Management from truckload (TL) carrier USA Truck (NASDAQ: USAK) didn’t back down Tuesday from the assertion that recent investments in a regionalized freight model as well as technology could produce significantly higher earnings.

Management said during its earnings conference call with investors that it believes there is roughly 500 basis points of potential operating ratio (OR) improvement in the TL division if rates were to climb back to year-ago levels. This would produce an OR, operating expenses expressed as a percentage of revenue, in the 93% range, a level of profitability the carrier hasn’t seen since the end of 2018’s record freight environment.

In July, revenue per loaded mile is up 5% sequentially from the second-quarter 2020 average. The metric was down 5.7% year-over-year in the second quarter. In short, USA Truck is closing in on 2019 rate levels and more importantly inching closer to meaningful profitability. Management did caution that the favorable supply-demand trends seen in July need to hold for this to happen.

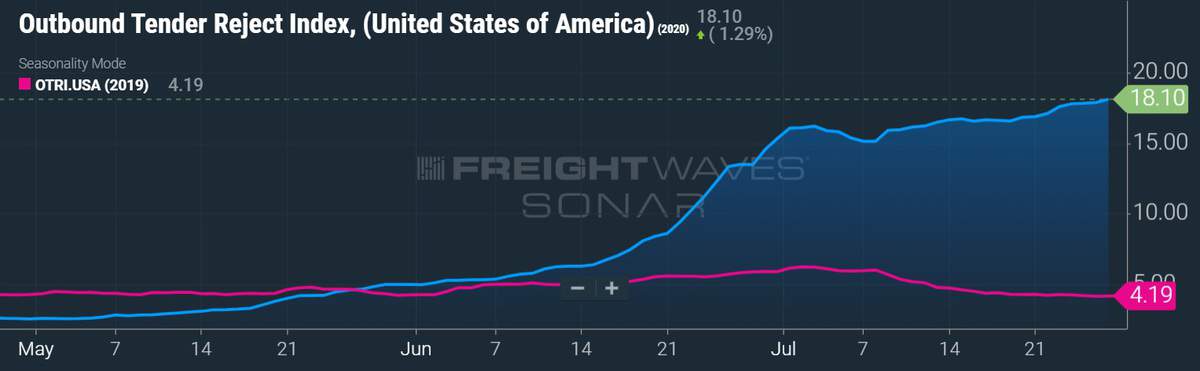

Currently, the Van Buren, Arkansas-based carrier’s trucks are overbooked daily with load rejections higher than 1,000 on average, 80% above the level typical for July. This has been seen in FreightWaves’ Outbound Tender Reject Index where load rejections are running more than four times higher than 2019.

The improved environment is allowing the carrier to reprice the bottom 10% of its customer book, where it is hauling freight at below market rates. USA Truck still has roughly half of its annual price renegotiations remaining in 2020, which could provide favorable price renewals as capacity has tightened and spot rates are climbing.

All in, management said the company is “on the verge of industry-competitive ORs.”

Second-quarter woes to inflect positive?

