We all know trade doesn’t work without people, from the worker who makes the products to those who move the coveted cargo.

In recent months, we have seen the men and women responsible for the transport of goods mobilize and push back on wage offers. They realize their worth and their pivotal role in the world of capitalism. The flow of trade is, unfortunately, choking in this tug of the purse strings between employers and labor.

Just like beauty, what is considered “fair” is in the eyes of the beholder.

The latest strike at the Port of Felixstowe in the U.K. is an example of this. The union Unite rejected the 8% raise offered by the port owner, C.K. Hutchison Holding Ltd. The company recorded a 75% increase in profits for 2021. In the first half of 2022, the company’s profits declined due to lower volumes of export/import cargo handled in the Hong Kong port.

Sharon Graham, general secretary of Unite, recently said C.K. Hutchison Holding prioritized shareholder profits over worker welfare.

“They can give Felixstowe workers a decent pay raise. It’s clear both companies have prioritized delivering multimillion-pound profits and dividends rather than paying their workers a decent wage,” Graham said.

A statement on the port’s website said the company was disappointed the walkout had gone ahead and called its offer of salary increases of on average 8% fair.

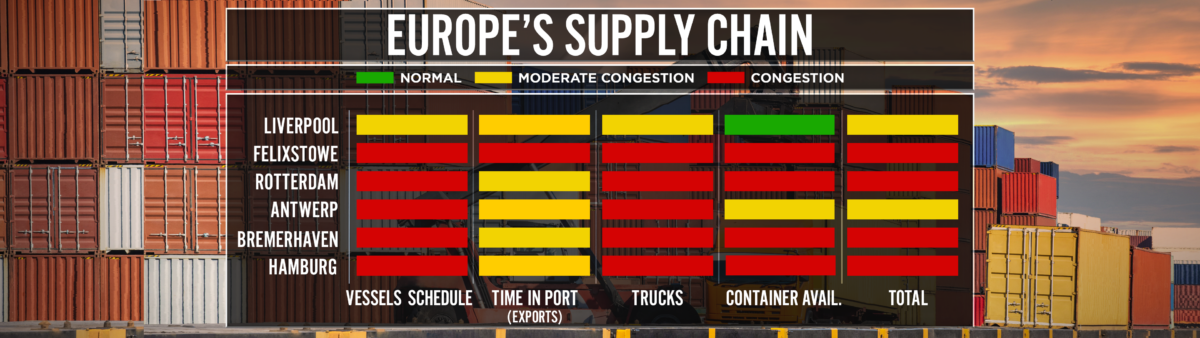

According to the CNBC Supply Chain Heat Map for Europe, trade has been strangled over the wage dispute.

Based on trade data analysis by MDS Transmodal, the total value of containers impacted by the eight-day strike is estimated at $4.7 billion.

It takes weeks — not days — for trade to right itself. According to Crane Worldwide Logistics, the backlog created by this strike will take at least two months to clear out.

“First talks with shipping lines have started to deviate containers,” explained Andrea Braun, Europe, Middle East and Africa Ocean product director at Crane Worldwide Logistics. “However, there are few alternatives to move containers to other ports. Ocean carrier lines are already facing congestion and container mess in the other ports.”

Maersk, the second-largest ocean carrier in the world, has omitted three vessel calls during the strike. In a statement, Maersk said, “We expect the strike action to have a significant impact to the vessel line-up and are working along with vessel partners to mitigate risk and disruption as much as possible.”

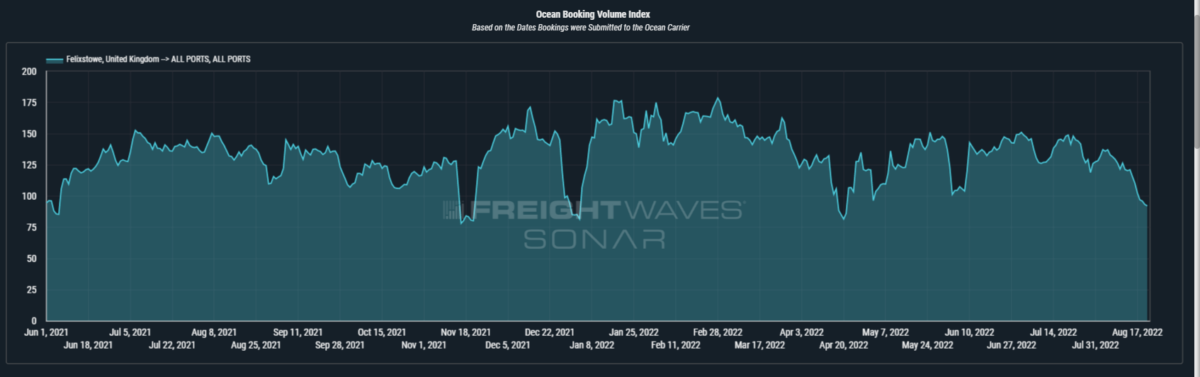

SONAR data shows the drop in ocean bookings from Felixstowe to all ports ahead of the news of the planned strike.

