U.S. Bancorp’s (NYSE: USB) Freight Payment Indexes, which track shipments and spending, moved lower in the fourth quarter of 2019.

Freight shipments

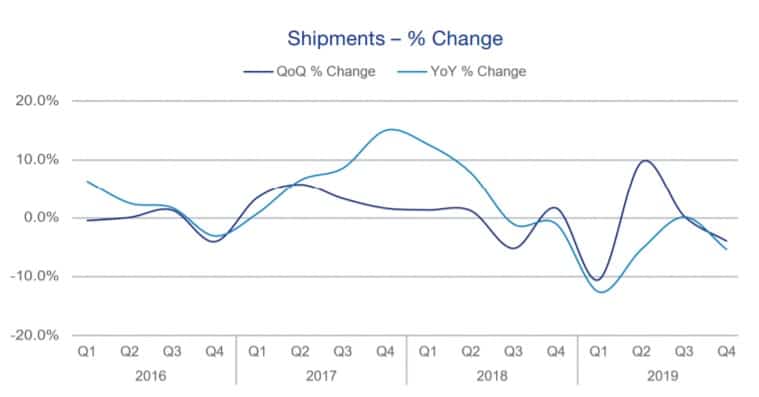

The U.S. Bank National Shipment Index declined 5.4% year-over-year in the fourth quarter, down 4% sequentially from the third quarter of 2019. For all of 2019, the index declined 5.9% year-over-year, the largest annual decline recorded since 2011.

The report, released Wednesday, cited “weaker economic activity,” specifically referencing the manufacturing sector, and tough year-over-year comparisons as the reasons for the quarterly declines. From the report: “For trucking, the falling factory sector is having a significant impact on shipments and spend. Truck sales have exceeded the demand for the added capacity.”

International trade uncertainty was another reason cited for the decline in demand in the quarter as inventory was potentially pulled forward earlier in the year.

“While there has been progress between the U.S. and China in de-escalation of the trade war, irregular trade volumes hurt truck freight movement. Although tariffs on many consumer goods did not go into effect on December 15 as anticipated, it is likely many of the goods were moved earlier in the year to warehouses, hurting truck volumes in the fourth quarter.”

The report qualified the 2019 retail season as “good” and stated that it likely had “some positive impact” on the period.

Freight spend

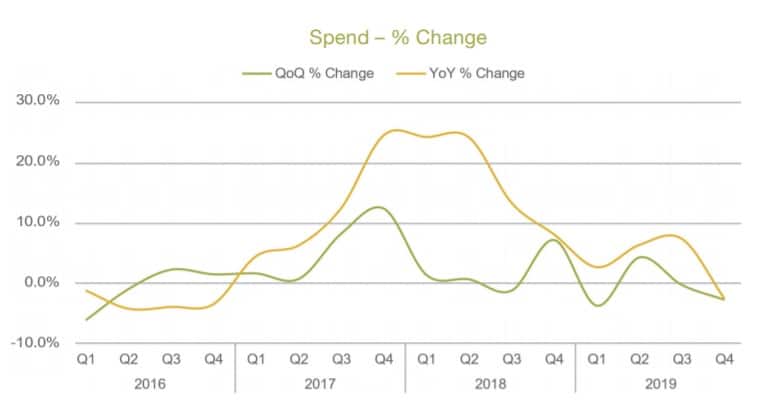

The U.S. Bank National Spend Index was down 2.5% year-over-year in the fourth quarter, down 2.7% sequentially. The year-over-year decline in freight spend in the fourth quarter was the first decline recorded in three years. Lower contracted rates along with weaker spot market pricing “put downward pressure on the spend index.”

“During the fourth quarter, the slowing in spend across the regions shows that capacity is outstripping freight transportation demand.”

Similar freight spending metrics were reported by Triumph Bancorp (NASDAQ: TBK) in its fourth quarter 2019 earnings report on Tuesday. The company’s trucking carrier payments business, TriumphPay, reported a 27.3% year-over-year decline in its average invoice to $1,073.

However, for all of 2019, U.S. Bank’s freight spending index increased 3.4% year-over-year, albeit the smallest gain recorded since 2016.

The report, like many recent industry prognostications, pointed to regulatory and financial headwinds facing the industry that could purge excess capacity. “Freight levels will likely remain sluggish into the second quarter; however, shipments could start to improve as capacity starts falling with fewer truck purchases as well as carrier closures,” the report stated.

Regionally

All regions of the U.S. saw a step down in shipments and spend from the third quarter of 2019. The Southeast was the only region to see improvement in the year-over-year comparisons, with shipments increasing 2.3% and spend climbing 7.3% in the quarter.

“Construction activity, especially in housing, has picked up in this region which has helped both shipments and spending. With new housing permits on the rise, this freight support will continue in the quarters ahead,” the report concluded.

US Bank processes more than $28.8 billion in freight payments annually for its corporate and government clients. The bank publishes its Freight Payment Index quarterly. It comprises shipping volumes and spending both regionally and nationally. The data represents payment activity generated from truckload and less-than-truckload transactions, the largest modes the bank services.

Commentary provided in the report is from American Trucking Associations’ Senior Vice President and Chief Economist Bob Costello.

Noble1

WOW this is certainly a great article and quite an eye opener .

Thanks for the update !