Trade has been proven time and time again to blow away the bluster of political rhetoric. China’s sleight of hand with its COVID reporting has the WHO accusing China of “under-representing” the severity of cases, and the flow of trade can back up the WHO’s statement.

As I have been reporting for years, trade is the most agnostic form of real-time and forward-looking data out there because trade takes people in every facet of the pipeline.

What we are seeing now in trade is that manufacturing orders are not being completed because Chinese factories are calling logistics managers, who are coordinating their factory pickups for ocean shipment, to cancel. The reason? They are telling these logistics managers that they don’t have the staff to complete the orders because workers are out with COVID. This is not the migration of workers leaving for Chinese Lunar New Year, and these are not the factories closing early for the holiday. This is COVID.

“With 1/2 or even 3/4 [of the] labor force being infected and not able to work, many China manufacturers cannot operate properly but produce less than their optimal outputs,” Hong Kong-based shipping firm HLS wrote in a note to clients. “The container pickup, loading and drayage (trucking) are also affected as all businesses are facing the impacts of COVID. We expect a very soft volume after the Lunar New Year because a lot of factories have slowed production due to the increasing infection, and have to cancel or delay the bookings for the second half of January and also early February.”

What is alarming about this is the fact manufacturing orders are already down 40%. This is just downright scary; the present shifts cannot keep up with the fewer orders. This shows you the severity of COVID cases hitting the country.

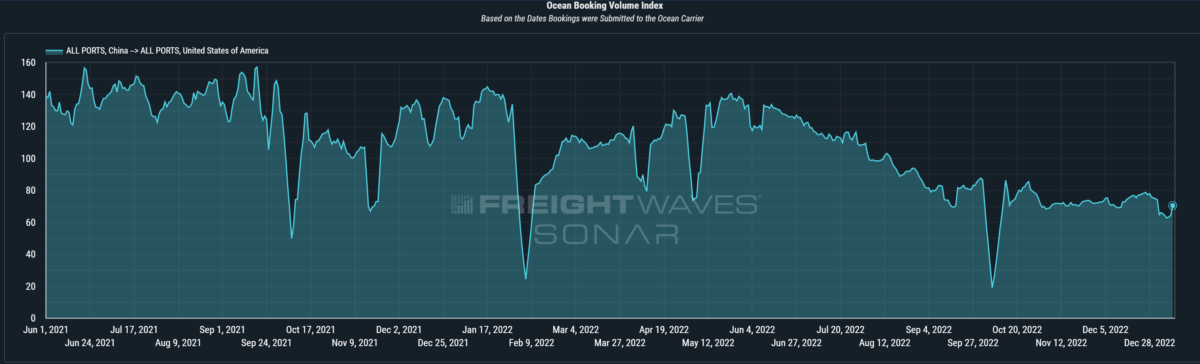

SONAR data shows orders for ocean bookings, which is a reflection of the factory orders being placed, are down. But as pointed out, some factories can’t even meet the lower demand.

The ports being affected by fewer ocean orders as a result of factories not able to complete the order are Shanghai, Shenzhen and Qingdao. All three ports are critical to the supply chain.

To make matters worse, we are seeing the impact of cases at the ports — specifically Shanghai, where MarineTraffic is seeing increased congestion matching April 2022, when the city was locked down because of COVID.

“While China has recently removed its zero-COVID restrictions, the congestion in Shanghai seems to have risen as MarineTraffic data shows that during the first week of 2023 that the average vessel TEU capacity waiting out of port limits was 321,989 TEUs, which is the highest amount recorded since April 2022,” said Alex Charvalias, supply chain in-transit visibility lead at MarineTraffic. “Also, the congestion in Ningbo and Qingdao is rising as well, with 273,471 TEUs and 277,467 TEUs, respectively.”

Another data point showing the impact of the lack of bodies moving trade is project44’s container wait time data out of the Port of Shanghai.

“The container dwell in Shanghai has begun to rise as a result of soaring COVID-19 rates,” said Adam Compain, senior vice president of global product marketing at project44. “These times are expected to continue to rise as cases increase and Chinese New Year causes seasonal delays.”

This “nonstory” per the Chinese government can be seen and tracked by the CNBC Supply Heat Map.

The product orders not being filled are items for spring and summer. So what does that mean for the recipients of these goods? Delays.

The turnaround of factory work all depends on what kind of COVID spike the country sees after the Chinese New Year. Factories are telling logistics managers they will bring back employees in two steps after the holiday. The first group will be at the end of February and the second group the first week of March. This means the spring and summer items not being made now will be on vessels by mid-March and arrive at the ports in April. If there are Easter products in these shipments, having these items on store shelves before April 9 will be a challenge.

These freight delays will also be a second punch to the gut of trucking — fewer orders being moved out of warehouses due to soft demand and now fewer ocean orders to move because of these factories being unable to complete their work. “It’s going to be a challenging first quarter,” said Alan Baer of OL USA.

So China can continue to hide behind its curtain of intentional data withholding, thinking it’s fooling the world. But it’s laughing alone. The logistics and trade world is not delusional. It has the real pulse of the health of Chinese manufacturing.