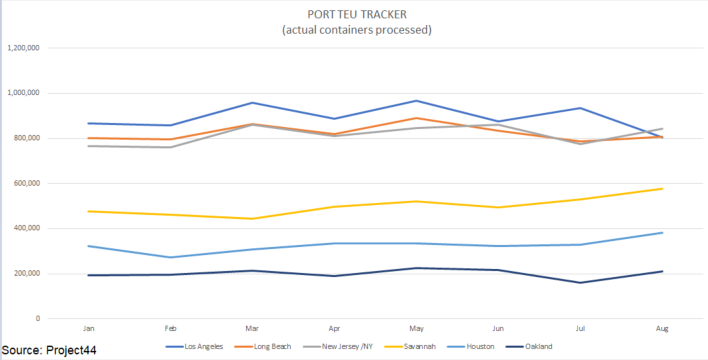

The diversion of trade continues, and the Port of New York and New Jersey took the top spot for moving the most import and export containers in the month of August. The Port of Los Angeles was pushed down to the third slot behind Long Beach.

The Port of New York and New Jersey moved 843,191 import and export containers. The port’s five busiest months have all occurred in 2022, including August.

“We are exceeding pre-COVID numbers — it is astonishing — and it is a credit to the men and women who are moving the cargo with such efficiency,” said Kevin O’Toole, chairman of the port authority. “Our planning with rail to complement the actual infrastructure and the dredging are allowing this added capacity that would not have happened four or five years ago.”

The Port of Los Angeles ranked third in the nation in August, moving 805,314 total containers. That was 37,877 fewer containers moved compared to the Port of New York and New Jersey. The Port of Long Beach handled 806,940 export and import containers.

Project44 has broken out the stickiness of the trade diversion.

The increase in vessels calling on the East Coast and Gulf Coast ports is adding to the wait times to berth. That increases the delays of materials needed for manufacturers to complete their products or get the finished products on store shelves.

This week MarineTraffic has monitored 28 container ships waiting off of the Port of Savannah in Georgia with an average wait to berth of 9.9 days. For the Port of New York and New Jersey, 12 container vessels are waiting for an average of nine days. Port Houston has 25 container ships anchored and waiting eight days.

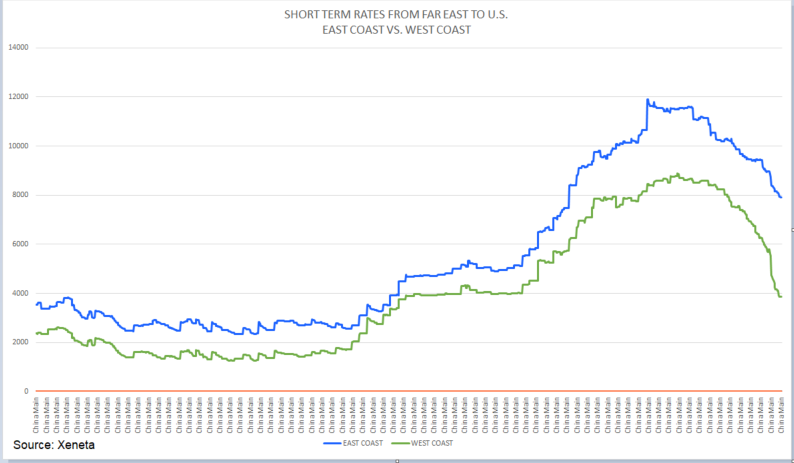

The decrease in demand for West Coast ocean freight has hit rates hard.

“A week ago, we had a new record split between spot rates from the Far East into either coast,” said Peter Sand, chief shipping analyst at Xeneta. “To me, that is a sign of congestion all but cleared on the West Coast, with volumes coming in being manageable for ports and terminals. That has caused rates to fall faster on the trans-Pacific than for East Coast-bound cargoes.

“When taking out the inflation in retail sales, U.S. retail sales were flat from last month, so demand has not fallen sharply,” Sand continued. “Shippers are still bringing in a lot of containers on the East Coast and West Coast and Gulf Coast as well. Congestion on the U.S. East Coast is keeping rates elevated, in a combination with added disruption to that coast coming from troubles in North Europe. Shippers are still hesitant to return rerouted cargo to the U.S. West Coast.”

There are logistics winners in this movement of trade and that’s the rails. CSX, Norfolk Southern rails move the import and export containers on the East Coast. BNSF, owned by Berkshire Hathaway, and Union Pacific move the containers in and out of Port Houston.