Universal Logistics Holdings (NASDAQ:ULH) offered a glimpse of how COVID-19 is playing out at the beginning of the second quarter – a 30% drop in revenue in April. The worst of it was due to shutdowns in auto and heavy truck plants, where dedicated freight volumes fell to zero.

“We had to make some difficult decisions,” CEO Tim Phillips told analysts on Friday, May 1, after the Michigan-based transportation and logistics firm reported first-quarter financial results.

Phillips said Universal furloughed 17% of its regular employees and 33% of administrative staff as part of efforts to cut costs, which also include the suspension of its quarterly dividend.

Phillips expressed cautious optimism that plant shutdowns will begin lifting in the coming weeks, helping set the stage for a recovery.

“We’re hopeful that we will see things start to pick back up in mid-to-late May,” he said. Universal has also managed to retain most of its employee drivers and owner-operators, which will allow Universal to quickly take advantage of an uptick of business, Phillips said.

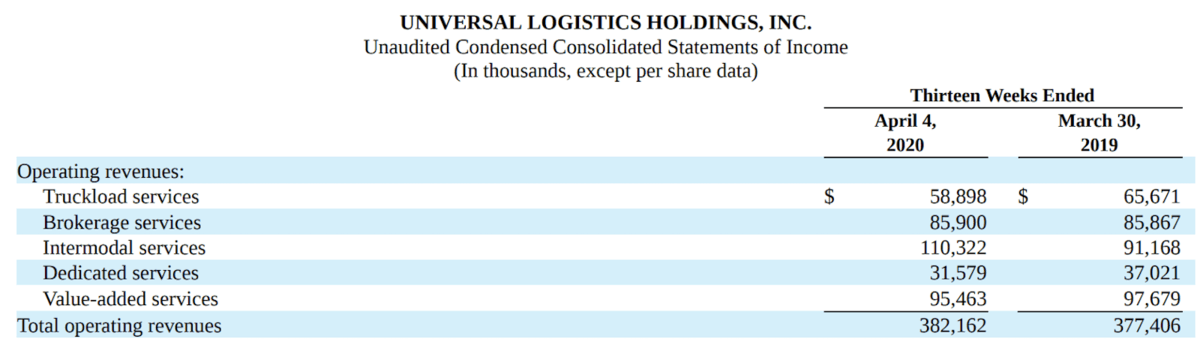

COVID-19 weighed on Univeral’s first quarter. The company had a net income of $12.2 million, or $0.45 per share, on $382.2 million in revenues during the quarter. Net income came in 29.4% lower than a year earlier, while revenues increased by 1.2%.

A $3.4 million loss on marketable securities helped drive down profits. The company’s underlying businesses appear more resilient than the decline in net income would suggest.

Operating income from its transportation segment – largely truckload, intermodal and brokerage operations – fell by 3.3% during the quarter. Operating income in its logistics segment – its dedicated and value-added services – fell by 15.4%.

Looking beyond the COVID-19 pandemic, Phillips said the acquisition of Road Runner Intermodal Services will continue to pay off as Universal completes the process of integrating the firm.

Universal’s truckload and dedicated operations saw the worst of the coronavirus impacts as slowdowns in retail and manufacturing eclipsed higher demand in essential consumer goods. Truckload revenue dropped by 10% to $58.9 million, while dedicated revenue fell by 14.7% to $31.6 million.

Despite intermodal revenue jumping by 21% to $110.3 million, Universal noted that COVID-19 weighed on its Southern California operations. Southern California’s intermodal revenue fell by $8.2 million during the quarter as loads plunged by 40%.

Universal’s brokerage services remained flat during the quarter, accounting for $85.9 million in revenue. Value-added services revenue fell by 2% to $95.5 million.