Why don’t you gaze upon your IKEA table with wonder? This is a piece of furniture that couldn’t have existed a few decades ago. One such table could be imagined in Sweden and manufactured in China with trees from Romania. It may then transit in a shipping container on a 400-million-pound ship, on a truck to a warehouse in Los Angeles, on a train to Chicago and to your home, eventually. Such a table is yours for, say, $200 — until you get sick of it or decide to upgrade to a $400 table.

Such intensively globalized supply chains are a somewhat recent invention. There once was a time where you could not buy tangerines in Minneapolis in January or receive South Korean face wash through free, next-day shipping. Little, if anything, that we use or eat everyday did not spend some amount of time in a shipping container. “In 1956, the world was full of small manufacturers selling locally; by the end of the twentieth century, purely local markets for goods of any sort were few and far between,” wrote economist Marc Levinson in his seminal book “The Box.”

For this, we can thank (or blame) the development of the diesel-powered semi-truck, the shipping container, and intermodal rail. But above all, we must appreciate the fact that ocean trade can happen at all.

It’s somewhat ahistorical that the world’s oceans have been relatively painless to navigate in the second half of the 20th century, permitting trade to flow around the world. That was not the case for much of human history. “Pirates, predatory states, and the fleets of great powers did as they pleased,” wrote Jerry Hendrix, senior fellow at the Sagamore Institute, in The Atlantic last year. “The current reality, which dates only to the end of World War II, makes possible the commercial shipping that handles more than 80% of all global trade by volume — oil and natural gas, grain and raw ores, manufactured goods of every kind.”

Such peace can no longer be assumed. It’s unclear whether ongoing diversions from the Suez Canal will become the norm going forward, but it’s clear that things are shifting — and it’s not in the favor of frictionless trade or a U.S. hegemony.

“It was almost like you had a conveyor belt from the shoe factory in Bangladesh to the shop in Chicago,” said Simon Sundboell, founder and CEO of Copenhagen-based maritime intelligence company eeSea. “That’s just not happening anymore. You’re in a world that’s going increasingly from American-controlled unipolar to multipolar globally. You’re going to have a much more fraught supply chain, and every BCO [beneficial cargo owner], importer, exporter, and logistics provider is going to have to deal with that going forward. The Houthis are just one step in that.”

Here’s what’s going on in the Red Sea

Since the end of November 2023, a militant group called the Houthis, who control about half of Yemen, has targeted “Israeli-linked” container ships transiting the Red Sea. The Houthis, who are allied with Iran, have fired drones and missiles towards these ships, and have even landed armed men from helicopters on one of them. No ships have been destroyed and no casualties have been recorded.

“They’re trying to boost their prestige,” said Gregory Brew, an analyst for the Eurasia Group who focuses on Iran and the geopolitics of oil, of the Houthis. “They’re trying to show off, essentially: We’re the new kids on the block. Here’s our arsenal of missiles and drones. We’re capable of doing this. Don’t mess with us. But they’re also trying to have a say in what’s going on in Gaza.”

In response, the U.S. announced a naval coalition with certain allies called Operation Prosperity Guardian on Dec. 18. The U.S. Navy said on Jan. 4 that U.S. warships have shot down 61 Houthi missiles and drones.

Some 1,500 commercial ships have transited safely through the Red Sea since Operation Prosperity Guardian launched. Still, many major container shipping companies don’t seem assuaged. Data from Flexport, a global shipping platform, on Jan. 9 reflects a massive diversion. Out of the approximately 735 vessels that would be expected to traverse the Red Sea, 517 are diverting, planning to divert or already diverted the key shipping corridor. That’s 25% of the world’s overall shipping capacity by container volume.

