One of the nation’s largest truckload (TL) carriers, Werner Enterprises Inc. (NASDAQ: WERN), expects continued headwinds in the first half of 2020.

The Omaha, Nebraska-based company reported fourth-quarter 2019 earnings per share (EPS) of 67 cents, 7 cents higher than the consensus estimate, after the close on Wednesday.

“We are pleased to report good results for the quarter, despite a challenging operating environment compared to the stronger freight and market conditions in the prior-year quarter,” stated Werner’s President and CEO, Derek Leathers.

Guidance and outlook

The company’s 2020 full-year guidance calls for its truck count to be in a range of down 3% to up 1% year-over-year. Additionally, the carrier expects revenue per total mile in its one-way TL division to decline 5-7% year-over-year. The press release stated that the rate-per-mile comparisons “are expected to remain difficult in the first half of 2020.”

Management said the guidance calling for a potential truck count decline in 2020 was mostly due to the current difficulty in the freight market, which is weighing on rate negotiations. They said one-way TL volumes were slightly lower year-over-year in January.

On the company’s conference call, several analysts asked questions about the guide for a 5-7% decline in revenue per mile in the one-way TL segment in 2020.

Management said contract renewals in one-way TL have been flat to down a couple of percentage points so far in 2020. They expect spot rates to be down 15% in the first quarter and 5% in the second quarter. Approximately 70% of the company’s contractual bid season will occur in the first half of 2020.

However, Leathers said they are seeing truck capacity exit the market as a sustained period of lower truck orders has resulted in a decline in new builds. He also called out the increase in TL carrier bankruptcies, 50-70% insurance expense increases and the Drug and Alcohol Clearinghouse as reasons to expect further capacity reductions. Further, he said that carriers don’t really have much room to back up further on pricing given the cost inflation facing the industry.

Leathers said he felt like they were “being conservative with the estimate” for one-way rate expectations, but noted “choppy times ahead of us,” specifically referring to the first half of 2020.

Lastly, it is “probable” that first-quarter 2020 earnings will be negatively impacted by a “serious accident” that occurred in January. Management said the company self-insures the first $10 million of liability exposure per event. If the accident were to impact Werner by the full $10 million exposure amount, that would result in a 10-cents-per-share negative impact to earnings.

Fourth-quarter results

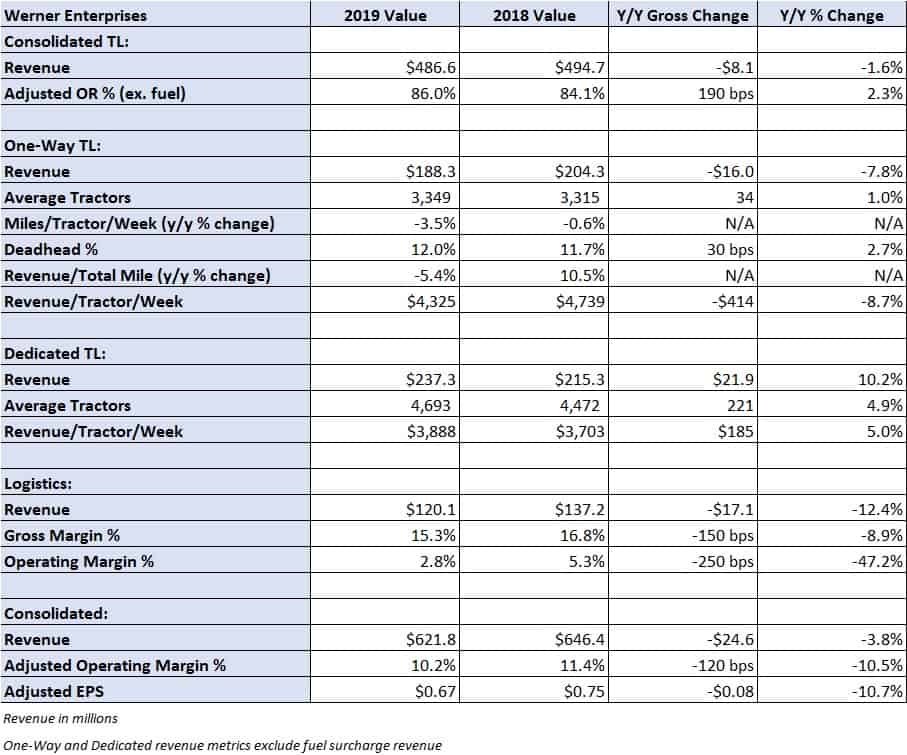

The carrier reported a 2% year-over-year decline in total TL revenue to $487 million. Revenue in the company’s one-way TL division declined 7.8% year-over-year with dedicated revenue climbing 10.2%. The one-way TL division reported an 8.7% decline in revenue per tractor per week with miles per tractor per week moving 3.5% lower and revenue per total mile falling 5.4% year-over-year.

“In fourth quarter 2019, freight volumes were comparable to fourth quarter 2018 and showed improvement sequentially from third quarter 2019; however, the rate environment in fourth quarter 2019 was meaningfully softer due to a decline in One-Way Truckload project and surge pricing,” Leathers said in the press release.

The dedicated TL division reported a 4.9% year-over-year increase in average tractors in service at nearly 4,700 units with revenue per tractor per week increasing 5% as well.

Revenue at Werner Logistics declined 12.4% year-over-year “due to fewer transactional freight opportunities, less attractive contract and transactional pricing and increased competition from logistics competitors, including digital brokers.” Additionally, the company’s intermodal revenue declined 9% year-over-year in the period.

The logistics gross margin was 150 basis points lower year-over-year at 15.3%. Management said there were fewer project and surge opportunities in the quarter and described the TL logistics freight market as “competitive.”

Michael Branch

Werner steel’s money from their drivers and owed me money for 6 mo. Before they paod me I quit in july last paycheck oct 3 2019. I would investigate werner for driver fraud .

Link

Werner is back to purging senior career drivers again.

Not the first time they have done that, as a training company the benefits to purge drivers who have 401K and healthcare and take more students who come with a government check and who might take weeks or months to start a 401k and to be eligible for healthcare benefits are in their favor.