Lower-than-expected Class 8 truck orders in December barely impacted the seasonally adjusted five-and-a-half months it takes to build and deliver a new unit. Strong orders for vocational trucks, demand in Mexico and exports softened slack bookings for over-the-road tractors.

Preliminary North America net orders of 26,500 in December came in 15,000 below November. Adjusted for seasonal factors, the intake was closer to 20,900, ACT Research reported.

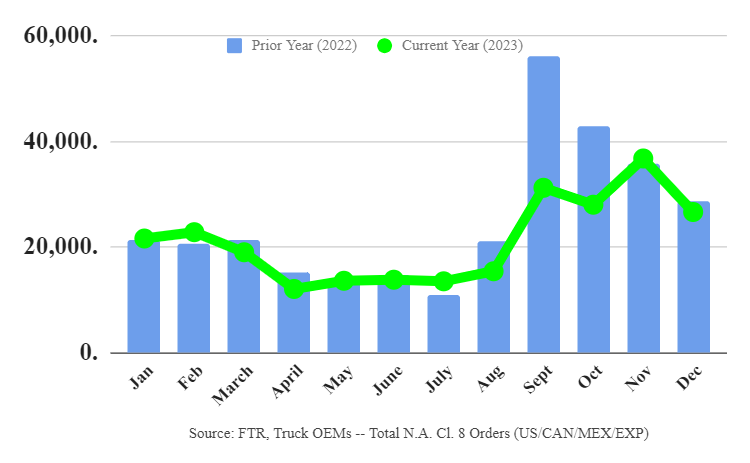

2023 orders down 7% compared t0 2022

Full-year 2023 orders fell to 278,500 units, down 7% from 2022, according to ACT. Truck manufacturers produced about 337,000 Class 8 trucks last year — far more than orders supported. But the backlog of about 180,000 units left the industry in good shape entering 2024, Kenny Vieth, ACT president and senior analyst, told FreightWaves.

FTR Transportation Intelligence put the full-year order number at 253,000 with the annualized rate over the past six months at 302,000 units. The last quarter of the year ran at an annualized rate of 362,000 units.

Class 8 orders fall in final report of 2023

FTR pegged preliminary December orders slightly higher at 26,620. That was 26% below November and 6% lower than December 2022.

“Despite the slight year-over-year decrease in orders in December, the market is still performing at a high level historically,” Eric Starks, FTR chairman, said in a news release. “Even as the freight markets have been weak for an extended period, fleets are still ordering equipment.”

Pent-up demand from 2021 that followed the pandemic was largely sated in 2023, according to ACT. About 12,000 new trucks were exported in 2023. Thousands more used Class 8 tractors also found their way to Central America, the Persian Gulf and some parts of Africa, Vieth said.

Seeking a soft landing for Class 8 equipment in 2024

“The tractor market is unfortunately overcapitalized, so there’s no avoiding some slowdown in 2024,” ACT’s Vieth said. “There are lower lows in the trough because of the ongoing strength in vocational, Mexico and export markets.”The Mexican economic recovery helped it pull ahead of China in July as the biggest trading partner for the U.S.

“As the Mexican economy has revived, demand has been constrained because U.S. and Canadian truckers were in line first,” Vieth said. “You had a very weak pre-pandemic Mexican new truck market. As a result, the fleet age is as old as it’s been in 20 years.

“We’ve been talking about reshoring for a decade. But between the supply chain breakdowns and COVID, over the last couple of years it has been more than lip service.”

Vocational demand a support pillar but pull-ahead orders could deepen trough

Strong orders of vocational trucks needed for commercial construction and oil production should continue in 2024.

“There’s a lot of brick and mortar being put in place on the heels of the infrastructure and CHIPS acts,” Vieth said.

Fleets and dealers elevated orders in California last year ahead of the delayed Advanced Clean Fleets rule that was supposed to begin setting quotas for zero-emission truck purchases this month.

“You had a pull forward in 2023 because of California, so that becomes a drag in 2024,” Vieth said. “The question becomes as you look out into EPA (nitrogen oxide emissions rules in) 2027, when does that [pull-ahead] start?

“The OEMs will say they’re going to do everything they can to get their customers to start spending money in 2024 because they want to make this ’24 trough as shallow as they possibly can. But because of these ancillary markets doing well, that helps with a soft landing. We call it the best recession ever.”

Related articles:

New Class 8 truck deliveries fall for 4 consecutive months

Class 8 orders hit 14-month high in November

Class 8 catch-up largely over as replacement iron drives orders