New warehouse data from WarehouseQuote reveals more insight into the retail industry’s outlook on the consumer this holiday season. Vacancy rates are up on the East and West coasts and we do not see any rush by retailers to fill the space. This latest data set not only shows the return to just-in-time inventories, but with the added fact of lower holiday orders this year, this information further illustrates the retail sector’s ho-hum expectations of a vibrant holiday spender.

“In 2023, WarehouseQuote has seen a pullback in inventory levels at a macro level,” said Jordan Brunk, chief marketing officer of WarehouseQuote. “A majority of our clients have reverted back to a just-in-time (JIT) inventory model due to less consumer demand. This has led to generally more available warehousing capacity (higher vacancy), yet warehouse services pricing remained elevated.”

Brunk told FreightWaves this wait-and-see approach could further influence costs of warehousing services in the near future. He said he expects capacity levels to contract slightly as shippers secure short-term capacity solutions for peak season in the second half of 2023.

“We will keep a close eye on changes in the market moving into peak season,” said Brunk.

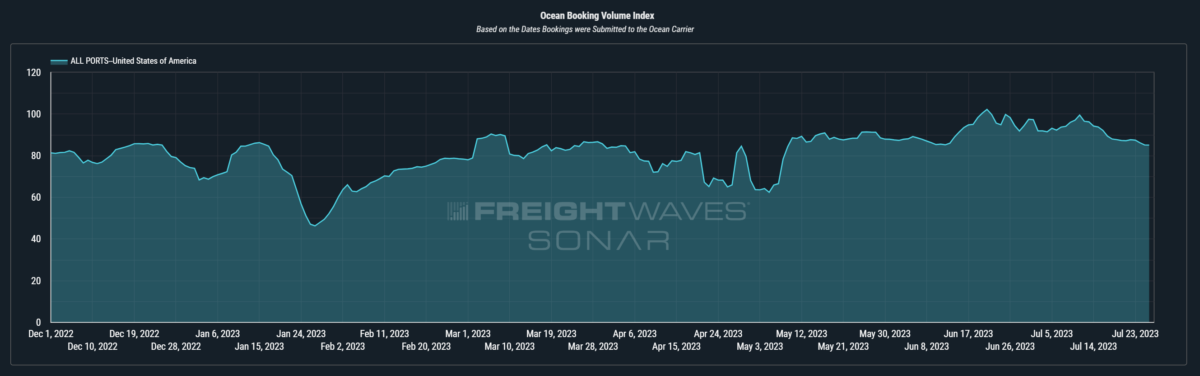

The reduction in orders for the holidays can be seen now in the ocean bookings for peak season. This trend was present in June 2022, when logistics managers started to report a 30% decrease in future orders. This decrease has continued as more consumers would rather spend money on experiences than a new couch.

The decrease in containers will not only impact the profitability of trucking and rail companies but warehouse providers as well. Eventually warehouse rates will have to go down in areas where vacancies are high. How low they will go remains to be seen.

But there are locations where the fight for space continues. In these areas, rates will continue to hold, Brunk said.

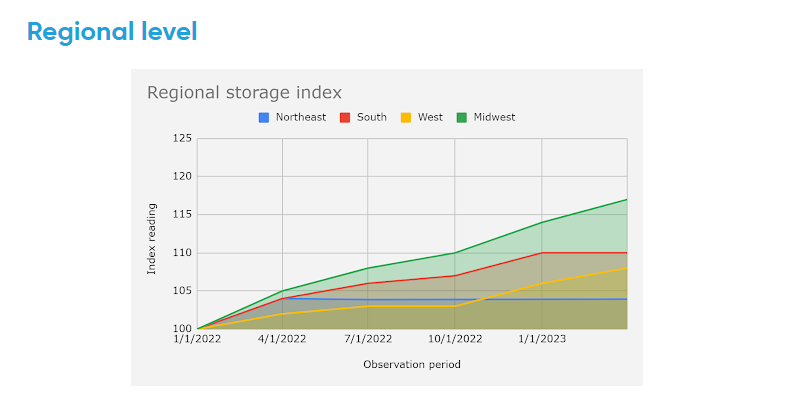

“The Midwest and South regions continue to lead all regions with 16.5 and 9.6% increases in warehouse storage pricing year over year,” said Brunk. “This is due to cost-efficiency and nationwide two-day ground shipping. As a result of this, the demand for warehousing space in centrally located markets continues to grow.

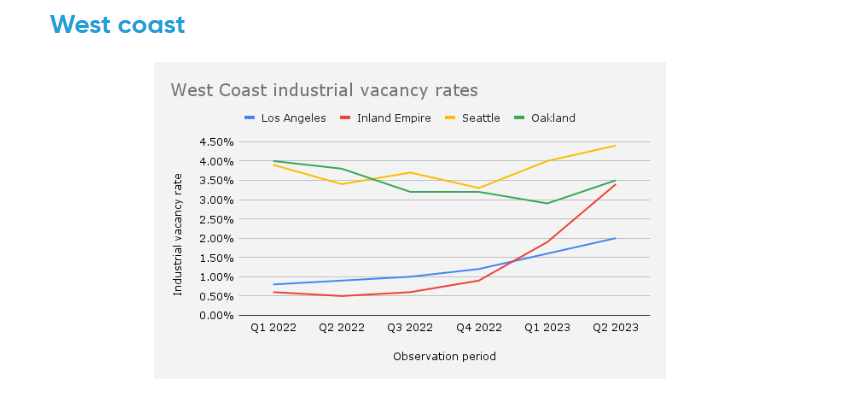

“Even with vacancies creeping up, the West Coast has remained at an 8.5 year-over-year pricing increase,” he continued. “The Northeast sits 3.4% higher year over year with the middle Atlantic division (New York, New Jersey and Pennsylvania) up 6.9% year over year.”

The latest Fed increase only solidifies retailers’ consumer concerns and justifies their reasons for bringing in less product. In a recent CNBC survey, 71% of retailers said they were concerned about a consumer pullback because of inflation and as a result, roughly two-thirds (67%) of those surveyed expect consumers to look for discounts. The amount of items they were importing was less as well.

While retailers admit current warehouse inventories contain some holiday items, the fact we are seeing this increase in vacancy rates shows there are not as many holiday items in those warehouses as one thought. The fact orders this year are skewed more toward lower-priced and promotional items are the tea leaves of a consumer with tighter purse strings.

The warehouse data tells us the irrational exuberance we saw during the pandemic has faded and we are finally seeing a return to supply chain inventory normalcy. We’ll see at the end of this year if retailers pegged the consumer right. Heaven knows last year that irrational exuberance was costly.