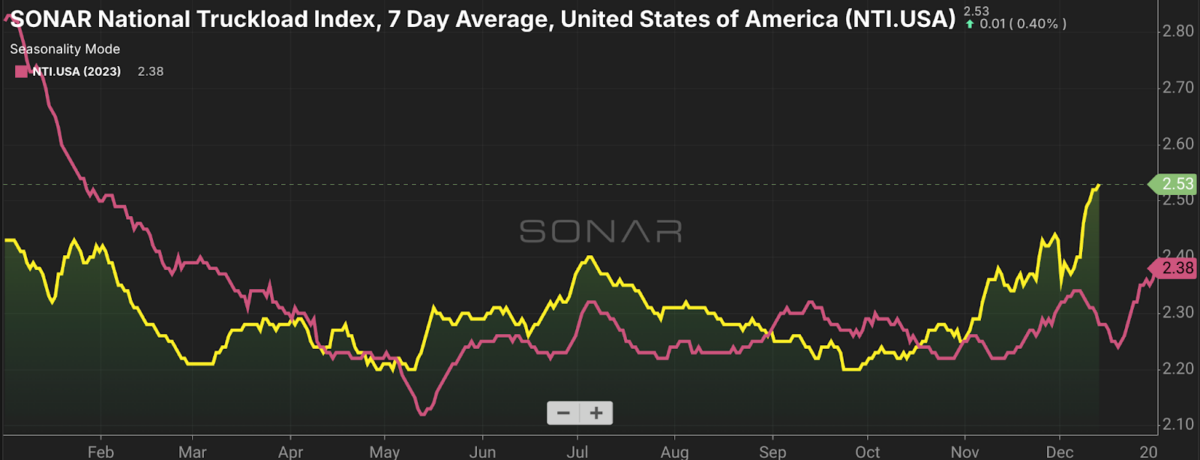

The SONAR National Truckload Index (NTI) is showing some numbers we haven’t seen in almost two years. We’re talking $2.53 per mile! The last time rates were this high was back in January 2023. Truckload spot rates are up 34 cents a mile since Oct. 1, 2024, a 15% increase. In the past week, we’ve seen spot rates jump from $2.38 to $2.53 a mile, a 15-cent increase.

This chart is the SONAR National Truckload Index (NTI), which measures spot truckload rates. The pink line is 2023; the yellow line is 2024.

This is happening a week before the end-of-year surge, which always delivers the strongest rates of the year.

What’s causing the spike?

Here’s the interesting part: Freight volumes are actually down compared to last year. So why are rates going up? There’s less competition out there. There are about 14,400 fewer trucking authorities active now compared with last year. That’s a 4% drop, which means fewer trucks fighting for the same loads.

Rejection rates on the rise

Carriers are getting pickier about the loads they’re taking. The outbound tender rejection rate has climbed to 6.47%, up from 5.96% just a week ago. That’s the highest it’s been since July. What does this mean for you? You’ve got more power to choose the loads that pay best.

Looking ahead: What to watch for

- Contract rates: Shippers might start locking in higher contract rates to make sure they can move their freight. This could mean more stable, higher-paying loads for those of you on dedicated routes.

- Potential boom in 2025: There’s talk that if certain policies create an economic boost, we could see a big surge in freight demand. That would be great news for carriers, as rates could climb and stay even higher.

- Capacity crunch: Remember the Clearinghouse II regulations that arrived in November? That could sideline a lot of drivers, making your skills even more valuable.

What you can do

- Stay informed: Keep an eye on these trends. Knowledge is power in this business.

- Be selective: With rates up and capacity down, you can afford to be choosier about your loads. Look for the best-paying freight that fits your schedule and markets you want to go to.

- Build relationships: Shippers are going to be looking for reliable carriers. If you have a good track record, now’s the time to leverage it.

- Keep your equipment in shape: With demand potentially increasing, make sure your rig is ready to roll when those high-paying loads come calling.

Remember: The freight market’s always changing. Right now, it’s swinging in favor of carriers. Make the most of it while the getting’s good, and stay safe out there on the roads!

For daily updates, check out the SONAR National Truckload Index (NTI.USA) page on GoSONAR.com.