The proposed merger between U.S. grocery chains Kroger and Albertsons faces challenges on two fronts: a skeptical and increasingly interventionist Federal Trade Commission and a deteriorating consumer macro backdrop that has slowed spending growth at Albertsons stores.

On Tuesday, Albertsons announced its results for the fourth quarter of fiscal year 2022, which ended on Feb. 25. Top-line revenue was up 5.1% year over year to $18.3 billion, and net income per share, adjusted after a laundry list of merger-related expenses, climbed 5.3% to 79 cents. On a GAAP basis, net income declined 31.6% year over year to $311.1 million.

“As we look ahead to fiscal 2023, we believe we are well-positioned to drive top-line growth by deepening relationships with our customers even as inflation continues,” said Albertsons CEO Vivek Sankaran in a release. “However, we also believe that the economic backdrop is uncertain and is likely to be more challenging later in the year. We have prepared our business for a more difficult consumer environment, and are expecting significant labor investments and inflationary cost increases.”

Albertsons management reported that a $3.9 billion special dividend to shareholders was paid after a restraining order blocking it was lifted. That dividend reduced the grocer’s cash and cash equivalents from $2.9 billion a year ago to $455 million. The dividend, which was announced as part of the merger in October 2022, was meant to provide cash to Albertsons investors such as private equity firm Cerberus Capital, whose position in Albertsons the proposed merger values at approximately $5.2 billion.

The mega-deal would create a combined entity operating 4,996 stores with more than $200 billion in annual revenue. But the transaction has come under scrutiny from the FTC, which is trying to block Microsoft’s acquisition of Activision-Blizzard and also intervened in last year’s failed combination of Penguin Random House and Simon & Schuster. In March, the FTC reached out to Kroger’s and Albertsons’ competitors for comment on the deal, seeking information about consolidation’s effect on retail food prices. The agency is expected to eventually file a lawsuit.

Consumer advocacy groups and labor unions have already launched their campaign against the Kroger-Albertsons merger, arguing that the deal would be bad for employees and customers. A private lawsuit noted that the combined entity would control “36% of grocery supermarket operators,” a plurality that could plausibly stifle competition and unfairly influence prices. But the highest-revenue grocery businesses are no longer supermarkets: Walmart, Amazon and Costco had more grocery revenue than Kroger in 2021. The Kroger-Albertsons combined entity would only account for 13% market share of total grocery revenue when nonsupermarket retailers are included.

For its part, Kroger expected a fight and has staffed up appropriately. The supermarket chain and senior partner in the deal has retained John Boehner, who has been ensconced at top lobbying firm Squire Patton Boggs with members of his former congressional staff since 2016, to help get the merger approved.

It’s unclear how moderating consumer spending could impact the deal. Albertsons has a fairly low net debt to earnings before interest, taxes, depreciation and amortization ratio at 1.81, a lower leverage ratio than the company maintained in 2018 and 2019, for instance. And Kroger is financing the merger with cash and committed debt from Citi and Wells Fargo, so closing the transaction isn’t dependent on its share price. Still, momentum at Albertsons is clearly slowing: Identical sales growth, equivalent to same-store sales, fell to 5.6% in the fourth quarter of fiscal year 2022, the company’s slowest growth since the third quarter of fiscal year 2021.

Albertsons’ identical sales growth rate was distorted by the COVID-19 whiplash but looked like it was returning to the same trend of slow-burning acceleration the company experienced prior to the pandemic. While it’s customary for public companies involved in an impending merger to not give earnings call transcripts, other grocers — particularly Walmart — have offered color on the changes in customer spending they’ve witnessed over the past few quarters.

These spending shifts seem to indicate consumers under pressure from inflation and looking to stretch their dollars further. Walmart said it’s seeing an influx of higher-income customers to its stores; meanwhile, general merchandise sales are lagging while grocery remains robust, and within grocery, private-label items are outperforming brand names.

While daily essentials like food and beverages are some of the most resilient parts of the goods economy, volumes haven’t been immune to the broader slowdown in spending. Albertsons grew identical sales by 5.6% year over year, but that number includes price inflation. On Wednesday, the Bureau of Labor Statistics released the Consumer Price Index data for March, which showed that while food prices have stabilized month to month, the food index was up 8.5% over 12 months. Inflation outrunning sales growth implies soft volumes, and that’s what transportation data implies, too.

