Multimodal transportation and logistics provider Universal Logistics Holdings reported record quarterly results during the first quarter of 2022. The company lifted its full-year 2022 outlook and issued second-quarter guidance ahead of the consensus estimate.

Universal (NASDAQ: ULH) reported earnings per share of $1.56 after the market closed Thursday. The number was nearly double the year-ago result and outpaced its implied guidance in the high-80-cent range.

“Our efforts evaluating operating cost structures and negotiating rate increases with our customers, as well as continued rationalization of underperforming business across our service lines, came to fruition in the first quarter,” CEO Tim Phillips said in a press release.

Consolidated revenue increased 26% year-over-year to $524 million, significantly better than the guided 6% growth rate. The intermodal (+52%) and contract logistics businesses (+30%) led the way, with trucking (+3%) and company-managed brokerage (+7%) seeing more moderate gains. Higher fuel surcharge revenue was a tailwind.

Purchased transportation, Universal’s biggest expense line, remained elevated, but higher pricing drove the line down 130 basis points as a percentage of revenue. On the outlook for third-party capacity costs, Phillips told analysts on a Friday conference call, “What you’re seeing now is what you’re going to get going forward into the second quarter and beyond.”

He believes the company has driver pay at levels appropriate to maintain capacity commitments to customers. He expects Universal will able to add drivers in the coming months.

“Although owner-operator capacity remains tight, we think there will be opportunity to capture owners who may have transitioned to their own authority and may be getting nervous about the softening spot market,” Phillips said. He believes Universal can also lure small trucking companies to its agent model.

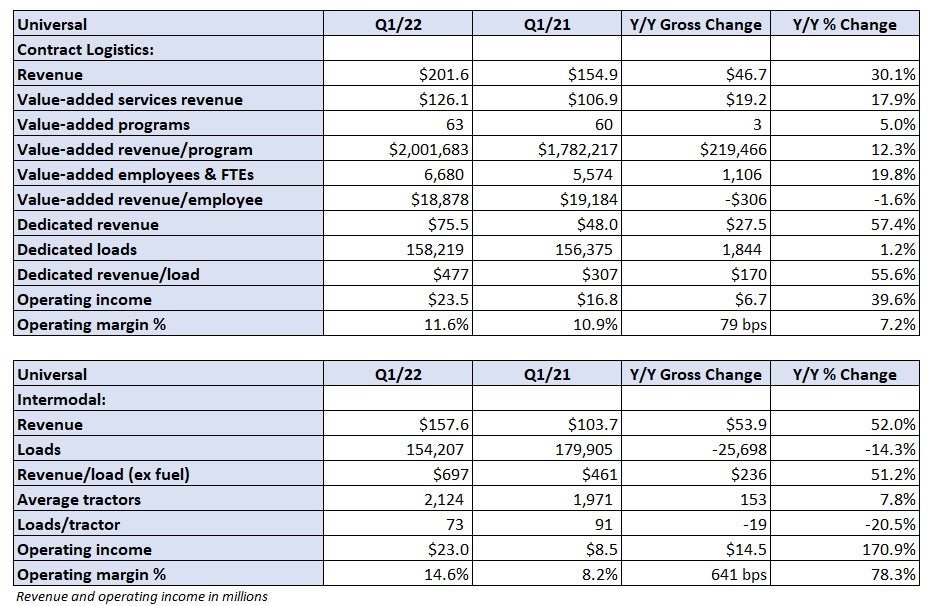

The contract logistics segment benefited from three additional value-added programs during the period. Dedicated transportation revenue within the division increased 57% due to a similar increase in revenue per load, the result of “repricing existing customer contracts.”

Intermodal loads were down 14% year-over-year, but revenue per load jumped 51%. The hike in yield resulted in a 640-bp increase in operating margin to 14.6%. Rail network congestion continues to weigh on volumes, but management doesn’t see elevated accessorial charges (detention, demurrage and storage), which were three times higher in the period at $36 million, rolling off anytime soon.

“I think the customers are really cautious knowing the fact that we’ve got a little bit of lull now and we know that we have this big glut of freight. When China does open up, that should push probably our way,” Phillips said.

The trucking unit remains in flux as Universal culls lower-performing business. Average tractors in use were down more than 300 units year-over-year to 1,000. Loads per tractor were down 8%. However, revenue per load excluding fuel was up 41%, with length of haul climbing just 8%. The higher yields pushed the segment’s operating margin 210 bps higher to 7.6%.

Outlook raised again, guidance may prove conservative

Full-year 2022 revenue guidance was raised 8% at the midpoint of the new range of $1.9 billion to $2.1 billion. The new guide was ahead of the $1.85 billion consensus estimate at the time of the print, 14% higher year-over-year at the midpoint. The top end of the consolidated operating margin guidance was raised 100 bps to a range of 8% to 10%.

The full-year outlook implies 2022 EPS north of $4.50 at the midpoint of the ranges, excluding the impact of nonoperating income and valuation changes in marketable securities. That compares to the consensus estimate of $3.32 and full-year 2021 EPS of $2.74. The guide may be conservative as it suggests a sequential step down of 20% in each of the next three quarters.

Second-quarter revenue was forecast in a range of $525 million to $550 million, 27% higher year-over-year at the midpoint. The operating margin for the quarter is expected to be between 8% and 10%, which implies EPS above $1.20 compared to consensus of 76 cents.

Universal concluded the quarter with $24 million in cash and marketable securities and $403 million in debt. Net interest-bearing debt-to-12 months’ trailing earnings before interest, taxes, depreciation and amortization was just under 2x.

Shares of ULH were up 9% in late-day trading Friday while the S&P 500 was down 0.3%.

Click for more FreightWaves articles by Todd Maiden.

- Echo adds expedited LTL, temperature-controlled warehouses in latest deal

- Large truckload carriers say recent downturn not hurting them

- US supply chain pressures ease as transportation capacity grows