Air logistics stakeholders may want to pump the brakes on celebrations of shipping volumes and rates finally climbing from the depths of a prolonged downturn. Newfound optimism is tempered by the fact that growth has more to do with normal seasonal patterns than a fundamental shift in demand. The market is essentially flat versus an anemic final stretch in 2022, according to the latest data.

And with no signs of a demand push as consumer finances get squeezed, analysts remain bearish about prospects for a traditional shipping peak leading up to the holiday season. More industry experts now say real growth in the air cargo sector is still a year away.

Many media outlets jumped on the International Air Transport Association’s recent announcement that air cargo traffic grew 1.5% in August — the first year-over-year (y/y) gain in 19 months — as a sign of a turnaround. A more complete analysis, taking into account different methodologies and IATA’s distance multiplier on tonnage, indicates the industry’s economic cycle has hit bottom. Market intelligence firm Xeneta previously reported airfreight demand was negative 1% in August. Taken together, growth for the month was essentially zero.

And it didn’t change in September. Xeneta reported global demand increased 6% month over month. But demand didn’t budge from the September 2022 level, when cargo bookings were quickly sinking.

Meanwhile, cargo capacity in September grew at the slowest pace in 11 months as passenger airlines entered the shoulder season and pulled flights from the market to match lower travel interest, but it is still about 10% more than a year ago.

Capacity numbers can be misleading because passenger aircraft aren’t always on routes needed by shippers. The Asia-Pacific is still heavily dependent on freighters because passenger flights have not recovered to pre-pandemic levels with the slow travel recovery in China and strained relations between the U.S. and China preventing both sides from granting full access to each other’s airlines.

Fewer flight hours for dedicated freighters reflect the weak demand and rising supply of passenger belly capacity. Freighter utilization for dedicated cargo jets has improved in recent months but was 2% lower y/y in September, according to research by Fadi Chamoun at BMO Capital Markets.

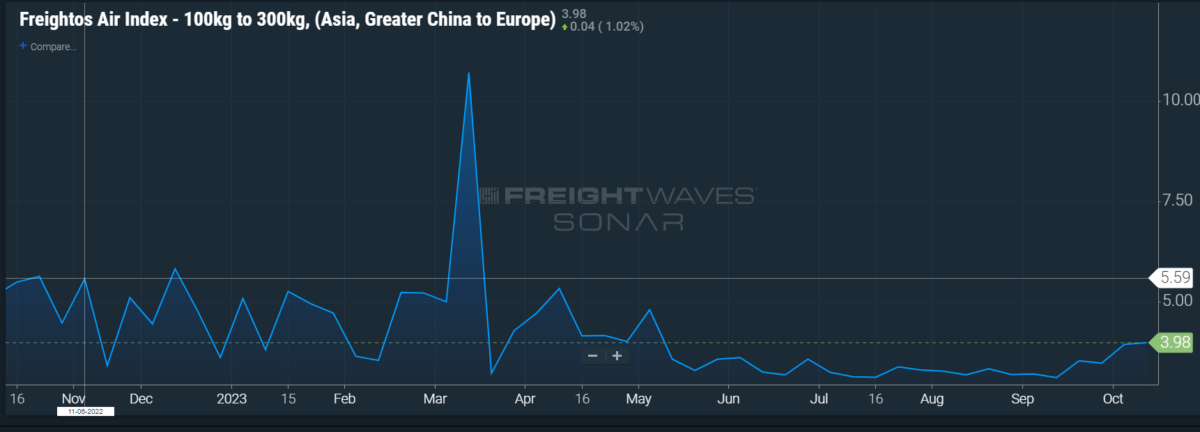

The reduction in transport supply was the main reason for a 2% rise in rates from August, which accelerated 10% over the final three weeks of September and into October. Figures from WorldACD, another data provider, tracked Xeneta with sequential volume growth of 3% and rates up 5%. It said volumes were down 2% y/y, representing the smallest monthly decline this year.

Global rates are about 30% lower than a year ago after being 40% to 50% lower for many months. But yields are still about 25% higher than before the COVID crisis.

The supply and demand rebalancing pushed up load factors by 2 points to 58%, but the fill rate for passenger bellies and freighter holds was still 2% less than before the COVID crisis.

One airline executive in a private conversation expressed concern that market conditions weren’t improving relative to last fall, which represents a low bar since the downturn was gaining momentum then. Delta Air Lines on Thursday reported a 36% drop, y/y, in third-quarter revenue.

