During the height of the COVID pandemic, a once-obscure diabetes drug underwent a critical Phase III trial that would eventually open up a gold rush and historic capex spree by pharmaceutical companies.

This is J.P. Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the fifth edition of our newsletter, which is dedicated to the weight loss drugs Americans love and the factories where they’re produced.

Scientists at Danish pharmaceutical company Novo Nordisk had been working on insulin regulators and GLP-1 inhibitors for decades, since the 1980s, and had finally developed a once-weekly injection for people with Type 2 diabetes: semaglutide, now known as Ozempic. The Food and Drug Administration had approved it as a diabetes treatment in December 2017.

(Photo: Jim Allen / FreightWaves)

But this study was different: Instead of limiting the drug to treating diabetics, Novo Nordisk wanted to know if it could radically expand Ozempic’s patient base to obese people in general. In March 2021, the researchers published their results in The New England Journal of Medicine: Across 1,961 study participants at 129 sites in 16 countries, the average patient lost 14.9% of his or her body weight in 68 weeks, which came out to 33.7 pounds (compared to 5.7 pounds for patients taking the placebo).

As it happens, the richest country in the world, with the third-largest population, spends the most on health care per person, and 40% of its people are considered obese (body mass index of 30 or higher). You already know which country I’m talking about: the United States. The biggest market with the biggest (pun intended) customer pool was an opportunity too good to pass up, and Big Pharma has wasted no time rapidly deploying capital.

Last week, Eli Lilly (maker of Mounjaro and Novo Nordisk’s only competitor in GLP-1 drugs) announced it was ploughing $3 billion into a Kenosha County, Wisconsin, facility it had acquired earlier this year to rapidly expand it for injectables manufacturing. Just a few months ago, in October, Lilly committed $4.5 billion to a manufacturing facility in Indianapolis.

Meanwhile, Novo Nordisk snapped up Novavax’s Czech pharmaceutical manufacturing operation for $200 million and started building a new quality hub in Denmark for $400 million, after noting that Wegovy sales growth had slowed slightly due to shortages.

And now, biopharma startups are popping up to challenge the Novo Nordisk – Lilly weight-loss drug duopoly. Kailera Therapeutics launched in October with a $400 million Series A led by Atlas Ventures and Bain Capital; Kailera has a portfolio of four Chinese weight loss injectables that it wants to bring to market. Earlier this year, in April, Metsera emerged from stealth mode with $290 million in financing and a partnership to supply Amneal Pharmaceuticals with its pipeline of GLP-1 injectables.

In short, the FDA’s regulatory decision to expand the use of GLP-1 agonists to treat obesity has opened up a vast new market for these drugs, and billions of dollars are being deployed to scale their production as quickly as possible.

