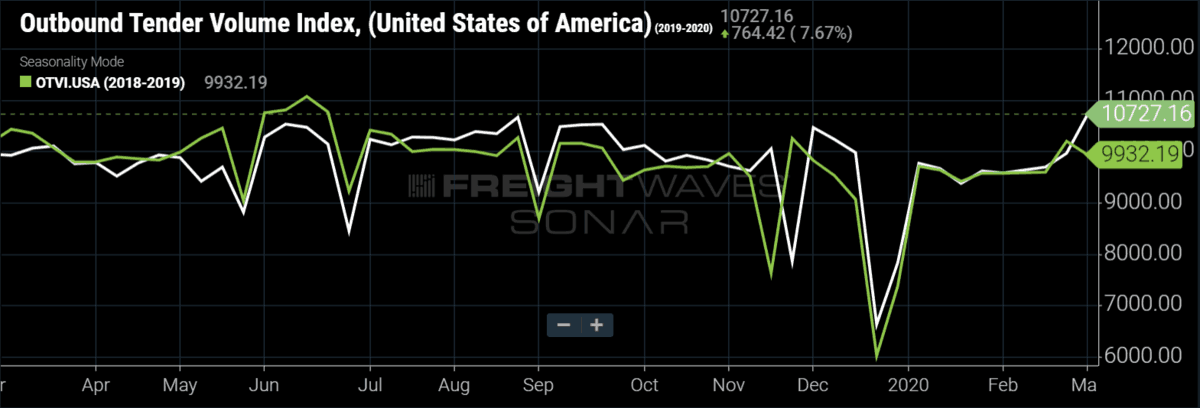

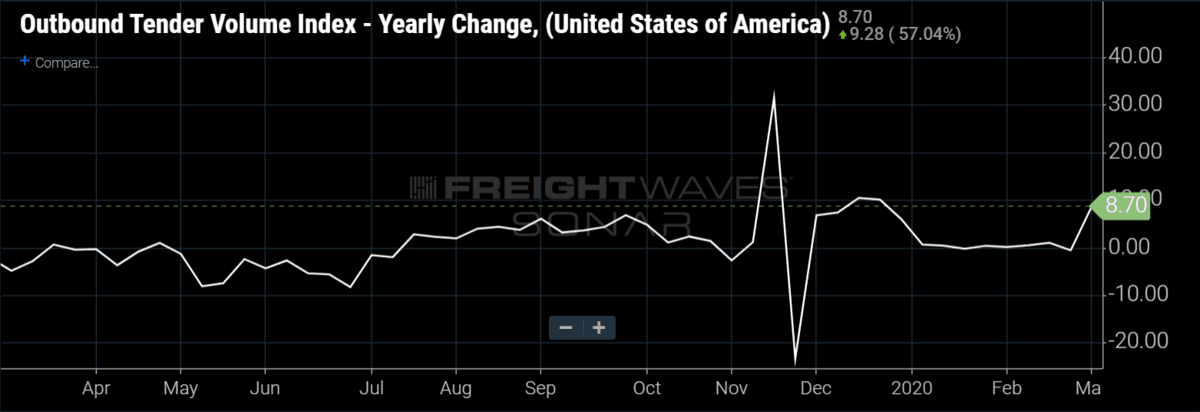

National outbound tender volume surged over 6% in the past week. This week’s gains are more than double the second-largest weekly increase, which happened to be last week. The outbound tender volume index now sits well above both the 2018 and 2019 comparisons at 10,727.16. This is the first time OTVI has been above its March 2018 starting point of 10,000 since before Christmas.

Last week, we predicted a low-single-digit volume increase because of the “March bump” exhibited in the past two years of data. While this has come true, it may not be long-lived. OTVI is already at the highest point it has been in any of the past three months of March. The possibility of widespread quarantines due to the coronavirus is the most threatening deterrent to the current volume momentum.

Reefer volumes have ticked up over the past week, but the majority of this upswing is from increasing dry van volumes. Our outlook for volumes for the remainder of the first quarter is blurred by the effects of the coronavirus on global trade flows. China is reporting that 60% to 70% of capacity is currently back in production, but other datasets tell a vastly different story. Until we get more viable evidence from outside of Beijing, it is difficult to forecast the short-term impact to U.S. truckload volumes.

Fourteen of the 15 markets FreightWaves tracks were positive on a week-over-week basis. Markets with the largest gains in OTVI.USA were Dallas (22.3%), Savannah, Georgia (15.2%), and Ontario, California (14.7%). On the downside, this week saw a decline in Seattle (-1.4%).

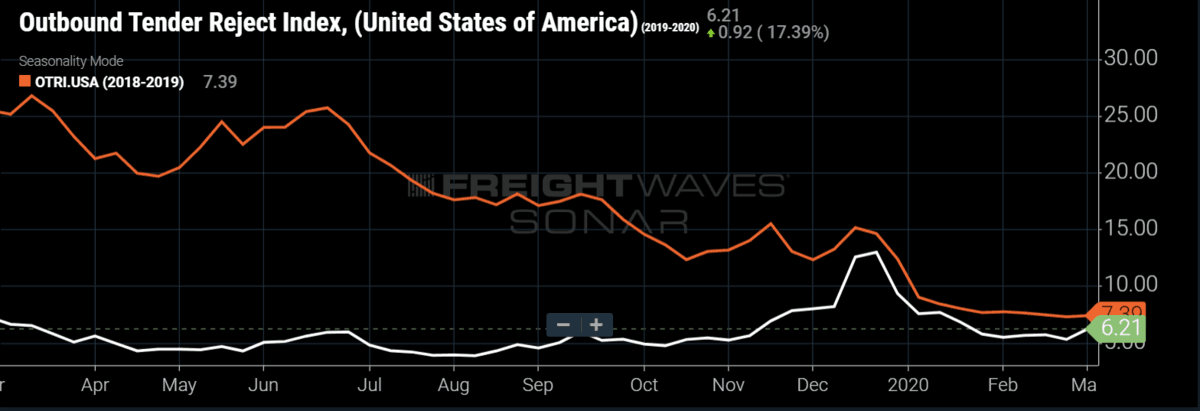

Tender rejections rise this week

Tender rejections snapped back more than 10% after falling 6% last week. Despite a strong weekly gain for carriers, the overall level (6.21%) is still extremely low. This week’s change in OTRI is due entirely to tightening dry van capacity. Reefer capacity loosened slightly over the past week with ROTRI.USA down nearly 3%.

Capacity is still extremely loose and it will most likely stay this way for the next few weeks. The coronavirus has not yet impacted American truckload capacity, but it is likely to do so in the near future.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.

Check out the newest episode of the Freight Intel Group’s podcast here.