Van Buren, Arkansas-based truckload (TL) carrier USA Truck Inc. (NASDAQ: USAK) reported an adjusted first-quarter 2020 net loss of $2.2 million, or 26 cents per share, 10 cents better than the consensus estimate. The carrier reported adjusted net losses of $4.5 million in the fourth quarter and $1.1 million during the third.

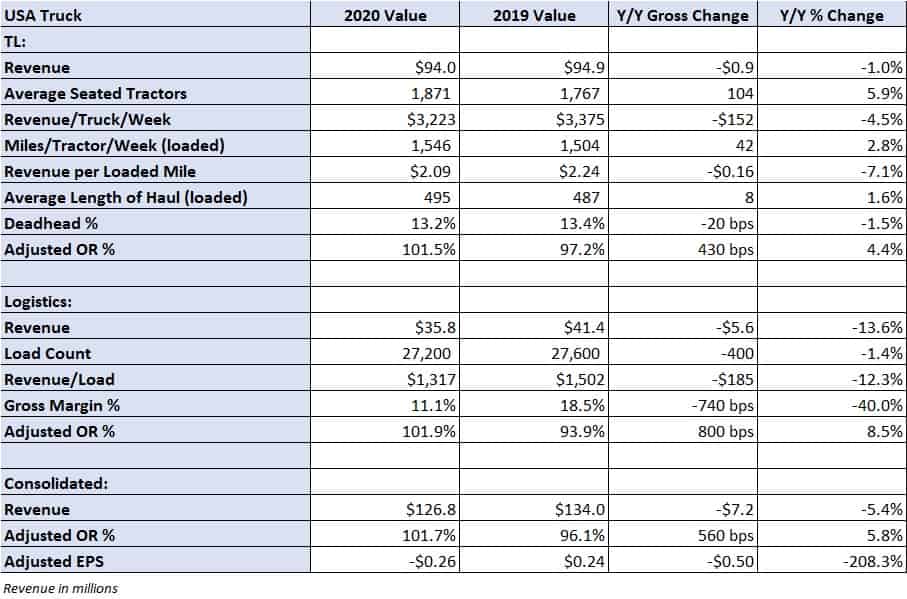

The company’s trucking division posted an adjusted operating loss of $1.3 million with a 101.5% adjusted operating ratio, 430 basis points worse year-over-year. Revenue was basically flat year-over-year at $94 million as the carrier’s average seated tractor count improved nearly 6%. Revenue per tractor per week declined 4.5% in the quarter as revenue per loaded mile moved 7.1% lower to $2.09, partially offset by a 2.8% increase in loaded miles per tractor per week.

“During the first quarter, many of our operational initiatives took hold as loaded miles per available truck increased, empty miles decreased and unseated truck count metrics improved. We also made significant progress in our move to regionalization as we fully staffed our teams in the operating regions,” said President and CEO James Reed.

The logistics division reported an adjusted operating loss of $624,000 with a 101.9% adjusted operating ratio, 800 basis points worse year-over-year. Revenue declined nearly 14% compared to the year-ago period as load count was off 1.4% and revenue per load fell 12.3%. Gross margin deteriorated 740 basis points to 11.1%.

The press release said logistics volumes improved late in the quarter and that the company expects the trend to continue. Loads improved 5.4% sequentially from the fourth quarter of 2019.

USA Truck ended the quarter with $85,000 in cash and $196.2 million in net debt and lease liabilities. The carrier dipped below the 20% availability threshold requirement on its lending agreement, which potentially limits its financial flexibility for investments, hedging, dividends and share repurchases. USA Truck responded by lowering its credit facility limit by $55 million to $170 million, which increased available borrowing to an amount greater than the 20% threshold and satisfied the requirement. Credit availability was $34 million on April 20, the date the facility was amended. The reduced facility is expected to save the carrier approximately $100,000 in fees annually.

At the end of the quarter, USA Truck’s net debt-to-earnings before interest, taxes, depreciation, amortization and rent (EBITDAR) was 4.2x, compared to 3.7x at the end of the fourth quarter. The company lists one financial covenant in its annual 10-k filing, with the U.S. Securities and Exchange Commission. If the company’s excess credit availability falls below a 10% threshold, the carrier is required to maintain a consolidated fixed charge coverage ratio of at least 1:1.

The company will host a conference call with analysts and investors Friday at 9 a.m. Eastern time to discuss these results.

KG

Another mega carrier readies to go down in flames. And they should!

Warren

I’m glad! You put cameras on your drivers! What a terrible invasion of privacy! How bout putting one on all y’all desks so everyone can see what you’re up too! Oh that’d be interesting ahe

James Bauman dba Kirplopus

As a small carrier, my operating costs, for assets = .52cpm. If I pay driver 50cpm; that’s about 54cpm to me (FICA); so total cost ops around 1.06. So, how can they loose money on 2.09 gross revenue per mile. Show’s how efficiency can actually decrease with scale, sometimes. For me; that would be over $1/mi profit. And they logged 150M mi; so should be $150M profit; and yet they lost money? I’d love to see the finer details; where are the holes?

Dave

This one has bankruptcy written all over it. Soon.