Containerized goods are still flooding into the U.S. at a near-record pace. Port throughput in August came in just under all-time highs. The pileup of waiting ships off East and Gulf Coast ports remains almost as bad as ever.

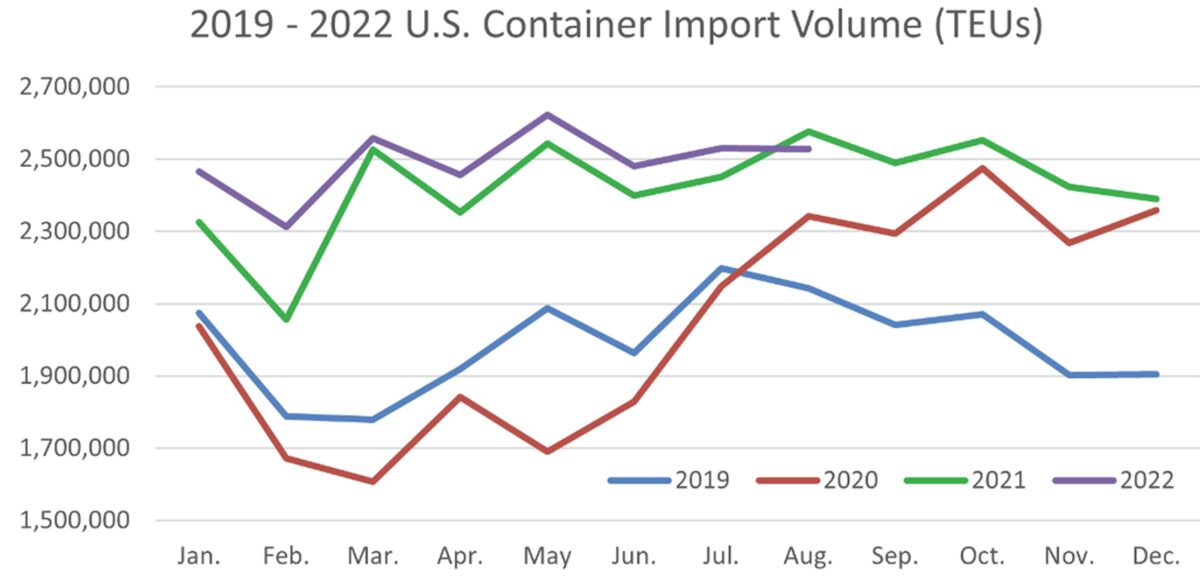

U.S imports totaled 2,529,042 twenty-foot equivalent units in August, according to Descartes. That’s down 1.8% year on year (y/y), marking the first time since July 2020 that Descartes’ monthly tally has not increased y/y.

However, a sequential drop in volumes did not drive August’s y/y decline. Rather, it was due to a jump in imports in August 2021, i.e., tougher comps versus the year before.

This August’s imports were essentially unchanged versus the very strong numbers in July. They fell 0.1% or 1,864 TEUs compared to July — a small feeder ship’s worth of cargo.

August’s imports were up 18% versus August 2019, pre-COVID. In July, volumes were up 15% from pre-pandemic levels.

“A number of factors, such as a slowing economy, inflation and high fuel costs have still not had the anticipated impact of slowing down U.S. container imports,” said Descartes.

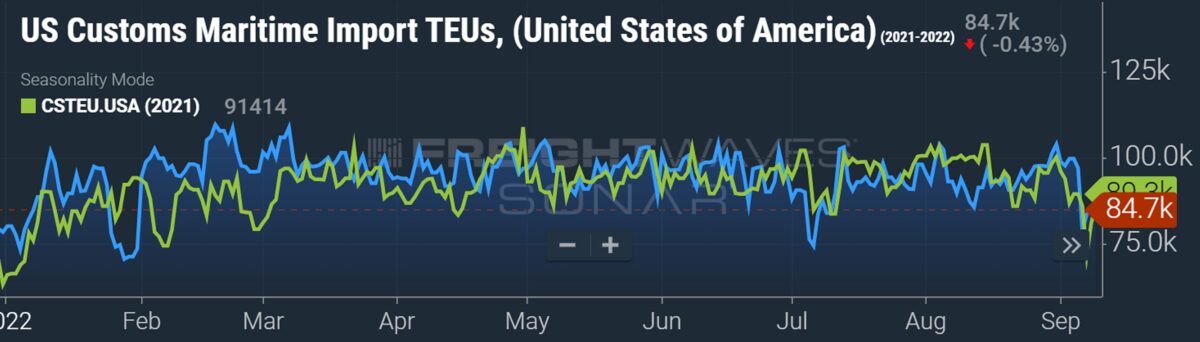

U.S. customs data confirms continued import strength. Customs filings measured in TEUs remain closely aligned with those in record-setting 2021.

