Rail equipment and technology manufacturer Wabtec (NYSE: WAB) is eyeing its international business as a potential offset against sluggish rail demand in North America, the company’s executives said during Wabtec’s third-quarter earnings call on October 31.

“We see a very robust international business. We’re growing our fleets internationally,” Wabtec CEO Rafael Santana explained to Wall Street analysts during the company’s earnings call. “When you look at the elements of transactional parts and multi-year service agreements, we see growth in those two segments.”

Santana said two-thirds of its existing business comes from international customers in areas such as India and Southeast Asia, some of whom have multi-year service contracts. The remaining one-third comes from customers in North America.

The company declined to provide guidance for 2020 during today’s earnings call, but executives said that besides international opportunities, there is some correlation between North American rail volumes and Wabtec’s freight revenue. The North American freight railroads have parked some locomotives in response to lower rail volumes in 2019, and as a result, Wabtec could see its freight revenue lagging behind any rail volume upticks in 2020.

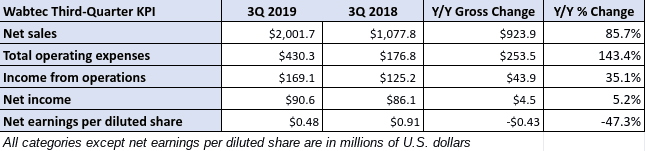

But despite higher costs and “challenging conditions” for freight in North America, Wabtec posted a 5.2% increase in net profit in the third quarter as it took advantage of synergies related to its merger with GE Transportation earlier this year.

Wabtec finalized its merger with GE Transportation in late February.

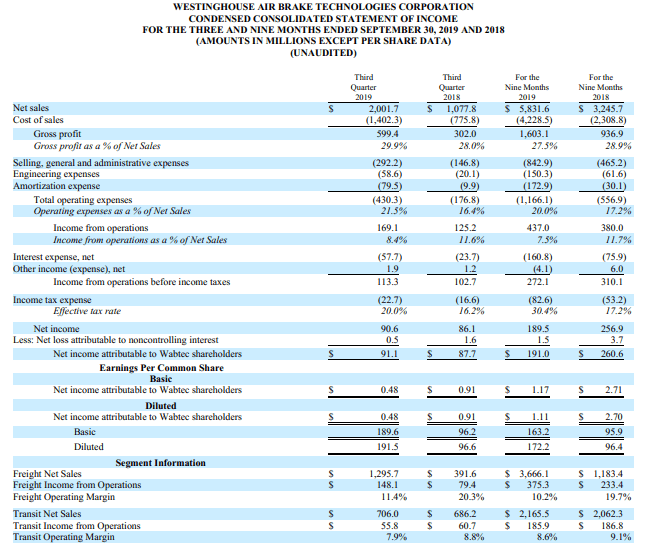

Third-quarter net income totaled $90.6 million, compared with $86.1 million for the same period in 2018. Earnings per diluted share were $0.48, compared with $0.91/diluted share in the third quarter of 2018.

Net sales were $2 billion in the quarter, up 85.7% from the third quarter of 2018 as sales from GE Transportation and higher transit sales partially offset lower sales in freight components, electronics and unfavorable foreign exchange rates, Wabtec said.

Of those net sales, freight net sales jumped 231% to $1.3 billion, due to $954 million in acquisitions. This was offset by $45 million in lower sales for freight railcar components and electronics, as well as “unfavorable” foreign currency exchange rates, Wabtec said.

Transit sales rose 2.9% to $706 million in the third quarter of 2019 on sales growth of $44 million and acquisitions worth $2 million. But foreign currency exchange rates of $26 million offset these results.

Meanwhile, costs were also up year-over-year, with third-quarter operating expenses rising 143% to $430.3 million from $176.8 million a year ago.

“We delivered a solid operational performance in the third quarter and we remain on track to achieve our full-year adjusted earnings and cash flow guidance, despite challenging conditions in the North American freight market,” said Wabtec CEO Rafael Santana. “Growth in our aftermarket and services revenues demonstrate the importance of our significant installed base across both freight and transit and the resilience of our business model.”

Looking to the remainder of 2019 and beyond

Wabtec lowered its adjusted revenue guidance again for 2019, and it now expects annual revenue to be around $8.2 billion, down from $8.3 billion given in July and $8.4 billion from earlier this year. But the company maintained its guidance of $1.2 billion in income from operations, and it kept its guidance of earnings before interest, taxes, depreciation and amortization, or EBITDA, at $1.6 billion.

The company confirmed that it expects to see synergies worth $250 million by 2022 as a result of its merger with GE Transportation.