The outcome of the U.S. election will steer stimulus spending, energy policy, trade relations, geopolitics and environmental regulation — and consequently, ocean freight rates — for years to come.

With just three weeks to go, financial analysts are weighing in on potential fallout.

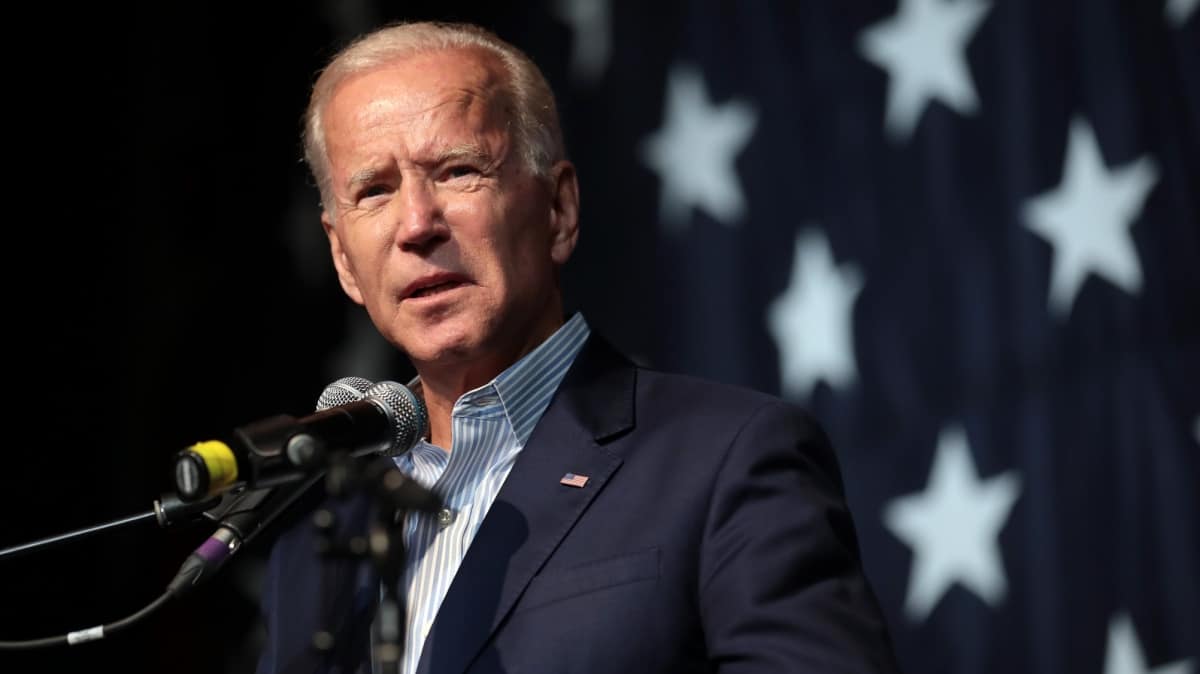

On one end of the spectrum lies a relative status quo. On the other, a “blue sweep,” in which Joe Biden defeats Donald Trump for the presidency and Democrats retain the House and take a slim lead in the Senate.

“All told, the fate of shipping could come down to who wins the presidency, along with all the other macro factors that drive demand,” said Jon Chappell, shipping analyst at Evercore ISI.

Stimulus spending

Stimulus has already artificially and prodigiously inflated container-shipping demand. Among the big benefactors: ocean carriers, trucking and intermodal rail. China-West Coast spot container rates were still above $3,800 per forty-foot equivalent unit (FEU) per day on Tuesday. That’s the same stratospheric level they’ve hovered around since mid-September.

As Jefferies Chief Economist Aneta Markowska put it during a conference call on Oct. 1, “The labor market took a massive beating during COVID. But fiscal stimulus was so massive that it more than offset it. Personal income was up 4.7% year-on-year in August. Fiscal policy essentially erased the recession if you look at just total personal income.”