“There’s more talk about will there be a peak than we see being materialized in volumes,” said Niall van de Wouw, Xeneta’s chief airfreight officer, on the latest Freight Buyers’ Club podcast. He attributed the recent jump in air cargo prices to seasonal increases that routinely occur between a slow August and September.

U.S. import tonnage from the Asia-Pacific, the United States’ largest air trade corridor, in August was below the rolling eight-year average, U.S. Commerce Department statistics show.

Still, the airfreight market is in a better spot now than 10 months ago. Cargo volume is down 6% to 7% year to date through August versus the same period in 2022, an improvement from the double-digit contraction at the start of the year.

Xeneta said several trade corridors out of Southeast Asia experienced a sharp increase in prices, driven by a rush to move shipments ahead of factory shutdowns for the Sept. 29 Golden Week holiday in China and Apple airlifting its new iPhone 15 around the world, rather than any fundamental shift in demand. (Golden Week had the opposite effect in early October, pulling down global air tonnage by 5% from the prior week.)

When Apple and other companies charter entire freighters for new product launches, it has a downstream effect for other air cargo providers, according to Matt Castle, vice president of global forwarding air at C.H. Robinson.

“All the components or accessories that circle around those tech releases — think cases, cords, screen covers — are items that typically fall into the forwarding space and are contributing to the uptick in Asia volumes,” he said.

Vietnam led the way, with rates surging 54% to Europe and 32% to the U.S. from August to September on the back of export manufacturing growth, according to Xeneta. For the region as a whole, rates to the U.S. moved up 40%, putting them on par with pre-pandemic levels after being well below that benchmark. In contrast, the trans-Atlantic lane declined another 3% from the prior month to $1.73 per kilogram.

Load factors on major lanes out of the Asia-Pacific are close to 90%, which indicates a seller’s market for carriers.

“While recent increases are a positive indication that could suggest a stabilizing market, we think it may be premature to celebrate [because] rates are still well-below where they were last year and where they started this year,” supply continues to enter the market and rising fuel prices account for roughly half the overall rate increases on certain lanes, said Bruce Chan, director of global logistics at Stifel Financial Corp., in a research note this month.

More shippers are committing to long-term freight contracts now because the market has set a floor on rates and there is more price certainty, Xeneta said in its monthly report. The number of shippers signing contracts of six months or more during the third quarter rose to 34% from 28% in the prior three months. On the Asia-to-Europe corridor, spot rates accounted for 43% of total volumes during September — down 4 points from a year ago. That’s a problem for many freight forwarders, which are buying shipping space as spot rates rise while selling contracts at a lower price, van de Wouw said on a webinar.

Logistics companies with long-term leases for self-controlled freighters contributed to rate deflation this year, as previously reported, by aggressively lowering rates to attract customers and cover sunk costs. Yields might be low enough now that some aircraft could be pulled out of service because it doesn’t make economic sense to operate them anymore, which could drive some cargo to passenger airlines, said Greg Schwendinger, president of American Airlines Cargo, on the latest edition of the Cargo Masters podcast.

“The break-even point of putting it on a passenger-operated aircraft in the belly as opposed to operating a freighter is starting to change. To some extent that could serve as somewhat of a yield floor,” he said. “We’ve heard from some of our customers, particularly those that operate a network of aircraft on their own, that they’re making efforts to potentially put a few aircraft on the ground and are looking to move that business onto passenger operations. So that could be one silver lining to a challenging macroeconomic environment that we find ourselves in.”

Seattle-based logistics provider Expeditors said in an August filing that it believes use of air charters will be significantly reduced as charter contracts expire, which will impact supply to some degree.

In search of peak season

The last week of August through early December is normally the busiest, and most profitable, shipping period each year as retailers rush in merchandise for the big holiday shopping events and other businesses try to meet annual sales goals. The shipping surge normally starts in July for ocean shipping before transitioning to airfreight. There was no measurable peak season in 2022 as the trade and freight downturn gathered steam.

The price to ship goods from Hong Kong to North America was up 12% over the past six weeks, but still below the 2016-2019 average of 19% during the same period, said Bascome Major, a transportation analyst at Susquehanna Financial Group, in a research note last Tuesday. Over the same six-week period, rates from Frankfurt, Germany, to North America have fallen 3%, worse than last year’s 7% gain and also below the pre-pandemic average growth of at least 10% during a similar time period.

