U.S. Xpress Enterprises, Inc. (NYSE: USX) reported a loss of $0.03 per share, citing excess capacity in the truckload (TL) market and low rates in the spot market as the culprits. Analysts were looking for earnings of $0.06.

“The third quarter was marked by continued industry-wide overcapacity of tractors in relation to freight demand. This overcapacity continued to pressure our revenue per mile as well as our ability to optimize equipment utilization, particularly in the non-contracted spot portions of our Over-the-Road Truckload operations. We believe the pricing environment was further impacted by unprecedented and unsustainable rate competition from digital freight brokers,” said President and CEO Eric Fuller.

Even with the current oversupply of tractors in the market, management believes capacity additions are the path to improved financial results.

U.S. Xpress is making a bit of a gamble on market conditions improving as it continues to add tractors to the fleet, which increased by more than 5% in the quarter to 6,533 units. The over-the-road (OTR) fleet grew by 7.8% year-over-year in the quarter, with the dedicated fleet growing 2.2%. Management said the growth positions them to capture a rebound in the spot market, which could see significant rate increases if industry capacity tightens.

Analysts asked many questions, suggesting this may not be the right call. The concern is that the company is growing tractor count in a softer environment and is currently more reliant on the spot market than normal. Many feel this may be increasingly difficult to achieve as the company implements hair follicle testing on all drivers, potentially further weeding out driving candidates and making it tougher to seat new tractors.

Management countered that the market can’t sustain these irrational levels much longer and that truck capacity is likely to tighten meaningfully in the coming months as increased regulation takes hold. Further, they believe they have a good deal of dedicated business coming on-line in the next 90 days and can move equipment to that offering, from OTR if need be. Management contends that the supply-demand dynamic isn’t as bad as it appears and that the newer, digital brokers are artificially driving rates lower. They don’t believe that the current price actions from brokers will continue in perpetuity.

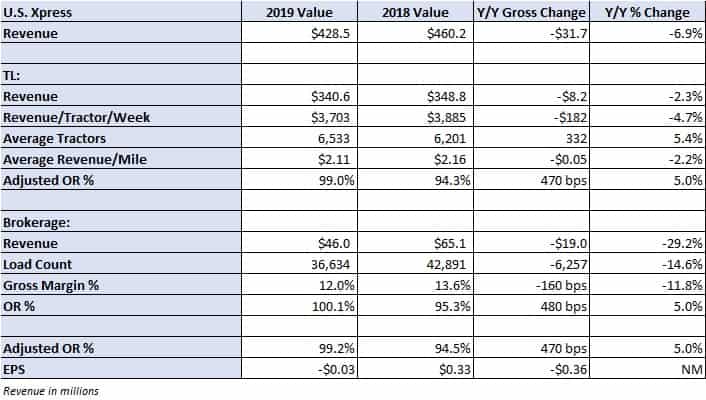

Total revenue declined 7% year-over-year to $429 million. More than half of the revenue decline was due to lower brokerage revenue, with the rest being attributed to the closure of the company’s Mexico operations. The company posted an adjusted operating ratio of 99.2%, which was 470 basis points (bps) worse year-over-year. The company’s consolidated operations posted a net loss of $1.4 million compared to more than $16 million in net income in the prior-year period.

TL revenue declined 2% year-over-year to $341 million as revenue per tractor per week dipped 5% and average revenue per mile declined 2%. U.S. Xpress’ over-the-road division drove these metrics lower with 12% and 8% declines, respectively. Management noted that its over-the-road TL operation traditionally sees 20% spot market exposure, but was higher in the quarter. The company’s spot market rates were 35% lower in the period. Both OTR and dedicated divisions saw increases in contract rates.

“While the severe decline in USX Spot rates pressured our OTR results, contract rates grew by low single digits in the quarter. Our Dedicated division continued to perform at record levels by achieving more than $4,000 per tractor per week for the second consecutive quarter. The initiatives put in place to improve the division’s execution are driving these strong results, and the outlook for Dedicated remains strong as rates grew more than 5% in the quarter,” Fuller said.

Dedicated revenue per tractor and revenue per-mile metrics increased nearly 6% year-over-year.

U.S. Xpress’ brokerage division recorded break-even results in the quarter as loads declined nearly 15% and revenue per load was lower. The combination resulted in a 29% decline in revenue for the group.

The company revised its full-year adjusted operating ratio guidance from its previously lowered range of 95.5% to 97.5% to approximately 98.5%. Management noted deterioration in revenue per mile in the OTR segment and softer gross margins in brokerage as the reasons. They believe the new guidance is a little conservative, but likely accurate if current market headwinds persist. They do expect to see a peak season in 2019, but it will be “very muted” compared with prior years. Management said conditions were a little more promising in September but that October was much weaker than normal.

Share of USX are down more than 15% on the day.

Dave

Yikes. Their stock is down 75% in 1 yr. I hope they can get back on track. Some good people there.