Werner Enterprises saw another tough quarter to close 2023 and said it will continue to favor investment in its dedicated fleet over one-way operations.

The company’s 2024 guidance calls for the total truck count to be down 3% to flat, noting that the one-way truckload market is “not reinvestable” at the current moment as rates continue to be pressured by excess capacity and tepid demand.

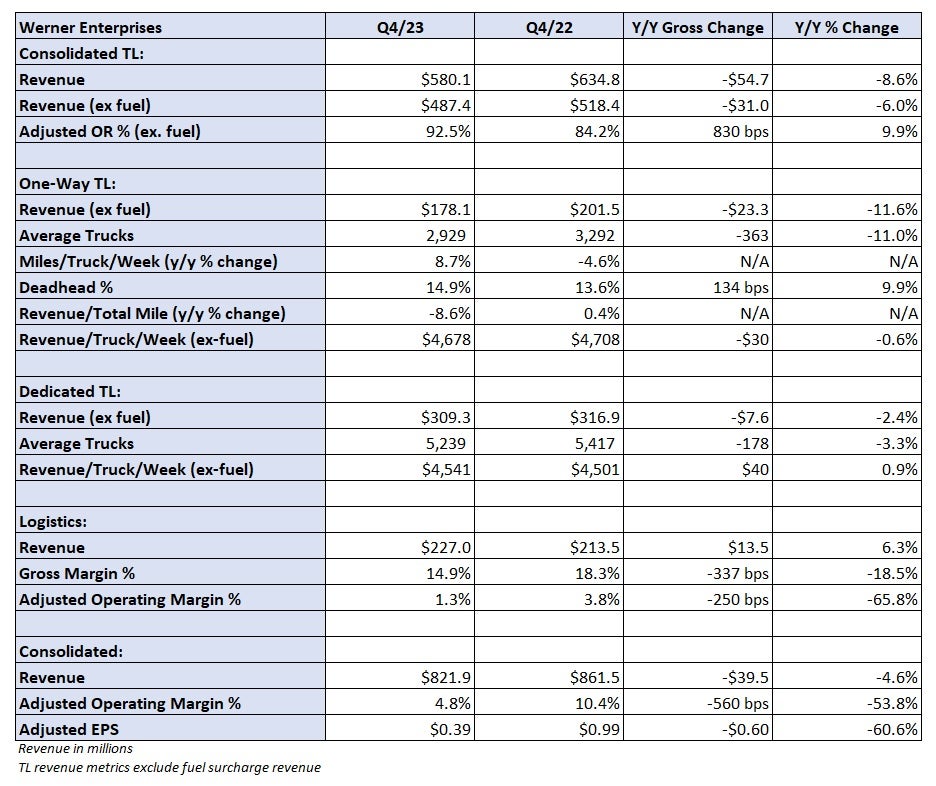

The one-way segment saw an 11% year over year (y/y) decline in average trucks in service to 2,929 units during the fourth quarter. Average trucks in use on the dedicated side were off just 3% y/y to 5,239 as some customers have reduced the number of trucks needed on a daily basis.

“We’re not going to continue to run a network in one-way at the return levels that we are seeing today … we owe it to our shareholders and others to make sure that isn’t the case,” said Chairman and CEO Derek Leathers on a Tuesday evening call with analysts.

The company achieved a $43 million cost savings run rate by the end of 2023 and has identified $40 million in new savings opportunities for 2024, of which, only 15% overlap with the prior year.

Werner (NASDAQ: WERN) reported fourth-quarter adjusted earnings per share of 39 cents, 4 cents light of the consensus estimate and 60 cents lower y/y. The result excluded acquisition-related expenses, costs from an insurance claim that has been appealed and changes to earnouts.

Compared to the 2023 fourth quarter, lower gains on sale were a 26-cent headwind, net interest expense (debt down $45 million y/y but variable interest expense up) was a 3-cent headwind, a lower tax rate was a 1-cent tailwind and a lower loss on equity investments was a 2-cent tailwind.

The company saw an 11% decline in the number of trucks sold but a more than 60% increase in trailers sold. Much lower per-unit gains were the culprit.

Werner’s dedicated business saw revenue decline 2% y/y to $309 million. Revenue per truck per week was up 1%. The full-year 2024 outlook calls for the utilization metric to be flat to 3% higher.

Werner’s one-way segment reported a 12% y/y revenue decline to $178 million. Revenue per truck per week was down just 1% with the drop in tractor count accounting for the rest of the decline. Revenue per total mile was off 9% in the quarter and is expected to decline 6% to 3% y/y in the first half of 2024.

Total truckload operations produced a 92.5% adjusted operating ratio (the inverse of operating margin), 830 basis points worse y/y.

The logistics segment reported a 6% y/y increase in revenue to $227 million. The number was partially boosted by a brokerage acquisition last November. The segment was profitable, recording a 1.3% operating margin, which was 250 bps worse y/y.

Ed O’Neil

“Werner Cares” about profits instead of Drivers.

James Bauman

So, if expected settlement amount (insurance); and the acquisition fees are included, what is the OR then? Over 100? Likely. All important footnotes.

Steve sam

They stress out there drivers low mileage the worst communication ever driver manager and to the top manager when they terminate you they pit so much bad reports on the that years and make it personal to get job any where drivers should be aware you do something wrong they pit on your record and then lie about that they won’t mess up your record

Samuel Jefferson

Simply means, Werner needs to make changes before it’s to late, there are evil people that hate this company and want to see the fall of it.

Samuel Jefferson

Such a great company, but making really dumb moves, I do believe there are people in high places in this company that has unclean feelings for such and is slowly making a effort to bring it down. The time is now to change positions by putting Truly dedicated people in those positions. Such a shame to let such a really good company be brought to ruins because of friends and hoodwinkers.

Jeffrey Blackwood

I am trying to understand what all of this really means.