Werner Enterprises said Tuesday the end of the downcycle appears to be getting closer. With a first quarter marked by inclement weather and higher insurance expenses in the rearview, it expects normal seasonal trends to take hold the rest of the year.

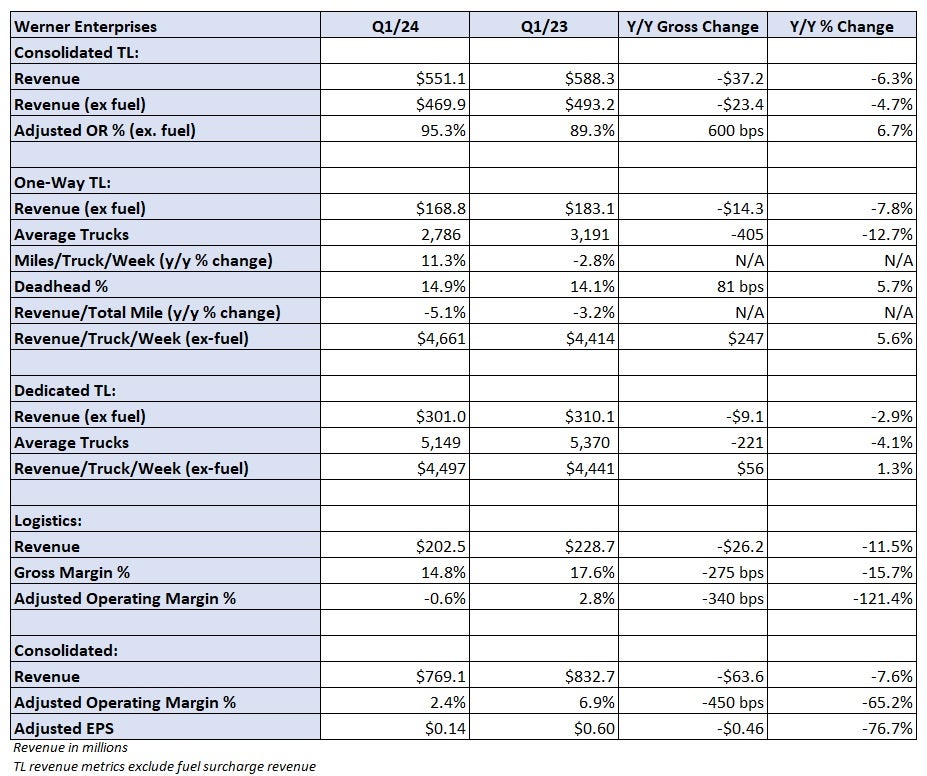

Werner (NASDAQ: WERN) reported first-quarter net income of $6.3 million compared to $35.2 million in the same period of 2023. When adjusted for items expected to not recur or items considered not part of normal operating activities (acquisition-related expenses, costs from an insurance claim that has been appealed, changes to earnouts and changes in the value of equity investments) the company reported earnings per share of 14 cents. The adjusted result was 13 below the consensus estimate and 46 cents lower year over year (y/y).

A decline in used equipment values pushed gains on sales 80% lower y/y to just 4 cents per share (an 18-cent headwind compared to the year-ago quarter). Unit sales of tractors were down 18% y/y but trailers sold increased 78%. Werner lowered its outlook for gains on equipment sales to a range of $10 million to $20 million from the prior range of $10 million to $30 million.

Management also called out one-time EPS headwinds of 5 to 6 cents from winter storms and higher health insurance costs.

Total revenue from truckload services declined 6% y/y to $551 million. Dedicated revenue declined 3% y/y as trucks in service fell 4%, which was partially offset by a 1% increase in revenue per truck per week. The company reiterated full-year 2024 guidance of flat to up 3% y/y for revenue per truck per week.

