Drivers at Universal Intermodal Services at the Ports of Los Angeles and Long Beach have voted to join Teamsters Local 848, marking the seventh company at the ports to employ workers represented by the union.

There are 28 drivers in the bargaining unit. Workers say they are seeking affordable health insurance, wage increases and retirement benefits.

“Every single one of us, my coworkers, we all have different reasons for joining the union,” said Universal driver David Lopez. Speaking through an interpreter, Lopez, 50, said his “first and foremost reason” is to gain access to dental insurance. Universal’s pay is inadequate, he added, and in addition to other benefits a Teamsters contract would ensure workers had access to due process.

Representatives from Universal Intermodal and its parent company, Universal Logistics (NASDAQ: ULH), did not respond to FreightWaves’ requests for comment.

About 600 of the approximately 12,000 drivers working the Southern California ports are Teamsters members, Fred Potter, director of the Teamsters Port Division, told FreightWaves.

In addition to Universal, the other drayage companies with union contracts or representation at the California ports are Toll Group, Sea-Logix, HLT, EcoFlow, Weber Logistics and Pacific 9 Transportation.

The Teamsters’ Port strategy: a complicated history

Union efforts to organize port drivers fits into a broader campaign on the part of the Teamsters and other labor groups alleging that truck drivers at the ports have been misclassified as independent contractors rather than employees.

The Teamster’s role in that campaign has a complicated history, marked by shifting tactics and alliances with environmental groups.

Between 1980 and 2010, the Teamsters had signed zero union contacts at the Southern California ports, said Scott Cummings, a professor of law at UCLA, where he focuses on public interest law and social movements.

The seven contracts signed since then reflect a new organizing strategy launched by the Teamsters after California’s Clean Truck Rule took effect a decade ago, according to Cummings. That rule banned trucks that did not meet the latest emissions standards from entering the ports.

The original clean truck program, backed by the Teamsters, included a labor component requiring trucking companies working at the ports to hire the drivers as employees, rather than treating them as independent contractors. The idea was to make the companies and not the drivers bear the cost of buying new rigs.

The American Trucking Associations sued and the 9th Circuit Court of Appeals tossed the requirement.

After the union tried but failed to convince the city of Los Angeles to mandate that trucking firms couldn’t access the port without employee drivers, Cummings explained, the Teamsters decided to target directly the drayage operators that had misclassified employees as independent contractors.

“The strategy shifted from trying to get a government agency to mandate reclassification to asserting misclassification was an illegal act and that the drivers were legally speaking employees,” Cummings said.

Given the significant forces — economic, political — arrayed against the Teamsters, he added, “winning even one contract is really, really significant.”

AB5 and misclassification

Other factors are emboldening organized labor. The recent passage of California labor law AB 5 limiting the use of independent contractors marks a big win for the Teamsters and other labor groups, as does Senate Bill 1402, a law that took effect this year making retailers and other customers of port trucking companies liable for contracting with or using port drayage motor carriers who have unpaid wage, tax and workers’ compensation claims.

“It is good legislation,” Potter said, and it is is one reason more companies this year have converted their alleged independent contractors to W-2 employees.

Industry groups are vehemently opposed to the new labor laws. In November, the California Trucking Association (CTA) filed a legal challenge against AB5, saying it will result in 70,000 drivers in the state losing their jobs and that the state legislation violates federal law.

For its part, the Teamsters plans to target other Universal Logistics subsidiaries, Potter said. Universal Logistics has been on an intermodal acquisition spree, and several of the companies have been accused of misclassifying employees as independent contractors.

