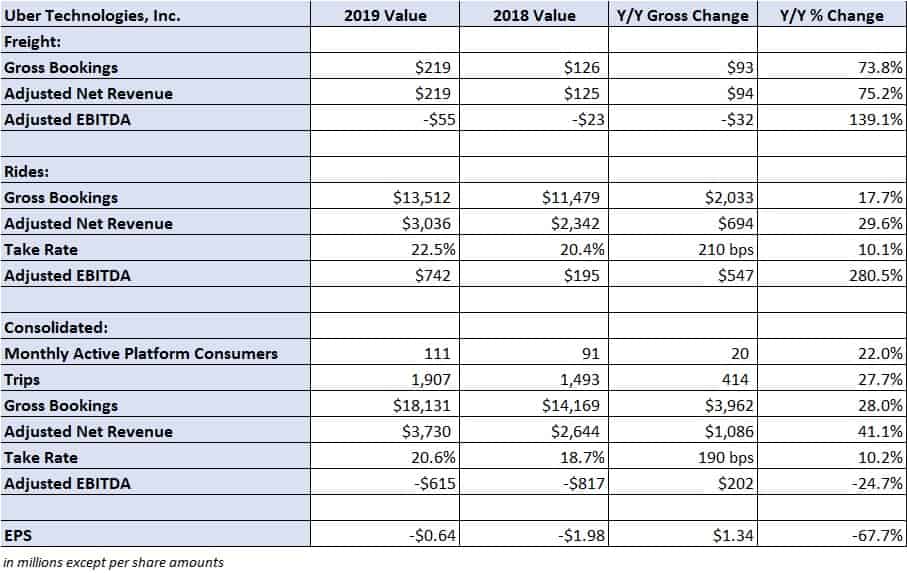

Uber Technologies, Inc. (NYSE: UBER) reported a net adjusted loss of 64 cents per share, 4 cents better than the consensus estimate. Consolidated adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was a loss of $615 million, a more than $200 million improvement year-over-year.

Uber pulled forward its profit guidance, which now calls for its first quarter of adjusted EBITDA profitability to occur in the fourth quarter versus the prior guide of during 2021.

Uber Freight results

The company’s digital freight brokerage division, Uber Freight, reported a 74% year-over-year increase in gross bookings to $219 million. Gross bookings declined $4 million sequentially from the third quarter. Loads in the freight division increased by 89% year-over-year, although the actual number of transacted loads on its platform was not disclosed.

Adjusted net revenue in freight increased 75% year-over-year to $219 million, but only $1 million higher sequentially in the period. It was the lowest quarter-over-quarter growth rate in adjusted net revenue for the freight division since the company began disclosing the division’s results.

Adjusted EBITDA was a loss of $55 million in the quarter, $32 million worse on a year-over-year basis. However, adjusted EBITDA was $26 million better than the third quarter of 2019 on a similar level of gross bookings. Management noted lower truck pricing in the quarter.

The web portal designed for web-based carriers, which launched in the third quarter, accounted for 10% of the freight group’s overall capacity during the period. The company said that freight’s in-app bundles that allow carriers to book multiple loads at once “have reduced empty miles versus non-Uber Freight matched bundles.”

Management was measured in discussing future expansion for the freight division. It said the company will pursue “responsible expansion” and noted a “heavy focus on unit economics.”

“We recognize that the era of growth at all costs is over. In a world where investors increasingly demand not just growth, but profitable growth, we are well-positioned to win through continuous innovation, excellent execution, and the unrivaled scale of our global platform,” Uber CEO Dara Khosrowshahi said about the company’s overall growth strategy.

UBS recently initiated coverage with a “buy” rating. In a note to investors, equity research analyst Eric Sheridan said that he believes Uber Freight could see $6 billion in annual revenue in the future.

“Going forward, we forecast Freight scaling to a $6bn+ annual revenue segment by 2024E as Uber continues to invest behind the further buildout of its logistics network and demand generation domestically as well as potential geographic expansion (incl. announced plans to launch in Germany),” stated Sheridan.

Consolidated and Rides

Uber reported that monthly active platform consumers increased by 20 million to 111 million users with total trips increasing 28% year-over-year. Gross bookings increased 18% in Rides with a 30% increase in adjusted net revenue. Adjusted EBITDA in the division increased nearly $550 million in the period to $742 million.

Shares of UBER are up more than 3% in after hours trading.

Abe F

I’d love to know Uber Freight’s headcount and how that compares to a traditional/legacy brokerage.

How many loads are they moving per carrier salesperson on the floor?

The advantage of digital brokers was supposed to be “do more with less, computers make the match and create efficiency” – I guess I’m not seeing it. To lose the money they have to have high headcount relative to revenue.

Ex Uber

Uber is highly manual. In many cases more manual than we were at Coyote. There is actually very little tech behind the scenes. Just marketing people

Bobby K

Uber Freight layoffs coming this quarter. They were hiring like crazy to grow the revenue at a loss. Now they have figured out that they can’t make money.

Dave

Eric, just imagine that when UF hits that $6 billion in annual revenue how big the losses will be.

This isn’t a business. It’s a joke. They buy sales by losing money on every load. The moment they try to increase their pricing all those shippers will disappear and move to some other idiot willing to lose money. Like Convoy.

Andrew

This. A race to the bottom is all they are running. Until Uber can release autonomous trucks and actually add capacity to the market, I don’t see a possibility of Freight turning a profit.