Union Pacific’s (NYSE: UNP) intermodal rail service saw average speeds sink to a two-year low in the second quarter, with shippers and intermodal marketing companies reporting extensive delays in getting their freight from the railroad.

The service hit came during an overall lull for West Coast container imports. And many of the delays were due to the extreme rains and flooding that hit the U.S. Midwest.

But shippers also say the railroad’s efficiency drive may have also contributed to the service deterioration.

Union Pacific’s Chief Executive Lance Fritz said that overall volumes are tracking 4 percent lower in the second quarter. Fritz blamed the poor weather and trade uncertainty as the main reasons for the lower volume.

High winds and severe rains forced Union Pacific to run shorter trains at slower speeds, so cargo has not been as quickly throughout its system in the last few months.

In a June 24 customer update, the railroad said “flooding conditions continue to impact operations across the southern portion of our network… These outages have caused network delays due to terminal and main line congestion with trains holding in multiple locations. Customers with shipments around the affected areas can expect delays of 48 to 72 hours.”

The weather’s effect on the network can be seen in performance statistics. Union Pacific saw average train speeds for intermodal cars reach two-year lows during the second quarter, hovering just over 26 miles per hour in parts of April. In the two previous years, Union Pacific intermodal cars saw weekly average speeds north of 30 miles per hour.

Average speeds picked up to just under 29 miles per hour by mid-June.

A Union Pacific spokesperson said up to eight subdivisions were impacted by flooding through the last week of May and that it worked with customers to prioritize trains and direct shipments away from flooded areas.

Extreme flooding also contributed to ingate suspensions at intermodal facilities in Chicago, St. Louis and Houston.

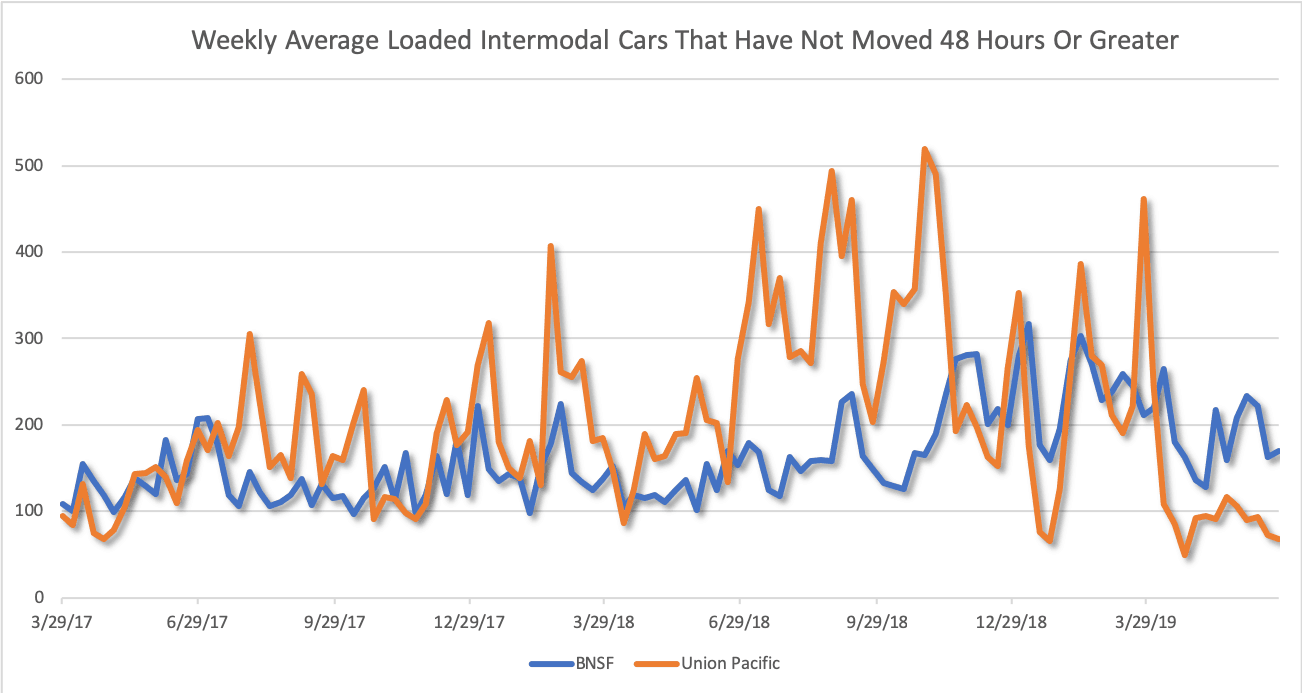

But other performance indicators showed declines in service ahead of the poor weather. The weekly average number of intermodal cars that have not moved in 48 hours or more spiked to as high 500 in 2018.

In June, Mediterranean Shipping Company (MSC) said BNSF would replace Union Pacific for its intermodal rail service out of marine terminals in Los Angeles and Long Beach.

A shipping line executive who was not authorized to speak publicly said the change stems mostly from MSC’s alliance partner Maersk already using BNSF on those lanes. But he said that shippers, as well, have asked for changes.

Speaking on condition of anonymity, a logistics executive who ships with Union Pacific out of the Midwest said working with the railroad has been a “has been a challenge to deal with.”

The big challenge is keeping up with the changes wrought by Unified Plan 2020, the railroad’s version of performance scheduled railroading. The railroad is in the process of consolidating six intermodal ramps in Chicago by closing two and limiting shipments at two others.

“We are facing long lift times at the yards they do still have open for our truckers, and the equipment they have in their facilities is down to bare bones – hardly anything available when we go in for empties,” the logistics executive said.

Union Pacific also halted some services as a result of changes in its intermodal interchange agreement with CSX for cars destined for east of the Mississippi. Those changes “limited the options they have to reroute when faced with the recent weather issues as well,” the executive added.

One intermodal carrier executive who spoke on condition of anonymity said Union Pacific’s Marion intermodal yard near Memphis presented severe problems for shippers. A lack of chassis in that particular location forced containers to be stacked, which created longer than expected turnaround times for drivers.

“The container stack became known as ‘the wall,’” the executive said. “Union Pacific told you it’s here and available. But it would take forever to dig out of the pile.”

But he added that BNSF also had its own share of troubles at Chicago intermodal ramps. He said chassis shortages at the yards forced containers to be grounded, resulting in higher dwell and detention time for drivers.

“The turn times went from 30 minutes to a couple of hours,” the executive said.

“The Union Pacific and BNSF both had substantial flooding, so everything was backed up three to four days,” he said.

In a statement, the railroad said the ongoing rollout of Unified Plan 2020 will “help our intermodal service become more consistent and reliable.”

things to do on the east side of the big island hawaii

AB

Tom Washbon

That was supposed to happen.

Adam Saenzpardo

They forgot to mention the large reduction in manpower has also created delays. The large hit to satellite mechanical operations has caused increased down time when mechanical issues arise.

Jim

This company is full of it. It’s all about the mighty dollar for them not the customers. Worst carrier to do buisness with.

Pete Nelson

UPRR – Chicago yards all 4 of them are marginal operations…. Chassis shortage issues are poor excuse…

Thanks UPRR you made it easy to close our Chicago DC and relocate to Memphis.