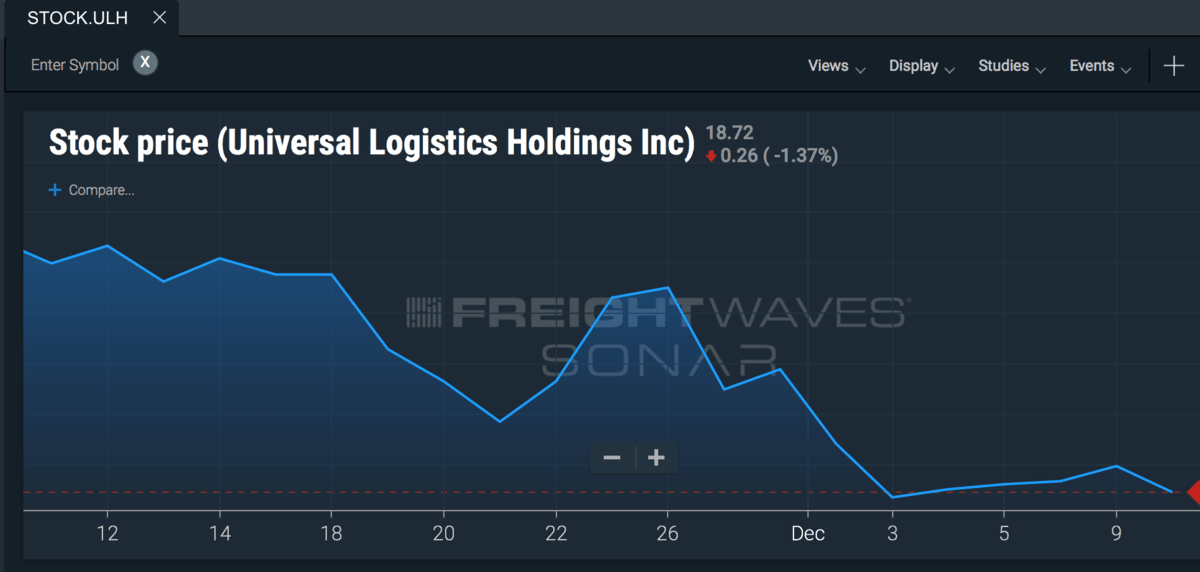

Reeling from a softened freight market, Universal Logistics’ earnings took a hit in the third quarter. Intermodal services were a bright spot, increasing $39 million to $93.9 million in the second quarter, up from $54.9 million during the same period last year. The increase was attributed in part to revenues generated from acquisitions.

Now that Universal drivers have voted to join the Teamsters local, the next step is to negotiate a contract, Lopez said.

Noble1

Contempt of court and aiding & abetting to do so etc !

Unifor president infringed court injunction and for doing so a restraining order was filed against him , LOL !

He should hand in his resignation . A wise leader never puts himself nor his followers in harms way , NEVER !

Furthermore , I have warned about “following” questionable leader actions blindly . Now he’s put members/picketers in harms way due to mischief/contempt of court etc. accusations against them , and he’s flying in even more members to commit mischief & contempt of court etc. !

Is this supposed leader normal ???

Why incite and induce members to break the law , put them in harms way , and potentially obtain a criminal record in the process for doing so ?

Quote:

“Dias added that he stayed in a cell at the police station for seven hours before he was able to leave. 14 people were charged with mischief; Dias is also not allowed within 500 metres of the Co-op Refinery Complex in Regina.

His court date has been set for Feb. 26 at the provincial courthouse.”

The irony in Dias’s statements is alarming ! What a disgrace . I’d be beyond embarrassed in his place . I don’t think he even realizes how ignorant and ridiculous he appears to be ,

In my opinion ……………..

Google it :

January 21 2020

Unifor president speaks out following Monday arrest

Noble1

Now this is hilarious !

January 18 2020

Quote :

“REGINA, Jan. 18, 2020 /CNW/ – As the lockout of nearly 800 refinery workers enters its seventh week, more proof that Federated Co-operatives Limited is a corporate bully emerged as five radio stations refused to air Unifor’s newest radio ad promoting Unifor’s national boycott.

Not only is Co-op attacking its own workers, they are using their corporate influence as a multi-billion dollar conglomerate to pressure radio stations from airing our boycott Co-op ad,” said Jerry Dias, Unifor National President.