Industry and macroeconomic developments suggest that any fourth-quarter pickup will be fleeting and very modest, with weakness persisting through the first half of 2024.

Although the U.S. economy could escape a mild recession as inflation calms down, consumers aren’t gearing up to buy imported goods. In fact, American pocketbooks are under increasing pressure.

Consumer spending has been relatively sluggish in recent months and the Federal Reserve Bank of San Francisco says 80% of Americans have used up pandemic-era savings. Meanwhile, credit card delinquencies are now above 2019 levels, the COVID student loan moratorium has ended, child care subsidies are expiring and the four-week strike by the United Auto Workers continues to widen — all of which could mean a drag on retail spending.

Analysts at BNP Paribas estimated the resumption of student loan payments could remove $100 billion out of consumers’ savings and slow overall growth during the fourth quarter.

Also, industrial production and new export orders are still contracting in the U.S. and other major economies. Consulting firm Trade and Transportation has data showing that about 60% of international air trade is to support manufacturing, Managing Director Tom Crabtree said on a recent episode of the Time on Wing podcast.

Central bank tightening of the money supply through higher interest rates is beginning to slow the economy and those effects could be more evident in the next few quarters, economists say.

Many logistics professionals mistakenly expected retailers to finish clearing out excess inventory by early summer and start ordering new products. That cycle took longer than expected and some sectors, such as electronics and apparel, still have more stock on hand than necessary, according to Jason Miller, a professor of supply chain management at Michigan State University. Even with the inventory corrections, many companies say it is difficult to gauge the underlying strength of the economy and have been cautious about placing new merchandise orders.

The downward spiral for PC shipments, for example, continued during the third quarter as global volumes declined 7.6% y/y, according to International Data Corp.

Robert Khachatryan, CEO of freight forwarder Freight Right Global Logistics, said on a September webinar hosted by booking platform Freightos that many customers are booking fewer shipments on expectations of a drop in consumer spending in the fourth quarter.

3M Co. is still seeing tepid demand for electronics and consumer products and CFO Monish Patolawala said at a Morgan Stanley conference last month the company expects weakness in consumer demand will continue through the year.

The outbreak of war in the Middle East adds to the uncertainty felt by consumers and businesses.

The International Monetary Fund last Tuesday downgraded its 2024 economic forecast, saying inflation and geopolitical friction will slow global economic growth to 2.9% from an expected 3% this year. It previously called for 3% growth. The global economy grew 3.5% in 2022.

The U.S. economy is expected to grow 1.5% next year, down from an estimated 2.1% in 2023, the IMF said. S&P Global also revised its 2024 forecast for the U.S. GDP to 1.5% from 2.5% and said it expected U.S. imports from Asia to be flat next year after a 25% decline in the first seven months of 2023.

The eurozone is barely expected to grow next year, the United Kingdom could be in a recession and China’s growth will be well below par, economists say.

“The global economy is limping along, not sprinting,” IMF Chief Economist Pierre-Olivier Gourinchas said in outlining the report.

The World Trade Organization recently cut its forecast for global trade growth in half to 0.8% for 2023.

A read through of ocean shipping developments doesn’t paint a promising picture for airfreight. Lower consumer demand is the reason U.S. seaborne imports of consumer goods fell by 26% y/y in the first eight months of 2023, according to S&P Global Market Intelligence. Ocean volumes in the trans-Pacific peaked in August as many importers ordered early and a cooldown is expected for the remainder of the year, said the National Retail Federation.

Amid a glut of container vessel capacity and air cargo 23 times as expensive as ocean, according to Xeneta, airlines are the last option for shippers with general commodities that don’t need special care.

“With inflationary pressure and rising energy prices putting strain on consumer discretionary spending, the likelihood of a breakaway restocking is unlikely, in our view. And while we think inventories have, for the most part, bottomed, we also think the risk of fundamental demand grinding lower, coupled with the memory of last year’s overstocking, will likely lead shippers to position conservatively,” wrote Stifel’s Chan. “Despite a modest sequential uptick in airfreight pricing, we believe indications are still for a slow grind off the bottom in terms of demand.”

Or, as van de Wuow succinctly put it: “I still hear very little hope of demand growth before the third quarter of 2024.”

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Sign up for the weekly American Shipper Air newsletter here.

RELATED READING:

Delta Air Lines cargo revenue drops 36% on slow freight demand