Hurricane Michael, a powerful, fast-moving storm headed northward to Panama City, Florida, couldn’t come at a worse time for Southern cotton farmers. The harvest has just begun and 90% or more of the crop remains in the fields. Georgia ranks second in the United States in cotton acreage and second in production per acre. The overall value of the crop in 2017 was nearly $870M.

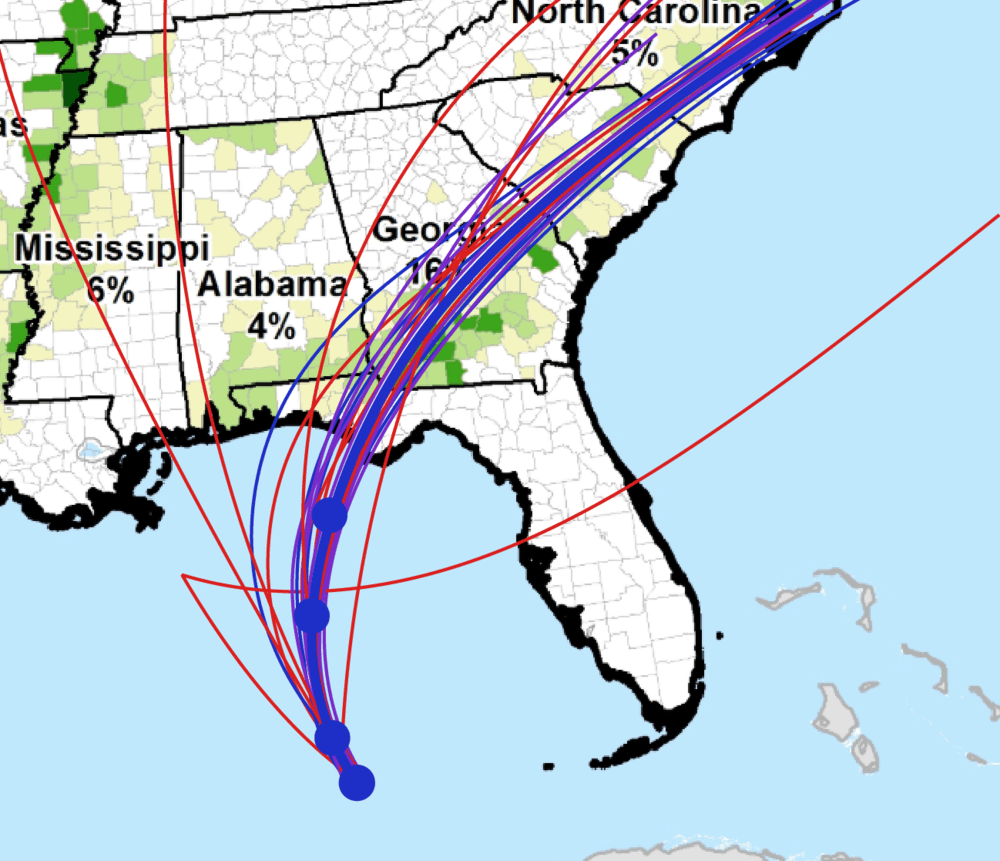

Michael, currently a Category 2 storm, is currently forecast to make landfall as a Category 3 hurricane with winds of least 111 mph. The projected path of the storm almost perfectly tracks the ‘Cotton Belt’ running southwest-northeast south of Atlanta in Georgia and through the east-central region of South Carolina. Cotton plants remaining in the fields are at risk to both wind and water damage.

If Michael’s winds are strong enough to break the plants—and Michael is projected to still be at tropical storm strength a day after landfall—then the crops could be lost entirely. Defoliant must be sprayed onto the plants to remove the leaves prior to harvest, but that process makes the plants more fragile and vulnerable to wind damage.

Heavy rain can have a range of effects on cotton plants, depending on how close they are to being harvested. First, wet cotton cannot be harvested; farmers must wait for it to dry. Even a five minute shower can delay a harvest by an hour. Violent rains can string out the cotton and even rip it from the bolls. The most common effect is that rain soaks cotton in open bolls, causing deterioration and discoloration, which lowers the grade and value of the cotton. The most commonly traded cotton futures contract, ICE Cotton #2, must meet a grade of ‘strict low middling’, which is light and white, not dark gray or yellow.

“We are looking at a quality and a yield damage likely, the most risk is coming when the cotton is opening bolls,” said Ted Seifried of Zaner Ag Hedge, referring to Florence’s impact on North Carolina. When Florence hit, a much smaller percentage of the bolls were open, and North Carolina accounts for far less of the United States’ total cotton production than does Georgia.

The weak Indian rupee and Chinese tariffs on American cotton have depressed Cotton #2 demand, and Florence’s disruptions were not enough to let prices break out of the doldrums. However, Michael already looks like a much more significant event, as the majority of its precipitation looks likely to be concentrated on primary cotton production regions.

ICE Cotton #2 prices have climbed 2% to 77.94 cts per pound since Michael was classified as a tropical storm on October 5, a one-week high. Global cotton supply is already being constrained by whitefly attacks in Pakistan’s Punjab region and extensive damage to the smaller North Carolina cotton crop caused by Hurricane Florence.

“We’re hoping we can run into the night,” said Greg Sikes, a Georgia cotton farmer who had only harvested 10% of his 4,000 acres yesterday. “If the wind doesn’t blow and the dew doesn’t fall, we’ll keep running.” Sikes spoke to WTOC 11, a local news channel in Georgia.