CFMY-FM in Medicine Hat, CHLB-FM in Lethbridge, CHWF-FM in Nanaimo, CJPG-FM in Portage La Prairie, and CKDV-F+ Prince George initially aired the ad but then pulled it.

“The stations claim they do not want to take sides but it’s clear they are caving to Co-op’s demands as they continue to act like a greedy corporate bully,” said Scott Doherty, lead negotiator and assistant to the National President.

Several vendors such as bus companies and other rental agencies have also refused to supply Unifor members, saying Co-op has asked them not to do business with the union.

Unifor 594 members were locked out December 5, 2019 after the company demanded concessions that include gutting workers’ pensions.

On December 15, Unifor launched a boycott of all Co-op retailers and has been advertising on radio, television and billboards.”

End quote .

HOW DOES IT FEEL TO BE “BOYCOTTED” ??? LOL !

NOW WHO IS BOYCOTTING WHO ? KARMA ! LOL !

YA SHOULDN’T THROW STONES IF YA LIVE IN A GLASS HOUSE !

Noble1

UPDATE !

January 20 2020

Unifor president arrested during blockade of Regina’s Co-op Refinery

Noble1

I’ll quote ,copy, and paste a comment posted on trucknews

AnonOP says:

December 21, 2019 at 1:14 pm

Unifor local 594 in violation with Section 6-59 of The Saskatchewan Employment Act

What duty does my union owe to me?

Section 6-59 of The Saskatchewan Employment Act states that an employee who is or a former employee who was a member of the union has a right to be fairly represented by the union that is or was the employee’s or former employee’s bargaining agent with respect to the employee’s or former employee’s rights pursuant to a collective agreement and that a union shall not act in a manner that is arbitrary, discriminatory or in bad faith in considering whether to represent or in representing an employee or former employee. A union does not necessarily have to carry out the wishes of every employee or place the interests of one member above the interests of another member. As long as a union has not made an arbitrary, discriminatory or bad faith decision, it will have met its duty under s. 6-59. If a union acts conscientiously and takes into account all relevant factors in making a decision, that decision is likely not arbitrary. A discriminatory decision is one which draws distinctions between union members on illegitimate grounds. A bad faith decision is one which is motivated by malice, hostility, favouritism or personal considerations. Unless a union’s decision is arbitrary, discriminatory or in bad faith, the Board will not find a breach of the duty of fair representation, even if the Board does not agree with the decision that the union made.

Unifor and local 594 are in violation with the Saskatchewan Labour Relations Board picketing code .

Picketing may occur during a lawful strike or lockout. The picketing is restricted to the employees’ place of employment. Picketing must be peaceful and carried out without trespassing or other unlawful acts. Violent or unlawful acts can involve legal consequences and may affect the employees’ continued employment. Picketing is regulated by the Labour Relations Board.

How do we remove the union from the workplace?

Visit FAQ – FREQUENTY ASKED QUESTIONS

Saskatchewan Labour Relations Board

or call (306) 787-2406

End quote .

Requote :

” If a union acts conscientiously and takes into account all relevant factors in making a decision , that decision is likely not arbitrary”

Now here is the million dollar question !

Did Unifor act “conscientiously” when it lead its members to break laws on the picket line ? Was Unifor’s decision “arbitrary” ?

AGAIN !

Quote:

” a union shall not act in a manner that is arbitrary, discriminatory or in bad faith in considering whether to represent or in representing an employee or former employee. ”

End quote .

And last quote :

“Picketing must be peaceful and carried out without trespassing or other unlawful acts. Violent or unlawful acts can involve legal consequences ”

End quote .

Indeed , Unifor used poor judgement on the picket line by acting unlawfully . In doing so Unifor did not take all relevant factors into account and acted in an arbitrary manner while representing union labourers on the picket line .

In laymen terms , Unifor lead union labourers to break the law on the picket line . And that’s an arbitrary decision while representing union labour members . In fact it’s extremely unreasonable ! Lucky for them , in this case the only legal consequence so far has been an injunction . They had to be told by the court ,like little misbehaved children, that their conduct was wrong and unacceptable , LOL ! What an embarrassment !