The one-way TL segment reported an 8% y/y decline in revenue. Average trucks in service fell 13% but utilization (miles per truck per week) improved 11%. Revenue per total mile was down 5% in the quarter. The company reiterated the first-half 2024 outlook for one-way revenue per total mile at down 6% to down 3% y/y. The outlook calls for “flat to slightly higher” spot rates in the second quarter, with further improvement in the second half.

The total TL truck count was down 2% y/y in the first quarter, prompting a guidance change from down 3% to flat y/y in 2024 to down between 6% and 3% y/y. The company has meaningfully lowered its one-way truck count and is seeing some headwinds to unit counts within dedicated accounts. However, it said all the discount retail customers it serves in a dedicated configuration have increased their truck counts with Werner this year.

The TL segment reported a 95.3% adjusted operating ratio (96.2% unadjusted), which was 600 basis points worse y/y and 280 bps worse than the fourth quarter. Adjusted operating income was down 58% y/y, with lower gains on sale accounting for nearly half of the decline.

The company has identified another $40 million in consolidated cost savings for 2024, $12 million of which has already been achieved. For all of 2023 and 2024, the company projects total savings of $80 million to $90 million, 60% of which it views as “structural and sustainable.”

The TL OR improved in each month of the quarter and management expects continued improvement as it has emerged from the seasonally weakest quarter of the year. A long-term target for the TL operating margin (inverse of operating ratio) remains intact at 12% to 17% but management no longer expects to achieve that run rate by the end of this year.

Werner’s logistics unit recorded a $2.3 million operating loss in the quarter ($1.2 million on an adjusted basis). Revenue was down 12% y/y to $203 million with gross margin falling 280 bps to 14.8%. Brokerage operating margins are expected to improve later in the year given the cost savings initiatives.

Shares of WERN moved 2.3% lower in after-hours trading Tuesday.

tbtbtbtbt

only 6million net income with 9k trucks?

Joe Sunday

ERIC CHAPMAN clearly sees the writing on the wall in my humble opinion. I grew up in Scranton Pa and got my start hauling produce from Vero Beach to New York in an insulated trailer with ice bunker and blower and a B-61 Mack struggling to get there. Yes, that long ago. Over the years I’ve hauled exempt freight, regulated dry freight, meat, steel, heavy equipment, and about everything used by man. I’ve moonlighted, trip-leased and had long term leases with regulated carriers. Ran all over the country in all kinds of weather in trucks that had minimal luxuries. After deregulation I finally got my own authority. Bought several trucks, hired a few drivers and thought I finally “made it”. And you know…nothing ever got better. I watched everything get worse and continue to get worse every year. Problems of all kinds just seemed to increase instead of the other way around. Too many trucks, idiot that call themselves drivers, aggressive government and some insane regulations like the e-logs and hours of service. Everyone and their brother are brokers wanting a piece of the earnings for shuffling paper. And we used to think the regulated carriers were bad taking their 25% for providing way more than brokers who don’t have a dime invested in anything substantial. I don’t agree with H MAN because there is little likelihood of a total economic collapse in the long term. Maybe a temporary slow down but as long as mankind inhabits the world there will always remain a need for transportation services. It’s just that it won’t be me, and I suspect it won’t be ERIC CHAPMAN filling that need. We’re still waiting for the boom that never comes and never will. Good luck to all.

Truck’n Curmudgeon

I’ve been a subhauler for Werner for 6 months. They have a 38% failure rate for on time payment. Take it for what it’s worth.

H man

Either the end of the freight recession is near or the start of a complete economic collapse. It is one or the other

ERIC CHAPMAN

As a 1 truck operation . And been at this for 33 years. Have Memorial Day weekend as a I’m done with it . The long term plan was 10 more years.

Been hearing the end is near for about 2 years from freight waves articles. Hate to get out now and then a boom happens. Just don’t see it getting better .

National Debt , infrastructure, fuel cost , equipment cost , regulations, Foriegn workers keeping wages down. Corruption at all levels of government. Population drop. Schools failing another generation of kids . Dollar losing value everyday. Interest rates to high. To top it all off the President is senile. Half the country doesn’t care.