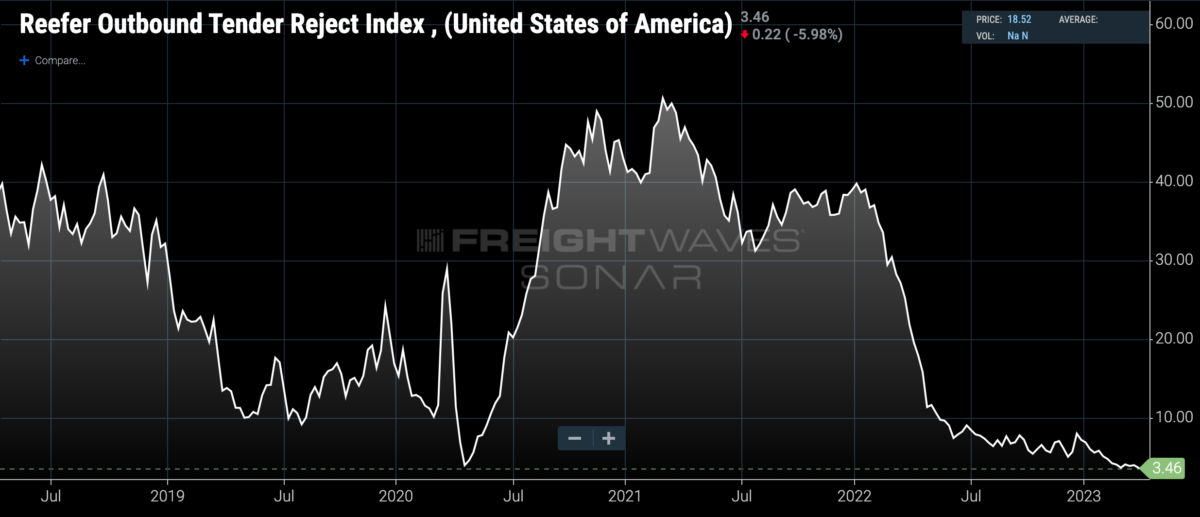

The FMIC-Cowen Freight Index for temperature-controlled truckload contract rates was down 21.3% year over year this week, while temperature-controlled spot rates have plummeted 40.8% year over year.

Temperature-controlled trucking carriers are only rejecting 3.46% of the loads tendered to them by shippers, indicating an environment of extremely loose transportation capacity and few lucrative spot market opportunities, even in the midst of produce season in Southern California and Florida.

A year ago, reefer carriers were rejecting nearly 19% of the loads offered to them and exercising their pricing power in the market to maximize yield. Now, during a traditional seasonal peak for temperature-controlled freight, when strawberries and asparagus are being harvested in California and bell peppers, oranges and lemons are being harvested in Florida, temperature-controlled trucking carriers are largely taking whatever freight they can get.

The near-time transportation data suggests there hasn’t been an uptick in demand, at least relative to the supply of trucks available for dispatch, and that further cooling in consumer spending may be ahead. That could mean continued margin pressure for grocers — even as transportation costs continue to ease — stemming from consumers choosing inexpensive items and continuing to shift to an unfavorable mix for grocers.

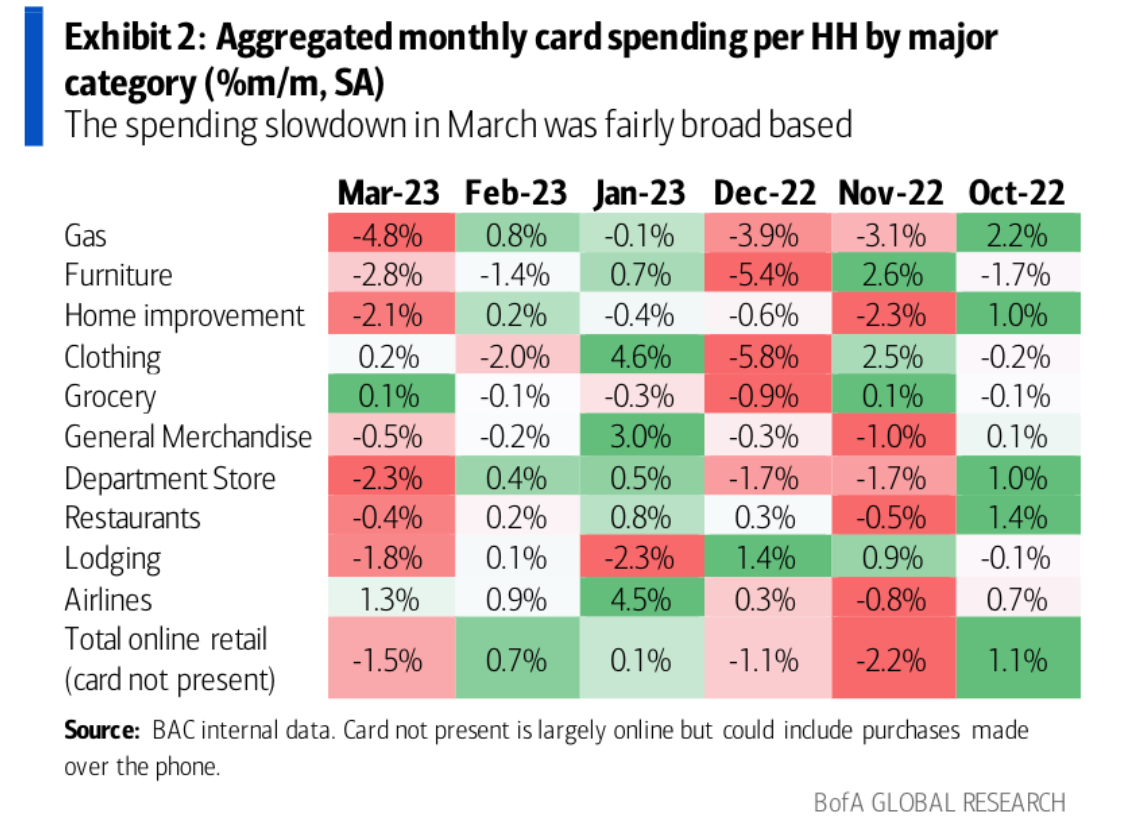

Weekly credit card spending data from Bank of America confirms that while grocery is holding up better than other parts of the consumer economy, which saw a broad-based slowdown in March, spending treading water, growing 0.1% month-over-month after contracting by 0.1% in February.