To put it another way: The federal government’s use of debt to subsidize consumer spending is indirectly subsidizing earnings of transport companies (including non-U.S. companies). Stimulus funding has waned in recent weeks. The election outcome will determine the timing and amount of future indirect U.S. government subsidies to the transport sector.

“We believe Democrats would pass a massive fiscal stimulus in response to COVID-19,” said Evercore ISI political policy analyst Sarah Bianchi.

“This is likely to mark an important contrast to what a Republican administration would pass in 2021. Senate Republicans have already shown in the latest round of negotiations that they are running out of patience for big spending packages. With a Republican Senate and president, the fiscal spending will likely dramatically decline.”

Democrats are also much more likely to raise taxes to pay for stimulus than Republicans. But this is of little concern to ocean shipping companies, which are overwhelmingly non-U.S. entities that pay little or no U.S. tax.

Ocean shipping’s taxation worry relates to future consequences for economic growth. Particularly given that U.S. money-printing cannot go on forever.

US oil production and exports

The energy team at Morgan Stanley led by analyst Devin McDermott predicted that a Democratic sweep could lead to more stringent permitting versus a Trump administration for U.S. pipelines, a decreased ability to frack on federal lands, regulatory limitations of methane emissions and flaring and other heightened oversight. All of which “could hamper domestic oil growth.”

At the same time, Morgan Stanley believes a Biden win could lead to stricter fuel-efficiency rules. That would be a negative for domestic gasoline demand. “In a Biden win, we could see [fuel-efficiency] standards revert to something resembling Obama-era policies,” wrote McDermott. He estimated that this would translate into a 435,000-barrel-per-day reduction in U.S. gasoline demand over time.

A key tanker-demand variable is U.S. exports, as these shipments often go on long-haul runs to Asia that soak up an inordinate amount of vessel supply. What’s good for U.S. crude exports is good for tanker spot rates, and vice versa.

A Trump win would be better for U.S. crude exports than a Biden win, implies Morgan Stanley. Under a blue-sweep scenario, not only could U.S. production — and thus exports — be curtailed, but the law allowing U.S. crude exports could be rescinded.

Congress changed the law in December 2015 to allow U.S. crude exports to countries other than Canada. Morgan Stanley cited the possibility under a Democratic administration of a “potential ban on U.S. crude exports”. If so, it would “tighten seaborne markets globally.”

Relations with Iran and Venezuela

A Biden win could also affect the supply-demand balance via the tanker markets of Iran and Venezuela. Both have faced heavy sanctions under Trump.

An easing of Venezuela sanctions would theoretically allow more long-haul Venezuela exports to Asia, a plus for tanker rates. But in reality, exports would be limited by the country’s financial collapse. The bigger effect would be to make charterers more comfortable with tankers they had previously rejected due to calls in Venezuela. More effective capacity would be negative for rates.

If the U.S. eases Iran sanctions, it would be negative for rates to the extent Iran exports to Asia supplant U.S. exports. The U.S-China route is 2.5 times longer than the Iran-China route.

Meanwhile, sanctions have forced numerous Iranian tankers into floating storage. If those vessels return to commercial service (assuming they’re still technically able to do so), it would increase vessel supply — a negative for rates.

According to Morgan Stanley, “With a Biden victory, the nuclear deal [with Iran] could be back on the table.”

In general, sanctions have had enormous consequences for tanker rates under Trump. Most notably, the U.S. sanctions on a division of Chinese tanker company COSCO in September 2019 propelled supertanker spot rates to over $150,000 per day.

“The use of sanctions as an economic tool” is a key issue in play during the U.S. elections, said the Clarksons Platou Securities analyst team led by Frode Mørkedal and Omar Nokta. The election will determine the extent this tool is wielded going forward.

The Saudi Arabia factor

The tanker equation would be complicated enough if it were just about U.S., Venezuelan and Iranian exports. But it’s a lot more complicated than that.