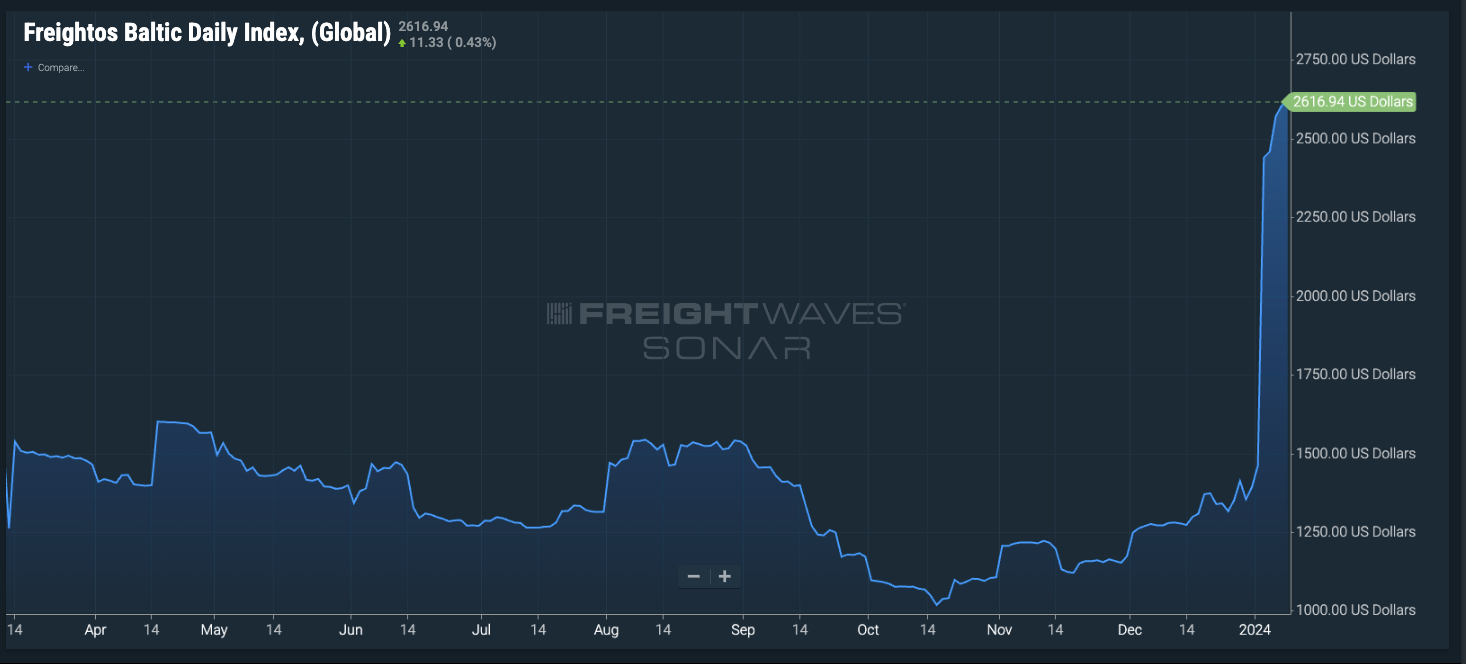

Rates from Asia to North America have popped by 75% over the last month, according to Flexport. The firm expects rates to increase by an additional 50% to 100% in the second half of January. Meanwhile, Asia to Europe rates have soared by 200% from mid-December to early January. Ocean carriers now must transit around the southernmost tip of Africa to avoid the Red Sea, increasing transit times by 10 to 14 days.

Peter Sand, the Copenhagen-based chief analyst at ocean and air freight platform Xeneta, said that has “ripple effects” for ocean trade outside of the Suez Canal. A typical container shipping company that has weekly sailings out of Asia to Europe, for example, would need to add three new ships to its service. That would likely take ships out of other parts of its service.

“That is a tall order and a tall task,” Sand said. “Not many of the big carriers have three ultra-large carriers doing absolutely nothing right now, even though the industry is working with overcapacity, but you need to find those ships and you need to feed them in.”

Diverting ships also requires ocean carriers to reorder their containers as it means a ship is visiting ports in a different order than it may have previously planned, said Anders Schulze, the Flexport senior vice president and head of ocean freight.

“That’s a very complicated logistic puzzle,” Schulze said. (I believe him!)

The attacks reveal a chasm in global trade

The Houthis claim to be attacking ships that have Israeli connections. Ocean shipping experts told FreightWaves that the uncertainty, for many companies, relates to how their ship could be categorized as Israeli-linked. Sundboell said a ship could be deemed such if, say, the carrier has previously serviced Israel in the past or if the ship has a feeder vessel that brings containers from that ship to Israel.

The Houthis have largely avoided targeting Chinese container ships. That shows how the militant group is aligned with a larger geopolitical strategy, Brew said. Iran counts the Houthis among its “axis of resistance” that seeks to repel American and Israeli influence. Going after China doesn’t align with that strategy.

“The Houthis are a little reckless as far as taking risks that other groups in the resistance front haven’t been willing to take,” Brew said. “But I think they know well enough not to go after Chinese ships, because that would complicate Iran’s relationship with China. [The Houthis] probably want a relationship with China.”

Chinese carriers have appeared to largely diverted from the Suez Canal, though without the splashy press releases that European carriers made.

Still, no one wants the Red Sea debacle to transform into a larger war

Some 15% of global shipping traffic, and 30% of container traffic, passes through the Red Sea and Suez Canal, which a key Iranian ally has disrupted. Meanwhile, 21% of the world’s total petroleum consumption transits through the Strait of Hormuz, which separates the oil-rich Persian Gulf from the rest of the seas. Iran directly borders that supply chain chokepoint.

