U.S. business spending on logistics services dropped 11% in 2023 to $2.4 trillion as supply chains normalized in the wake of massive disruption caused by the COVID crisis, according to the “State of Logistics” report from the Council of Supply Chain Management Professionals released on Tuesday.

Logistics costs are still relatively high after rising 22.4% in 2021 and nearly 20% in 2022 from a baseline of $1.5 trillion prior to the pandemic.

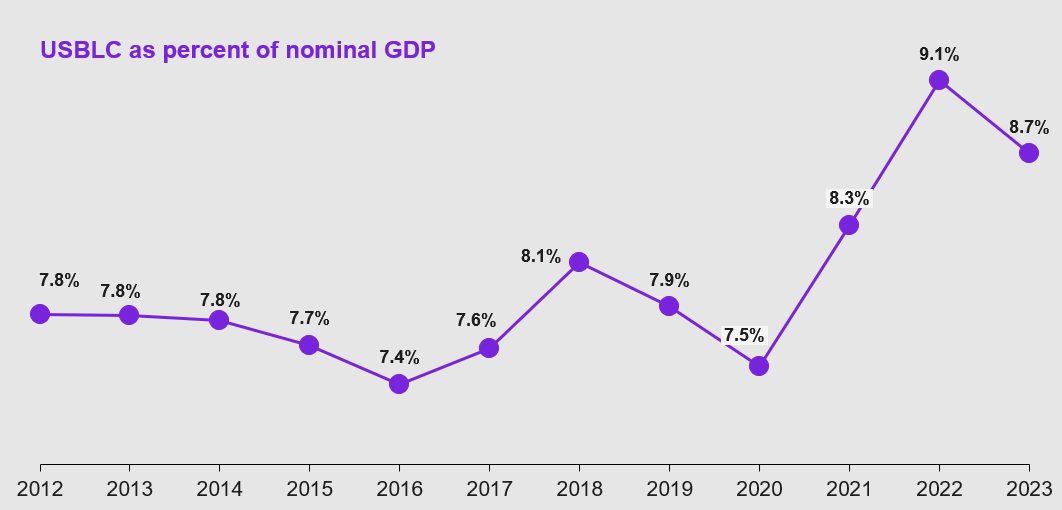

More significantly, the ratio of business logistics costs to nominal U.S. GDP last year was 8.7%, compared to 9.1% in 2022 and 7.7% in 2019. The lower the ratio, the more efficient the country’s logistics system because the cost of moving goods consumes a smaller piece of the total economic pie. Between 2012 and 2019, the ratio of logistics expenses to GDP only ticked above 8% one time.

The report, compiled by Kearney, said there is increasing recognition among logistics executives that volatility is the normal condition for supply chains, which makes it critical to have a robust, flexible transportation and warehousing network. Many shippers and logistics service providers have not meaningfully invested in technology and assets that make it possible to minimize disruption, such as longer transits circumnavigating Africa to avoid Houthi rebel missile attacks in the Red Sea or low water levels in the Panama Canal limiting voyages, by pivoting to alternative freight services, they said.

Freight demand was tepid last year, although ocean and air volumes picked up in the fourth quarter with a large push from e-commerce. The slack demand coincided with excess transportation and storage capacity, resulting in low cargo rates. The authors projected a tightening of capacity and potential upturn in rates by the second half of this year — something that is already happening in air and ocean freight.

2023 was a difficult year for motor carriers with a huge capacity overhang that coincided with sagging volume and hammered down rates. Although more than 1,000 truck brokers went out of business the decrease was less than expected because many of them lived off outsize profits during the prior two and a half years, said Kearney’s Josh Brogan, during a virtual briefing for journalists last week.

“Until there is an increase in the rebuilding of retail and business inventories, improvement in consumer sentiment and housing market index, and rate cuts by the Fed, we do not expect the balance of power to change and reactivate idle transportation assets,” the report said. Trucking prices could begin to recover late in the fourth quarter or in early 2025.