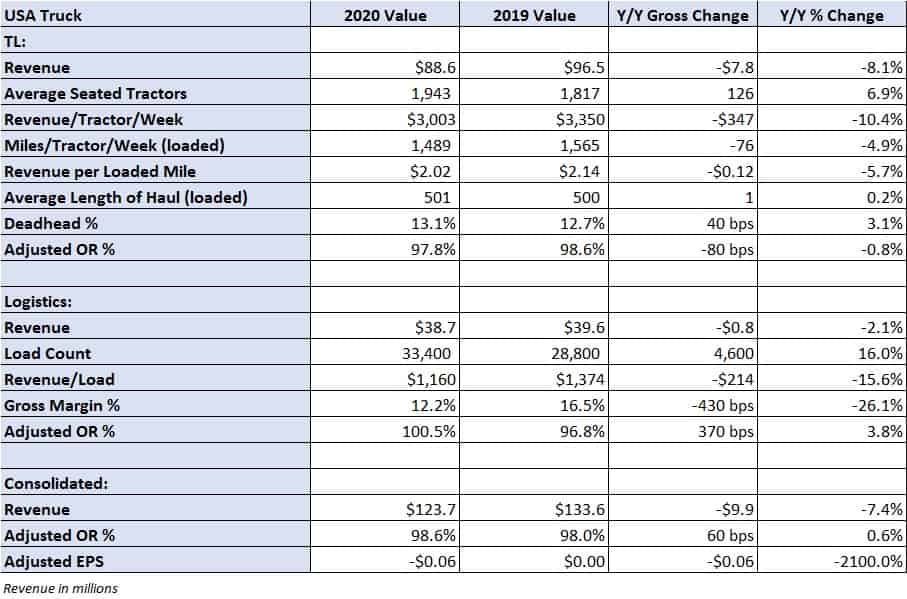

That wasn’t the case in the second quarter of 2020, though. USA Truck reported a 7.4% year-over-year decline in consolidated revenue, down 3% excluding fuel surcharge revenue, and an adjusted net loss of $513,000, or 6 cents per share, compared to analysts’ forecasts for a 9-cent-per-share loss.

It was the carrier’s fourth consecutive quarterly net loss but included an unfavorable tax headwind. USA Truck’s per diem pay structure is partially nondeductible and results in a higher effective tax rate the closer pretax earnings or losses are to breakeven.

A key reason cited for the loss was the carrier’s dependence on transactional, spot freight at lower rates in efforts to prop up equipment utilization. For a six-week stretch in April and May, USA Truck’s spot exposure was roughly 20%. In comparison, spot freight accounted for 10% of the carrier’s revenue in the first quarter and has historically been below 5% of its total business.

The trucking division saw revenue decline 8.1% year-over-year as revenue per tractor per week dropped 10.4%. Utilization, or loaded miles per tractor per week, declined 4.9%, with the decline in revenue per loaded mile accounting for the rest of the revenue-per-tractor decline.

The segment still managed an 80-basis-point improvement in adjusted OR at 97.8% as cost controls, like a 10% headcount reduction and the closing of its Van Buren maintenance facility, aided in the improvement. Further, fuel expense declined 500 basis points, and insurance and claims expense declined 260 basis points as a percentage of base revenue.

Management said in-cab investments like inward- and outward-facing event recorders have helped drive the severity of events and claims expense lower. The collision mitigation initiatives are expected to lower the total expense line by $2 million annually.

A partial offset may come in the form of increased driver recruitment expenses and driver wages. USA Truck’s driver turnover is higher than the industry average as some drivers don’t like the added surveillance. Also, the carrier has relied heavily on owner-operators to move freight in lieu of capital-intensive tractor purchases. Management warned some owner-operators may leave the company for better opportunities if the market remains firm.

Logistics revenue was down slightly at $39 million. Load count increased 16% year-over-year, but revenue per load declined 15.6% and was down 11.8% sequentially from the first quarter. Management said revenue per load was the lowest in at least a decade as a prolonged period of “excess capacity” drove contract pricing lower and fuel revenue was off 44% compared to the year-ago quarter. Gross margins were 430 basis points lower at 12.2% and the division posted a modest adjusted operating loss.

Management believes the division is poised to see a quick return to profitability. Loads per employee increased 51% year-over-year in the quarter as headcount was reduced by 28.5%. The thought is that increases in TL pricing and fuel prices will drive yields higher on a lower cost structure. They said the volume is there as the company just saw its highest ever load count during the second quarter.

USA Truck ended the quarter with $189.4 million in net debt including lease liabilities. Net debt-to-earnings before interest, taxes, depreciation, amortization and rent (EBITDAR) was 4.1x compared to 4.2x at the end of the first quarter and 3.7x at the end of 2019. USA Truck had $38 million available to borrow under its credit facility at the end of the period.

USA Truck is expecting “minimal capex” moving forward and plans to take delivery of 189 new tractors in the back half of the year. These leased units are expected to reduce fleet age by four months to an average under 30 months by year end.

Shares of USAK are off nearly 4% in midday trading compared to a flat S&P 500.

My goodness

Well, with a 500 BP improvement they will be barely making money in no time! Would hope they’d be more aggressive on pricing instead of driving rates down for everyone else.