The third-quarter performance of U.S. Xpress was a mixed bag, significantly stronger in many areas but with clear pockets of weakness.

But on his company’s quarterly earnings call with analysts, CEO Eric Fuller kept coming back to the same theme: The rollout of the Variant program at U.S. Xpress is going to have some bumps along the way, but the evidence is already clear that it is making improvements in operations.

Immediately after the release of the company’s earnings, the price of U.S. Xpress stock was down more than 20%, wiping out most of the strong gains of the past month. The loss narrowed later to about 16%.

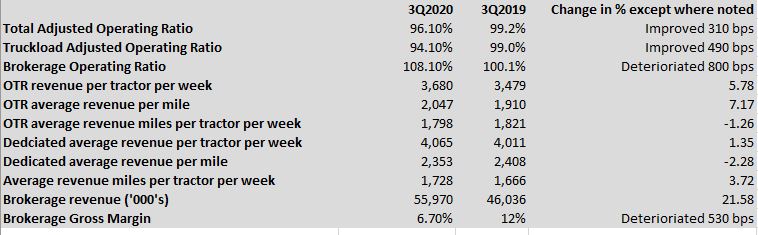

Investors seemed to be overlooking a significant improvement in the company’s operating ratio — down 490 basis points in its truckload operations–and producing a net profit compared to a net loss in the third quarter of 2019.

But miles driven were down, which contributed to a relatively modest increase in revenue during a period of a strong freight market. Revenue net of fuel was $403.6 million, up from $386.6 million in the third quarter of last year. That 4.3% increase matched almost exactly the increase in non-fuel revenue announced a day earlier by Knight Swift.

Net earnings of 20 cents per share were below consensus forecasts of 22 cents per share but marked a turnaround from the Q3 2019 loss of 3 cents per share.

In his comments on the call, Fuller said some of the negative developments, like the miles driven number, resulted in part from a company strategy to continue the shift over to the digital-based Variant operating model rather than trying to shore up what he called the “legacy OTR business.” And that meant recruiting fewer drivers into that OTR business than it might have in the past.

“As attrition took place, what happened this quarter was that we had a couple of decisions to make,” Fuller said. U.S. Xpress had “deprioritized” recruiting for the legacy fleet, but that was getting hit with turnover in excess of 150%.

“Our long-term plan was for Variant,” Fuller said. “We had kind of a sanity check early in the quarter on whether we should go back and recruit for the legacy business.” The company’s discussions “landed” on the decision that U.S. Xpress’ strategy eventually called for getting out of the legacy fleet, and efforts to significantly step up the recruiting of new drivers into it, just to chase the hot freight market, were not something it wanted to do.

“As attrition takes place, we will bring new drivers into Variant and not into the legacy business,” Fuller said.

U.S. Xpress rolled out Variant three months ago as it was releasing its second-quarter earnings. It is digitally based but it isn’t just a driver app. It is more of a fully integrated system with significantly reduced human touchpoints, what Fuller referred to as a “new paradigm” and a “cradle-to-grave” strategy.

There are more than 500 drivers converted into the Variant program now, he said, with the expectation that the company will convert up to a total of 900 by the end of the first quarter of 2021.

In the discussion with analysts and in a presentation released alongside the earnings call, Fuller said there have been significant improvements in Variant over the OTR fleet. Miles per week are up about 20% compared to the legacy fleet; the company’s turnover rate in Variant is 70% improved; and safety incidents are better by about 30%.

Because the company did not hire as aggressively into its legacy OTR division, U.S. Xpress reported that it drove about 10 million fewer miles in the third quarter than in the second quarter of this year, owing to the drop in seated tractors. “But we remain committed to our strategy and understand that this transition would not be linear in nature,” Fuller said.

One problem that the transition has run into is skepticism. “We thought as we went into the market that we would get this influx of drivers,” Fuller said. “That didn’t happen.” Additionally, U.S. Xpress is committed to hiring experienced drivers so new drivers out of school were not being considered.

“We had to spend more time with marketing,” Fuller said on the call. The company had current drivers in the Variant program speak to more drivers in the market, “and as we did that, we got some traction.” He added that the results of that are starting to be seen, with 15 new drivers hired into the program last week and the expectation that more than that will be hired this week. But a new weekly hire rate of 20 is what the company is seeking, he said.

“We now feel we’re getting our name out there and we’ve gotten over the hump,” he said. But he added that “we didn’t recognize how difficult it would be launching a new brand and getting driver acceptance.”

Just converting existing drivers to Variant is not as simple as it would seem. Fuller said there is “a specific type of driver” the company is looking for in Variant. They need to be “digitally native … willing to operate in a bit more of an environment where there isn’t as much hand-holding,” he said.

U.S. Xpress, as a company that has struggled with driver retention, has always had a front-row seat to driver market trends. Fuller’s comments on his earnings calls about the state of driver turnover are always something to note. Long before most of the industry took notice, he had been vocal that the federal Drug & Alcohol Clearinghouse was going to significantly tighten driver supplies.

He told analysts on the call that with the combination of losses from the driver pool due to the clearinghouse plus the loss of drivers coming out of temporarily or permanently closed CDL schools, the driver population in the U.S. will be down by about 200,000 by the end of the year compared to the start.

Other highlights from the call and the earnings report:

— Contract rates are “going to have to go through fairly significant increases” given the increase in costs, Fuller said. Recent bid cycles have been flat to negative, and a reversal is necessary. “That will happen in this cycle,” he said. At another point in the call, Fuller suggested that contract rate increases will be double-digit percentages.

— The company’s beleaguered brokerage division, which had an OR in excess of 108% for the quarter, posted a breakeven week last week for the first time in many months.

More articles by John Kingston

U.S. Xpress has strong second quarter

U.S. Xpress mix means steady freight volumes even as it posts a loss

Chris Smith

USX will keep talking about its great improvements in its digital unit. Yet adjusted revenue per truck has not improved. Something really bizzarre is brewing over there. No surprise then that Wall Street is punishing yet another underwhelming earnings report…

Time for change at the top?