With no end in sight to the United Auto Workers strike, the losses to the auto supply chain and industry are adding up.

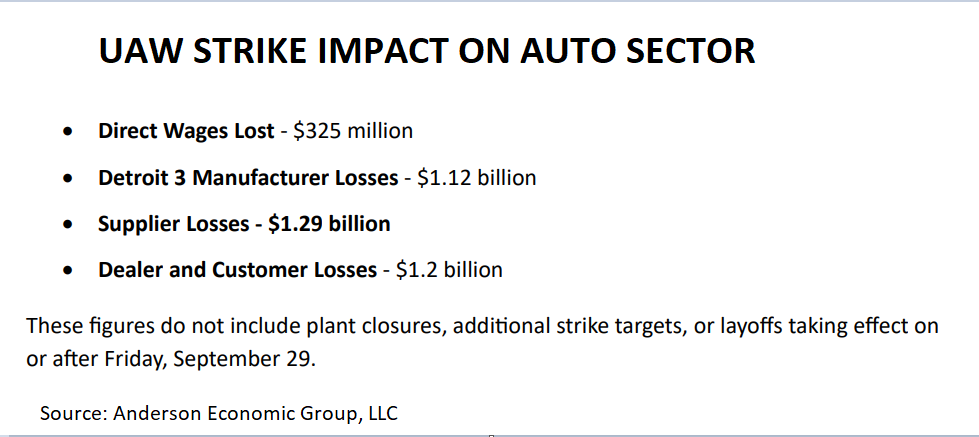

In its latest estimate, Anderson Economic Group (AEG) reported that the first two weeks of the strike against the Detroit Three automakers resulted in $3.95 billion in economic losses. Almost half of that is from supplier losses.

Patrick Anderson, principal and CEO of AEG, said the second week was more costly than the first because of the supplier impact.

“There is no $800 million strike fund to help suppliers, and they don’t have a vote in this strike,” he said Monday. “The most serious damage is occurring to the workers and owners of these firms.”

The shutdown of 38 parts distribution centers also crimped dealership service operations. The AEG report noted when distribution centers were shut down, the strike’s impact spread to dealers, customers and additional suppliers, none of which are party to the strike negotiations.

“When the innocent bystanders begin to feel it,” Anderson said, “it will affect the generally supportive sentiment Americans have been expressing about the UAW’s demands thus far in the strike.”

The latest round of strike targets announced Friday will impact both Ford and General Motors customers. The UAW announced 7,000 more workers would strike at a Ford plant in Chicago and a General Motors assembly factory near Lansing, Michigan.

The Ford plant strike will directly hit its supply chain in the production of the company’s most popular and profitable models, the Ford Explorer and the midsize SUV Lincoln Aviator models. The GM plant manufactures the large crossover SUV, the Chevrolet Traverse.

Daniel Rustmann, co-chairman of the global automotive practice at Butzel, which represents auto suppliers, said he is already seeing an impact.

“I know some suppliers are laying off hundreds of workers and they are worried about getting them back,” Rustmann said. “It’s a tough labor market … . The situation can be dire in the next couple of weeks depending on their size. Historically, they don’t get support from their customers, the OEMs.”

Rustmann said prior to the strikes, the suppliers were still faced with supply chain difficulties. The industry continues to receive delayed products as a result of the Canadian ports labor strikes over the summer. There is also an inability to store products. All of this adds to the supply chain delivery timeline.

“When the strike ends, OEMs will want to turn on the fire hose and start back at 100%, but the suppliers can’t because of labor,” he said. “They will need to ramp back up. There will also be delays because some products need materials compounded or formulated, they have shelf life issues.”

Freight Zippy

The Democrat Socialists of America are pushing for this strike.

It is time to rid America of these hard line socialists.

My guess is these plants will close and these jobs shift to Mexico.

That will be best for all..