Uber Freight and Waymo Via are working together to map out what widespread autonomous trucking will look like.

The digital freight broker and autonomous trucking software developer describe the partnership as a deep collaboration aimed at what Uber Freight head Lior Ron called the “democratization” of autonomy.

Most autonomous trucking today involves software developers testing their products with large fleets on interstates in the Southwest known for long, flat stretches of roads and favorable weather conditions. Humans drive the trucks to drop-and-hook locations and pick them up at the other end of the middle-mile route.

Waymo and Uber Freight could infuse autonomy across fleets

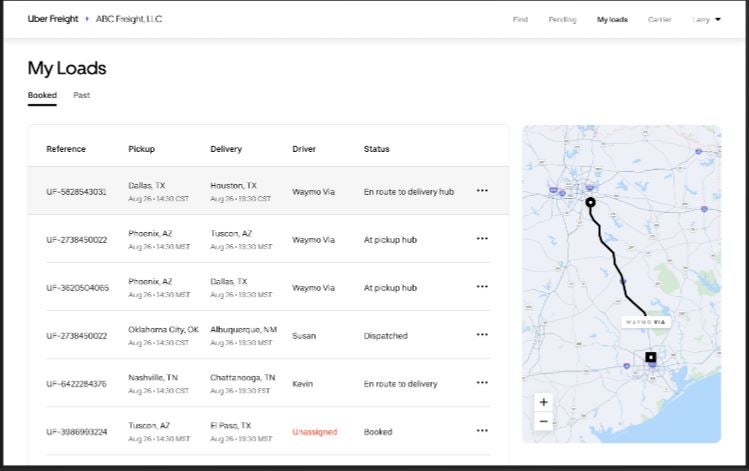

Beginning with Waymo Via’s research and development test fleet, carriers that operate trucks equipped with the Waymo Driver can opt in to deploy their autonomous assets to transport loads via the Uber Freight network.

The collaboration with Waymo follows an ongoing pilot with Aurora Innovation that began in December. Uber Freight is booking first- and last-mile loads in Texas that Aurora is running weekly for customers on Interstate 45 from Dallas to Houston. Aurora and Uber Freight expect to expand to other routes.

The arrangement with Waymo Via could be a game changer. It makes autonomous trucking an option for large, medium and eventually small carriers that make up the majority of the $700 billion trucking industry.

“This really allows us to go beyond the transactional pilots and really start planning 10 years ahead on what this industry is going to look like,” Ron told FreightWaves.

Uber Freight paid $2.25 billion to acquire freight management company Transplace in November. Transplace now operates as part of Uber Freight.. It has $17 billion of freight under management.

“It’s really about how we can maximize the value of autonomy for all parties,” Ron said.

Waymo keeps focus on autonomous technology

Waymo Via’s focus remains on tweaking its Level 4 autonomous Waymo Driver platform. The software is shared between ride-hailing passenger cars and driver-as-a-service commercial trucks.

“They’re not quite at that maturity for a third party to own and operate these. But that’s the intended business model,” Charlie Jatt, Waymo head of trucking commercialization, told FreightWaves.

“Waymo and Daimler [Truck North America are] working together to integrate the Waymo driver with the Freightliner Cascadia. We make that available to carriers. And then carriers have to go out and monetize these assets.”

Waymo Via is committing to reserve billions of miles of its goods-only capacity for the Uber Freight network. That would make Uber Freight a significant player in autonomous trucking.

“Our goal is to put all of the commercial building blocks in place so that every milestone we hit on the technology front — when we take the driver out for the first time, when we scale to the first several routes, when we start really scaling up massive numbers of autonomously driven trucks — the rest of it is ready to go,” Jatt said.

Waymo-Uber Freight model differs from rival TuSimple

Rival TuSimple is creating high-definition maps of tens of thousands of miles of freeways for its software to ingest and react to. By contrast, Waymo is leaving the routing to carriers to determine where autonomy makes sense.

TuSimple also runs a fleet of nearly 100 trucks to haul freight. It is working with Navistar on a ground-up International LT with its autonomous software to sell beginning in 2025. TuSimple has several thousand reservations for the trucks.

“There is so much expertise in the marketplace today, through the base of carriers from large, medium and the vast network of small carriers,” Jatt said. “We think the fastest, most scalable and most efficient way to unlock the benefits of this technology is going to be through empowering those carriers.”

Getting carriers and shippers to think about “their future network topology” is going to take five to 10 years, Ron said. Autonomy will become an option for intermodal, truckload, less than truckload and cross-border freight.

“Overall, it’s about democratizing access to autonomous technology at scale. The entire carrier community is invited. And there’s a very important role for everyone.”

Related articles:

Uber Freight takes on $550M in new ownership, closes Transplace deal

Uber Freight, Transplace to combine operations

Waymo Via partners with C.H. Robinson to explore small fleet autonomy