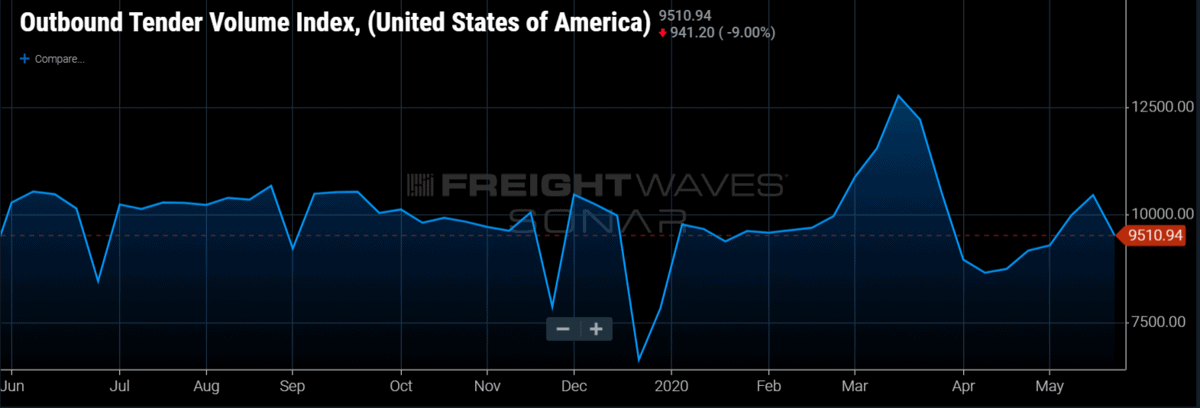

Outbound tender volumes are benefiting greatly from the reopening of the economy and a release of pent-up consumer demand. Supply dynamics are taking longer to adjust and capacity remains loose. While rates are coming off a depressed base, spot rates have surged to $1.47 per mile and have increased in the vast majority of lanes. Consumer spending data is improving, now only running down 10% year-over-year compared to the -40% trough.

On a weekly basis, volumes fell 8%, ending the multiweek streak of strong sequential growth off the bottom for OTVI in mid-April. However, that is a small blemish as volumes are now running up 10% year-over-year compared to an admittedly easy comparison from last year but still the highest rate of growth since the trucking market peaked in March.

Volumes should continue to be supported by most of the states reopening, continued plugging of the income gap by generous unemployment benefits and stimulus, auto plants reopening, and produce seasons kicking into gear.

On the negative side, just two of the 15 major freight markets FreightWaves tracks were positive on a week-over-week basis. This ratio plunged this week relative to the strong levels seen in recent weeks. The markets with gains this week in OTVI.USA were Ontario, California, (1.99%) and Seattle (1.30%). The markets with the largest declines this week were Houston (-20.71%), Elizabeth, New Jersey (-13.25%) and Fresno, California (-11.95%).

Tender rejections continue to improve with volumes

Outbound tender rejections have increased week-over-week for the third week in a row after tumbling for the six weeks since the OTRI peak of 19.25% on March 28. It seems the trough is now behind us, but at 4.84%, OTRI is still in a relatively low range historically speaking (though rapidly improving).

Rejection rates vary by trailer type. Currently, reefer rejections are nearly double van and four times higher than flatbed.

There are pockets of tightening capacity, mostly on the West Coast and in New England. Now that volumes have begun to return, OTRI is likely to rise modestly in the coming weeks as carriers regain confidence that they may have options besides their contracted freight. However, carriers are still accepting nearly every contracted load they can get their hands on to keep utilization high and keep trucks rolling. Capacity will not tighten aggressively until freight volumes are fully restored in most markets around the country, and that has not happened yet.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.

Check out the newest episode of the Freight Intel Group’s podcast here.