In case you haven’t heard, there is a major hurricane scheduled to hit the Carolinia coasts this week. Hurricanes are one of nature’s most destructive forces that affect large areas. At the height of human technology and knowledge, our cities and infrastructure are still as vulnerable as they were thousands of years ago to these storms. The main difference today, other than our advanced forecasting allowing people enough time to evacuate, is it costs a lot more to rebuild. Freight markets have already started to react to the impending weather event.

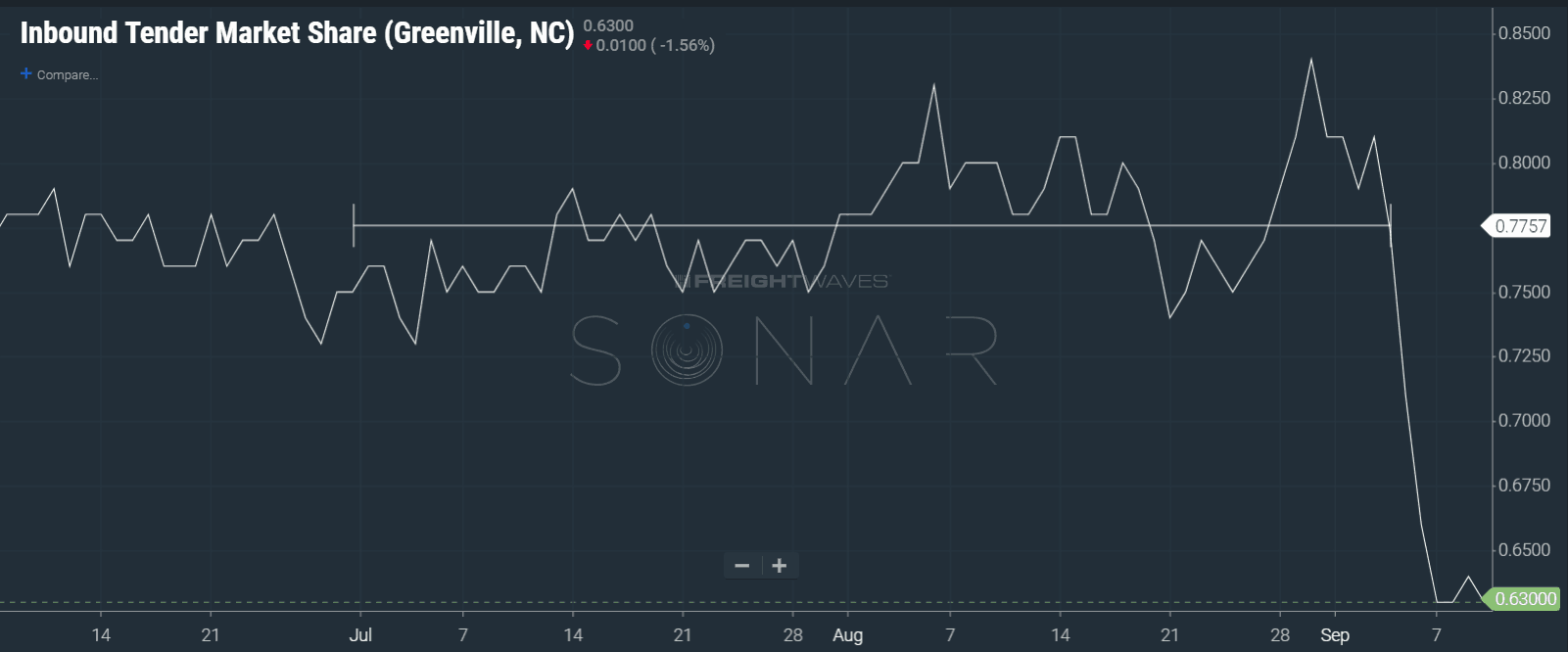

Looking at the inbound tender market share (ITMS) values in North Carolina, there are already anomalous decreases in load volumes moving into the area that is forecast to have the largest rain. ITMS measures load volume as a percentage of total loads in the U.S. The relatively stable inbound Greensboro, North Carolina market has averaged 0.77% of the total U.S. load volume since July 1st dropped to 0.63% in anticipation of Florence a few days ago.

Information can have as much impact on freight markets and truck movement as actual demand. Anticipation of rain and heavy wind have already influenced the market in North Carolina before the first rain drop has fallen.

Over the last 24 hours, Florence’s forecast has changed to a more southerly track, sparing central North Carolina from a more severe impact. As the forecast evolves, the markets will change as well. Carriers are all watching the forecast and making decisions to best position their fleets. This positioning can have short-term impact impact on capacity imbalances as production comes offline and normal network flows are disrupted while the storm hits.

Charlotte’s volume has jumped over the past 2 days with outbound tender market share (OTMS) jumping from 1.7% to 1.81%. Many shippers will try to get freight out in front of the storm as they know they will not have capacity in the market nor do they want freight sitting in the warehouse.

The biggest impacts of the storm on freight markets will be seen in the coming weeks as carriers are contracted to provide relief supplies, taking their attention off the normal demand. Watch the larger markets surrounding the damaged area, like Atlanta, where capacity shortages will be felt the most.

The Atlanta market is the largest market in terms of market share in the U.S. with an average of 4.73% of total outbound load volume and 4.69% of the total inbound load volume. The similar values of inbound and outbound indicate the market has been in relative equilibrium over the summer. Spot rates outbound from Atlanta have been falling after reaching annual highs in June.

The rest of the country will certainly feel the impact if the storm manages to hold together and make landfall as a major hurricane. It will take time to assess any damage and start the rebuilding process if damages are as bad as anticipated in the Carolinas and southern Appalachians. Another system is expected to develop in the Gulf of Mexico over the next 5 days, although it’s not projected to strengthen past tropical storm levels.