New highs were reached by logistics warehouse operator Prologis Inc. during the 2022 third quarter. However, the company’s management team struck a more cautious chord looking forward.

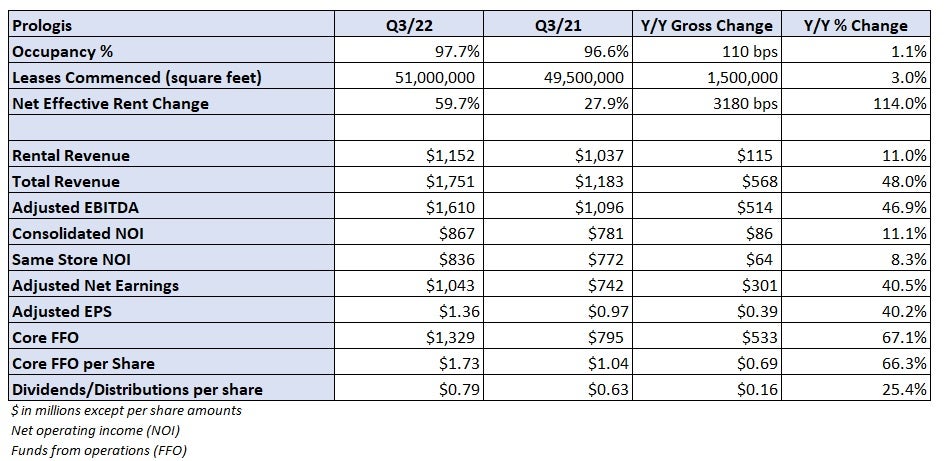

Prologis (NYSE: PLD) reported core funds from operations (FFO) of $1.73 per share in the period, 6 cents better than consensus and 69 cents higher year over year (y/y). Rental revenue was up 11% y/y to $1.15 billion and many of the core metrics used to evaluate the company’s portfolio of properties increased in the quarter.

Occupancy tightened to 97.7%, 110 basis points higher y/y. Leases commenced were up 3% y/y to 51 million square feet. Net effective rent change — the average rate change over the life of the lease — reached an all-time high of 59.7%, up 67% in the U.S.

Click for full report: “Logistics real estate market moderating but rents going higher”

“Our record results for the quarter point to the continued strength of our business; however, given the impact of aggressive Fed tightening and the rapid change in market sentiment, we will run our company assuming an economic slowdown,” Hamid Moghadam, co-founder and CEO, stated in a news release. “We have built our portfolio to outperform and our balance sheet to be resilient throughout cycles — we view this as a time of opportunity. We will remain patient to capitalize on growth opportunities as they emerge.”

Updated full-year 2022 guidance for core FFO was basically unchanged at $5.12 to $5.14 per share. Net earnings guidance was lowered 18% at the midpoint of the range to $4.25 to $4.30 per share. The revised outlook includes the $26 billion all-stock acquisition of Duke Realty that closed on Oct. 3.

“While confident as ever about the resiliency of our business, we are exercising caution in the near term,” CFO Timothy Arndt said. “Accordingly, we are taking a more conservative approach in how we choose to allocate our capital, and are therefore lowering our guidance for development starts, dispositions and contributions while we closely monitor the market.”

Development starts were reduced 7% at the midpoint of the range to $4.2 billion to $4.6 billion.

The company will host a call at noon Wednesday to discuss these results with analysts. Stay tuned to FreightWaves for continuing coverage of Prologis’ earnings report.

Prologis Ventures is an investor in FreightWaves.

Click for full report: “Logistics real estate market moderating but rents going higher”

More FreightWaves articles by Todd Maiden

- J.B. Hunt looks to balance costs with moderating demand

- XPO, RXO financial targets imply no letup through 2027

- Cass: September increase in shipments a head fake