East/Gulf Coast congestion unabated

Meanwhile, ship backlogs of several U.S. ports continue to be extremely elevated.

As of Monday morning, there were still 144 container vessels waiting off North American ports, according to an American Shipper survey of MarineTraffic vessel-position data and California port queue lists. The total of ships waiting offshore peaked in the low 150s in January and again in late July.

There were 37 container ships off Savannah, Georgia on Monday morning; 25 off New York/New Jersey; 24 off Houston; 14 off Vancouver, British Columbia; 14 off Los Angeles/Long Beach; 12 off Virginia and Maryland; 11 off Oakland, California; and seven off other ports. Of the total, 70% of waiting ships were off the East or Gulf coasts.

According to Descartes, U.S. monthly import volumes of 2.4 million TEUs or more have led to port congestion. August throughput “is still quite high and above the level that has caused port congestion and delays for the last 18 months,” it said. Its data “continues to point to congested and challenging global supply chain performance for the rest of 2022.”

NRF trims 2nd-half import outlook

On Wednesday, the National Retail Federation (NRF) released its August import estimate and a slightly reduced outlook for the second half.

The Port Tracker report, published by the NRF and Hackett Associates, projected that August imports would total 2.17 million TEUs, down 4.3% y/y. This is virtually unchanged versus July (down less than 1%) and up 11.3% from August 2019, pre-COVID. (Port Tracker covers 11 U.S. ports, so its totals differ from Descartes’.)

The NRF expects U.S ports to set a new import record this year, up 1.2% from 2021, driven by strength in the first half.

It calculated that import volumes in the first half were up 5.5% y/y, to 13.5 million TEUs. The NRF projects a lower total for the second half: 12.6 million TEUs, down 3.1% y/y. Port Tracker has slightly lowered its forward estimates in each of the past three months. Its latest second-half forecast is down 1.6% from its outlook in August.

Imports face demand headwinds

While the majority of U.S. imports are shipped under annual contracts, cargo being moved in the spot market is seeing much lower rates, indicating lower spot demand in relation to transport supply.

Drewry’s Shanghai-Los Angeles spot-rate assessment sank to $4,782 per forty-foot equivalent unit in the week reported Thursday, down 14% from the prior week and 59% from the same week last year.

On Monday, Platts assessed the North Asia-West Coast North America route at $4,200 per FEU and reported carrier offerings as low as $3,600 per FEU last week. “Rates are coming down aggressively,” a source told Platts.

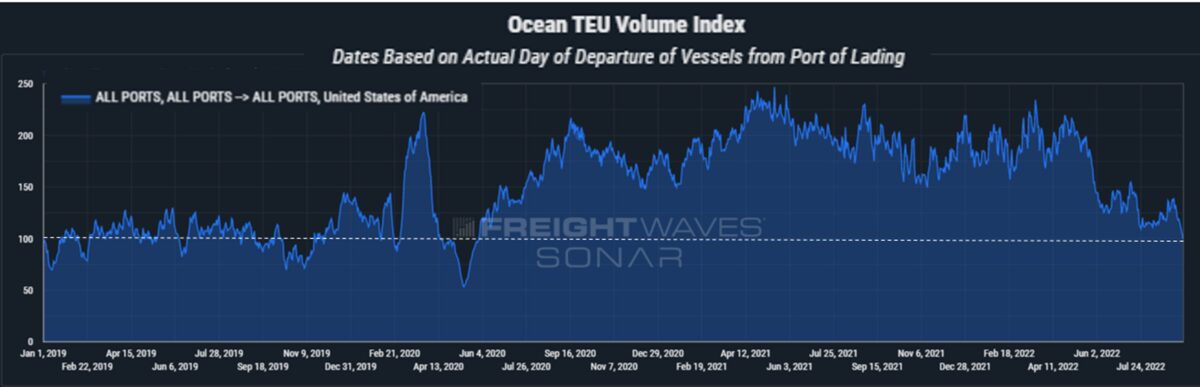

As with spot rates, a proprietary index from FreightWaves SONAR that tracks a subset of U.S.-bound bookings also indicates falling demand.

After a steep slide in May, the index remained lower throughout the summer. It has fallen yet again in recent weeks and is now down to levels seen in 2019, pre-COVID.

Click for more articles by Greg Miller

Related articles:

- Only 8 ships waiting off Southern California — but 41 off Savannah

- Despite billions in canceled orders, container imports stay near peak

- Trans-Pacific rates still sinking. Trans-Atlantic rates still peaking

- Turning point? Port of LA boss sees imports ‘easing’ lower in August

- Container line Zim hit by exposure to falling spot rates