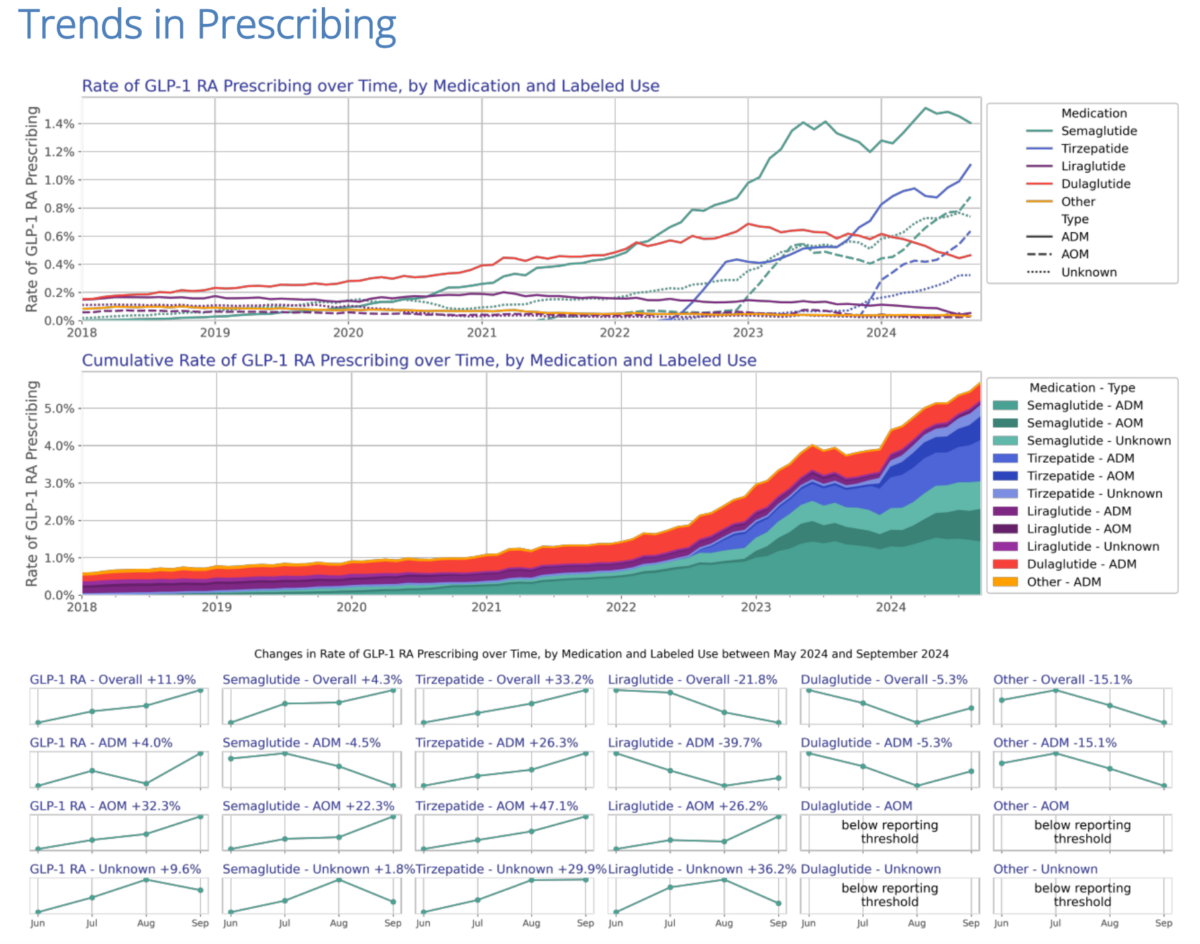

The takeaway? There’s still a long way for weight loss drugs to run: While more than 40% of Americans are obese, in September 2024, GLP-1 drugs accounted for 5.38% of all U.S. prescriptions. It seems to me that number could triple over the next few years.

Quotable

“We are now serving more than 43 million patients with our diabetes and obesity treatments. This is an increase of almost 3 million patients compared to 12 months ago … . Our GLP-1 sales in diabetes increased by 26% [year over year], driven by North America operations growing 32% and International operations growing 16%. Insulin sales increased by 10%, driven by North America operations growing 31% and International operations growing 4%. Obesity care sales increased 44%, driven by North America growing 32% and International operations growing 95%.”

– Lars Fruergaard Jorgensen, president and CEO of Novo Nordisk, the Danish pharmaceutical company and maker of Ozempic and Wegovy, on an earnings call Nov. 6

Infographic

Prescription growth among GLP-1 agonists has been explosive in the past three years as they expanded from their initial use as an anti-diabetic medication to anti-obesity medications with a much larger patient base. American demand for GLP-1s is fueling a surge in pharmaceutical manufacturing investment with multiple billion-dollar plant acquisitions and expansions in 2024 alone.

The prescriptions data, from Truveda, can be found in the pre-print “Monitoring Report: GLP-1 RA Prescribing Trends – September 2024 Data.”

News from around the web

China bans rare mineral exports to the U.S.

Sales of gallium, germanium, antimony and so-called superhard materials to the United States will be halted immediately on the grounds that they have dual military and civilian uses, China’s Ministry of Commerce said. The export of graphite will also be subject to stricter review.

China created a legal framework last year for controlling exports of gallium and germanium, which are used in semiconductors, and on Sept. 15 China added antimony, which is used in military explosives. In October, China began requiring its exporters of rare earth metals, used in everything from advanced semiconductors to smart bombs, to disclose, step by step, how the minerals would be used in Western supply chains.

China’s exports of gallium and germanium briefly halted a year ago until officials in Beijing devised a system for approving such transactions.

Lilly announces $3 billion expansion of its recently acquired manufacturing facility in Wisconsin

Eli Lilly and Co. announced a $3 billion expansion of the Kenosha County, Wisconsin, manufacturing facility that the company acquired earlier this year. This investment will extend the company’s global parenteral (injectable) product manufacturing network, helping to meet the growing demand for its diabetes, obesity and future pipeline medicines across therapeutic areas. Lilly expects to add 750 highly skilled jobs to the current 100-plus workforce at this location.

The acquisition, expansion and additional purchases of land and the adjacent warehouse bring Lilly’s total planned investment in Wisconsin to $4 billion. The expanded facility will focus on manufacturing injectable medicines, device assembly and packaging for medicines across multiple therapeutic areas.

Amgen to Add 370 New Jobs in North Carolina With $1B Manufacturing Investment

Amgen announced it will pump $1 billion into its North Carolina operations to construct a manufacturing facility that will create 370 new jobs in the region.

Thursday’s investment follows Amgen’s previous $550 million commitment to North Carolina, announced in March 2022, which also went toward the construction of a biomanufacturing facility. The new North Carolina site also follows the opening of another manufacturing site in Ohio in February 2024 — infrastructure that increased the pharma’s head count in that state by 400.