Josh Brazil, vice president of supply chain insights for project44, said the supply chain is going to face more pressures with congestion expected to worsen across Europe with an increase in blank sailings and the container rollovers.

“European ports have floundered in their attempts to reconcile with their striking labor force. causing ports like Rotterdam, Hamburg and Bremerhaven to struggle with accommodating vessels, leading to vessel queuing off their coast,” he said. “The average cargo lead time for the trans-Atlantic route has climbed to 27 days in July, close to its all-time high of 29 days at the start of the year.”

Antonella Teodoro, senior consultant at MDS Transmodal, told American Shipper this is going to increase inflation on products being moved along this trade route.

“With retailers getting ready for the approaching festivities (Halloween and Christmas), the strike at the port of Felixstowe has the potential to disrupt the U.K. supply chain at a crucial time,” explained Teodoro. “Assuming that other Southern ports in the U.K. (Southampton and London Gateway) or continental ports have spare capacity to handle additional cargo, shipping lines could divert their ships. The rerouting, however, would not eliminate the risk of longer delivery times and higher costs, which can only worsen the U.K. economy already affected by high inflation. This goes beyond a ‘logistics problem,’ as the increase in cost can be felt by the final consumers.”

If you think this is only a U.S. import problem or a U.K. inflation problem, think again. This could impact the arrival of products for the holidays in the United States.

“It takes on average a week for containers to clear out of the port, and then a week to schedule a pickup by truck,” said one logistics manager. “You are looking at the second half of November at the earliest to have products arrive at stores to be put on store shelves.”

American Shipper reviewed the bills of lading and customs data to see the impact. The list is lengthy. Some notable names listed were Amazon, General Mills, Loreal, GSK and Bacardi. Also listed were Diageo, the company that owns Guinness, and Suntory beverage, which owns Jim Beam, Kellogg and Mars Foods.

This strike will impact U.S. exporters as well. The timing of the arrival of their goods in the U.K. for the holidays is also a concern.

Also in large quantity are lumber and agricultural exports. Almonds, peanuts, walnuts, pistachios and cranberries head to Felixstowe, and delays impact these perishable goods.

Other product categories that are processed through Felixstowe are furniture, computers and auto parts.

The wave of labor strife is far from over.

In Germany, you have round 10 of talks between trade union verdi and the Central Association of German Seaport Operators (ZDS). Braun told American Shipper he is concerned about another strike now that the court-imposed no-strike has expired. The backlog is so bad for trade it will take until the first quarter of 2023 to clear out. That’s if a deal is made. If not, this hairball of wage discontent will only grow and it is spreading.

September no better

In September, Liverpool, England, dockworkers are expected to strike. The options for trade to move unencumbered are dwindling fast for logistics managers.

Here in the U.S., there’s a threat of 115,000 U.S. rail workers walking off the job on Sept. 16. Last week, the White House-appointed Presidential Emergency Board released its recommendations. Both sides have 30 days to accept. If they don’t, the rail workers are allowed to strike.

“A railroad strike would be more detrimental to the flow of trade than the ILWU striking,” one logistics CEO told American Shipper. “It would severely impact trucking.” Approximately 40% of long-distance freight is moved by rail. One-third of all U.S. exports are moved by rail.

The most recent U.S. rail strike in 1992 reportedly cost the U.S. economy $50 million per day. The National Association of Manufacturers revised that number to a daily loss of $7.5 billion.

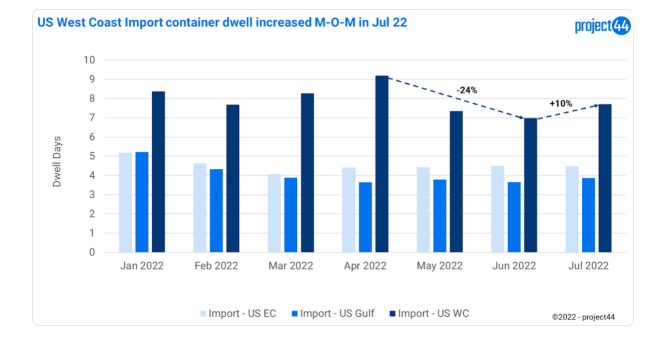

Fears of a strike by the longshoremen on the West Coast continue to add to congestion on the East Coast. Project44 data shows container dwell times on the West Coast are on the rise again, increasing by 10% month over month in July. The Port of New York and New Jersey is up a staggering 1,153% year over year. Meanwhile, dwell times are roughly staying level at 4.48 days on the East Coast and 3.86 days in the Gulf.

Negotiations between labor and employers are different this time because of the pandemic. Employers have made record profits based on the work of labor moving the historic volumes of trade. The unions are flexing their muscles. The question is: Will the employer loosen those purse strings? Inflation and the global supply chain depend on a compromise sooner rather than later.

The CNBC Supply Chain Heat Map data providers are AI and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight rate benchmarking and market analytics platform Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; DHL Global Forwarding; freight logistics provider Seko Logistics; and Planet, provider of global, daily satellite imagery and geospatial solutions.