“Under the Obama administration, a series of events caused a shift in the U.S.-Saudi Arabia relationship,” recalled Morgan Stanley. “First, the shale revolution led the U.S. to become one of the world’s largest global oil producers. Second, the Iran Nuclear Deal of 2015 brought the U.S. and Iran in closer alignment. Finally, in December 2016 the U.S. administration decided to limit arms sales to Saudi Arabia over events in Yemen.

“Under the Trump administration, U.S. foreign policy toward Saudi Arabia has pivoted back. President Trump’s 2018 decision to withdraw from the Iran Nuclear Deal and reimpose sanctions was supported by Saudi Arabia.

“Under a Biden presidency there is the potential for a shift in Middle East policy,” wrote Morgan Stanley. It noted that “Biden has suggested he would see a ‘reassessment’ of U.S.-Saudi relations.”

“In the event of a Biden victory and a new tack in U.S.-Saudi relations, we see the potential risk that Saudi Arabia could attempt to gain oil market share back from U.S. shale,” warned Morgan Stanley.

On one hand, more Saudi crude to Asia replacing longer-haul Atlantic Basin crude is a negative for tanker demand. On the other, the last time Saudi Arabia opened its spigots, in March, the overflow forced tankers into floating storage and spot rates topped $200,000 per day.

So, not all potential consequences of a Biden win are negative for tankers.

Relations with China

Regardless of the segment — containers, tankers, dry bulk, liquefied gas — future relations between the U.S. and China loom large.

“Clearly, better relations with China and a potential reversal of protectionist policies would bode well for trade,” said Chappell of a blue-sweep scenario. “We think container ships would benefit most directly, followed by dry bulk.”

In the “red sweep” Republican victory, “it is hard to imagine a scenario that is good for global trade,” Chappell added.

According to Bianchi of Evercore ISI, a Biden administration would behave very differently toward China, but trade tensions would remain.

“A Democratic administration would take a starkly different approach to China than the Trump administration, relying more on allies and traditional means of diplomacy. However, it is also likely to be different than the Obama-Biden administration approach, given how unpopular China has become with the American people and the tough issues ahead, like intellectual property and tech transfer,” she said.

Yet even so, an easing of the war of words under a new administration could be positive for shipping equities.

“The shipping sector has been caught in the trade-war crossfire between the U.S. and China over the past three years … market and investor sentiment [is] affected by changes in rhetoric from both sides,” said the Clarksons team.

“This overhang may ease should a new president take office. … The outcome of the election may have a meaningful impact on … investor attitudes toward the [shipping] sector,” wrote Clarksons.

Decarbonization timing

Looking longer term, the election could play an important role in the dynamics of shipping decarbonization over the coming decades.

The next four years will be a critical period in negotiations for shipping decarbonization rules. These regulations will have multi-decade consequences for vessel supply, chartering behavior and freight rates.

The International Maritime Organization (IMO) goal of reducing greenhouse gas emissions by 50% by 2050 is consistent with the Paris Agreement. The Trump administration has committed to withdraw from the Paris Agreement.

If Biden wins, the U.S. would remain in the international accord. This could tilt the scales toward the U.S. backing more aggressive regulatory action by the IMO. And that could include a global carbon tax on shipping.

According to Clarksons, “Europe has been a faster adopter of using renewable sources of energy and placing limits on greenhouse gas emissions. The U.S. has been gradually following suit. We expect this will continue should the existing Trump Administration remain in place, but [it] will likely accelerate should Biden win, especially as the green transition is a core theme of his campaign.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON OCEAN SHIPPING ISSUES AT STAKE IN THE ELECTION: U.S. import bonanza could extend into 2021 on ‘record’ restocking: see story here. Key moment for global decarbonization rules, but what will U.S. do? See story here. Sanctions are cleaving the global shipping fleet in two: see story here.