By blocking the Strait of Hormuz, Iran could very easily throw supply chains into chaos; there’s no other seaborne route out of the Persian Gulf. It’s understandable, then, why some bellicose commentators have pushed for the U.S. military to plan for a larger land war.

Still, Brew said it’s unlikely that Iran would want such chaos, especially in the Strait of Hormuz. The heavily-sanctioned country has found much economic success in increasing its oil exports to — you may have guessed it — China.

According to a November report from Reuters, China’s oil imports from Iran, during the first 10 months of 2023, were 60% above imports during the same time span in 2017, before the U.S. had reimposed sanctions on Iranian oil trade. That’s in spite of Chinese customs not logging any direct imports from Iran since 2020. Importers appear to be using a “dark fleet” of oil tankers that have fake locations or origin points.

“The general consensus view has been: Iran wants to pressure Israel, it wants to pressure the United States, it wants the war in Gaza to end,” Brew said. “What it does not want is a regional war. It does not want the situation to escalate to the point that it starts to become directly involved.”

Supply chain resiliency is again the key buzzword

Geopolitical chaos is, obviously, nothing new. The Suez Canal was indeed blocked during the Suez Crisis in 1956 and again from 1967 to 1975 following the Six-Day War. Somali pirates threatened sailors and ships for much of the 2000s and 2010s.

The Somali pirates, however, never managed to fully upheave global trade in the way that the Houthis have in less than two months. And the Houthis doing that without ships of their own or even fighter jets — just relatively cheap drones and websites that track the world’s shipping fleet.

“Global shipping has been safe because, when you only have one naval power, you only have one state exerting or projecting power over the flow of commerce,” Brew said. “If that naval power is also the hegemon, the status quo power, that means there’s really no ability for anyone to disrupt the flow of trade.

“What we’ve seen from the Houthis in Yemen has been a suggestion that the status quo may be changing,” Brew added.

It’s probably time again to remind our fine retailers and manufacturers to not depend on, say, just-in-time inventories coming from any part of the world.

“We’ve now in the past couple of years seen enough meaningful black swan events to definitely ensure that you have to have a resilient supply chain with sort of a diversified footprint,” Schulze of Flexport said. “You don’t put all your eggs in one basket. It would simply be too risky.”

What do you think of the current shipping crisis? Email rpremack@freightwaves.com with your thoughts and subscribe to MODES for more.

Jeff Engels

Well with the prevalence of Flags of Convenience ships ie FOC’s , it is not always so clear whom is benefiting from the movement of a ships Cargo. It certainly isn’t the Seafarers who are being used by the Traditional Maritime Nations to undercut their own countrymen to increase profits. Perhaps Liberia or Panama or Malta will come to the aid of these Merchant Vessels now? Fat Chance. The Chickens have come home to Roost so to speak . Corporate Globalization and its never ending thirst for profit at the expense of workers , the environment and Now World Peace are to blame. The US will continue to play World Police on behalf of the Worldwide 1% who own the Supply Chain until someone fires a real missile ie Nuclear either in the Middle East or Ukraine then the whole mess will come crashing down. In the meantime make sure you turn on your TVs to Football and other Diversions while the

Meltdown continues. Over…

Whitehall

The choice for Americans is whether we want to take up the burdens of another cycle of world hegemon or do we want to retreat into a regional economic sphere with Canada and Mexico.

If we choose isolationism, there will be either a non-American world hegemon or there will be chaos and disorder. Americans will not like nor prosper under either outcome.

While I hope there is a solution to the Houthis that doesn’t require land attack, I don’t see a non-military resolution.

Yigal Maor

Reminding that Chinese operated vessels or loaded for China were attacked in this area. Recently it was the “Number 9” operated by OOCL and the Coal carrier (to China) AOM Sophie II. Then, even 10 years have passed, The Chinese still remember the attack on the “COSCO Asia” in the Suez Canal by islamist group. They are not immune at all to Houthies and other piracy acts. But they are very wisely keeping very low profile regarding their ships’ involvement in such events. Reminding also that COSCO liner activity in this artery (Asia-Europe), is usually mixed with its “Ocean” alliance members’ activity that for sure are not “Houthi Imunned”.

Ralph Schatz

There’s no such thing as free lunch, and now no such thing as free shipping. Risk makes everything more expensive. Excellent article.

A. Ramachandran

Global? I beg to disagree. The crisis may be affecting some nations and their begrudging allies due to their myopic foreign policy dealings, but China and the Rest of the World are sailing along smoothly.

Capt. John M. Pasko

Note well….because future changes in commerce are on the horizon.

Shrek

Another way to look at it the terrorist groups / states are too accustomed to disrupting trade without consequences.