A big thank you and shout-out to AnonOP !!! Much obliged !

In my humble opinion …………….

Noble1

UPDATE !

FCL(Federated Co-operatives Limited) vs Unifor

FCL won their injunction against Unifor behavior on the picket line !

Judge issues order restraining Unifor from impeding refinery traffic

December 27 2019

Unifor dealt blow as labour unrest at Co-Op refinery continues

“A Regina judge has ruled Unifor members picketing outside the Co-Op refinery will have to abide by rules as they deal with traffic coming in and out of the facility.

Justice Janet McMurtry heard from both Unifor and Federated Co-Op this week before deciding “the restriction of access to or exit from the said premises, shall only last as long as necessary to provide information, to a maximum of 10 minutes, or until the recipient of the information indicates a desire to proceed, whichever comes first.”

Shortly after receiving strike notice from Unifor, Federated Co-Op served a 48-hour lockout notice on December 5 affecting an estimated 700 workers.

The situation has been nasty at times with lengthy lineups of trucks waiting to get into the refinery and the union calling for a boycott of Co-Op stores across Western Canada.

Pension is the main issue.

It is not known when the two sides will get back to the bargaining table.”

End quote .

At first it was a maximum of 5 minutes , now it’s a maximum of 10 minutes or until the recipient of the information indicates a desire to proceed, whichever comes first.

That means if they approach a ,ie: truck driver and the driver responds, ” not interested I’d like to go through” , it can be “seconds” , LOL !

That’s a big score for the FCL !

Furthermore , there was jurisprudence on the matter due to a similar case . That goes to show you the incompetence of the labour union and their legal team in this particular matter !

Be VIGILANT concerning who YOU choose to follow !

In my humble opinion …………….

George

So how did that union thing work out for you? I bet some of you idiots still don’t get it. I saw the pictures of the picketers and thought to myself, self there sure are a lot of stupid looking people in that picture.

Noble1

December 18 2019

Quote :

OHS contractor alleges harassment, assault, from Unifor 594 members

REGINA — Jared Savage, an occupational health and safety professional, was called into work at the Co-Op Refinery Complex during the first few days of the labour dispute at the facility, but he never made it beyond the fence.

Savage was one of 24 temporary workers on a bus chartered by Federated Co-Op, but the bus was stopped from entering the facility. It then travelled to a Balgonie gas station where Savage alleges the bus was followed by a vehicle full of Unifor picketers.

He claims the locked out workers confronted them at the gas station and alleges they harassed and assaulted him.

“It’s almost like he checked me into his shoulder, I smashed into the guy, we smashed heads and with an overhand strike, he smashed my hand because he wanted the list – I had a list of people with their phone numbers on it – and he smashed my hand, ripped it out of my hand and started running away,” Savage told CTV News.

RCMP is investigating the incident.

Savage says the names on the list have been receiving phone calls and text messages from Unifor members.

“The next morning, when we got up, we went to have another meeting and one of the gentlemen brought out his phone and said, ‘Hey, people are texting me’, and we come to find out that they were fishing for information, asking him if he got out of the situation okay, if he was alright,” Savage said.

Unifor Local 594 President Kevin Bittman says he isn’t aware of this incident happening.

“In the first three or four days when tensions were a little bit high, the company locks you out, people were amped up a little bit,” he said. “We did communicate with our membership and everybody’s calmed down quite a bit, so I’m not sure if something went one early in the proceedings.”

Savage says the incident is something that will stay with him.

“This isn’t going to be overnight being able to let this go,” he said. “I’m concerned when I walk in public places, who’s going to jump me now, so this was something that was pretty traumatic and I don’t know how long I’m going to be dealing with it.”

Savage provided an affidavit of the incident to Co-Op’s lawyers, which Co-Op included in their injunction filed on Tuesday to force Unifor to pare down the picketing at entrances and exits of the refinery.

End quote .