The parcel market is experiencing declines, underscored by a 7.4% drop in domestic volumes at UPS and Amazon surpassing FedEx and UPS in total U.S. deliveries in 2023. Large shippers have diversified their parcel carrier base, including regional and local carriers, and learned how to shop for the best rates in a convoluted pricing environment.

Rail traffic grew year over year, but revenue for the Class 1 railroads declined 2% and caused operating income to decline 11%. A small rise in volumes was attributed to carload traffic with intermodal volumes down 6% from the prior year. The intermodal outlook is good, the authors noted, because of the increased relocation of manufacturing to Mexico.

The CSCMP report validated other data that buyers of freight services are in a stronger position, but that could change as capacity tightens. Air and ocean volumes have recently surged during the normal quiet season for shipping as many companies ordered early to beat the fall holiday rush and avoid getting squeezed for space.

Ocean demand exceeds available equipment and vessels, as rerouting around Africa stretches carrier networks, resulting in vessel bunching and localized port congestion. The imbalance has caused container rates to jump far above seasonal norms. Daily trans-Pacific and Asia-Northern Europe rates are 50% higher than in April, nearly three times higher than a year ago and 3.5 times higher than in 2019, according to freight market trackers.

Prices from Asia to the U.S. West Coast are about $6,000 per forty-foot equivalent unit and have surpassed $7,500 to the East Coast, with rates for each lane about $1,000 higher than their peaks early this year when the Lunar New Year coincided with the start of the Red Sea crisis.

“We’re seeing customers pushing to get products moving and not waiting, whether for seasonal releases of products or to match ad campaigns,” said Ron Marotta, vice president at Yusen Logistics’ international division. “I don’t think that there will be less need to move products. I just think it’s going to become more difficult. I predict that the vessels that are going to the West Coast are pretty much full already. I think it will be harder to get space and the rates are certainly going up.”

Yusen Logistics is the logistics arm of ocean carrier NYK Line.

Meanwhile, inventory levels remain high by historical standards but have begun to settle after companies held on to more stock during the pandemic as a hedge against manufacturing and transportation delays. More recent evidence suggests that most companies have sold off most of their excess inventory and are ordering from overseas sources to fulfill orders.

Whether demand for logistics services materially increases in the coming years is an open question because global macroeconomic forecasts show weak growth through 2030, but the calculation could change if geopolitics, weather, labor action or other events disrupt supply chain operations, the CSCMP report said.

The authors said an emerging trend is ultralarge shippers like Amazon and Pepsi Logistics Co. turning their in-house logistics expertise into a profit center by marketing their capabilities externally, with some going a step further and offering asset-heaving service such as drop trailers and truck fleet management. These companies are commercializing their operations in large measure because their networks have surplus trucking capacity in their own networks. The report said the shippers need to comprehensively combine truck brokerage services and technology, such as routing optimization – not simply sell space on backhaul routes within their private fleets.

“The strategy behind this, I think, is tied to a broader view of whether your ecosystem is large enough to drive advantage for yourself, or whether you view the ecosystem writ large as a utility that you plug into,” said Brogan.

Paying a premium for private fleets provides other strategic benefits for mega shippers, including the ability to manage fleet electrification and improving quality of life for drivers that reduces employee turnover.

Also worth watching, the authors said, is the convergence of logistics services, with more asset-light brokers investing in drop-and-hook trailers and more asset-based carriers entering the brokerage and freight forwarding sectors to expand business opportunities. The line between brokers and asset-based providers is blurring as players pursue these new business models. Gaining the requisite expertise, technology and capital to achieve the necessary scale to be successful could be difficult for many, the report said.

Kevin Smith, the head of Sustainable Supply Chain Consulting and former senior vice president of supply chain at CVS Caremark, said high interest rates are making it difficult for many companies to invest in logistics technology, equipment and warehouses.

“That 7% cost of money, compared to 0% of your company’s capital, determines whether they want to invest in hard assets,like equipment and space, or if they want to invest in technology, automation, visibility, inventory control. The cost of money is making people question whether they should invest in hard assets,” he said.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Sign up for the weekly American Shipper Air newsletter here.

RELATED READING:

What does air cargo’s early peak season mean for peak season?