Appearing at the Barclays Industrial Select Conference, management from Werner Enterprises (NASDAQ: WERN) said the negative impacts from recent winter storms would result in a 3- to 4-cent hit to first-quarter earnings.

The current consensus earnings estimate for the Omaha, Nebraska-based transportation and logistics provider is 67 cents per share.

Weather challenges

“Q1 weather has been a significant challenge to say the least,” said Derek Leathers, vice chairman, president and CEO of the 7,800-truck carrier. Poor weather has forced drivers to park their trucks, resulting in a freight backlog that could take a couple of weeks to unwind. The costs of paying drivers on downtime along with a higher frequency in roadside service events has created a “clear-cut impact to the quarter.”

The company has had to shut down more than 1,000 trucks per day recently. In past winters, it would only see up to a couple hundred trucks idled for a few hours at a time, mostly waiting for the storms to pass and roads to reopen. Widespread power outages have also slowed operations in some areas this winter.

‘Extreme oversold environment’

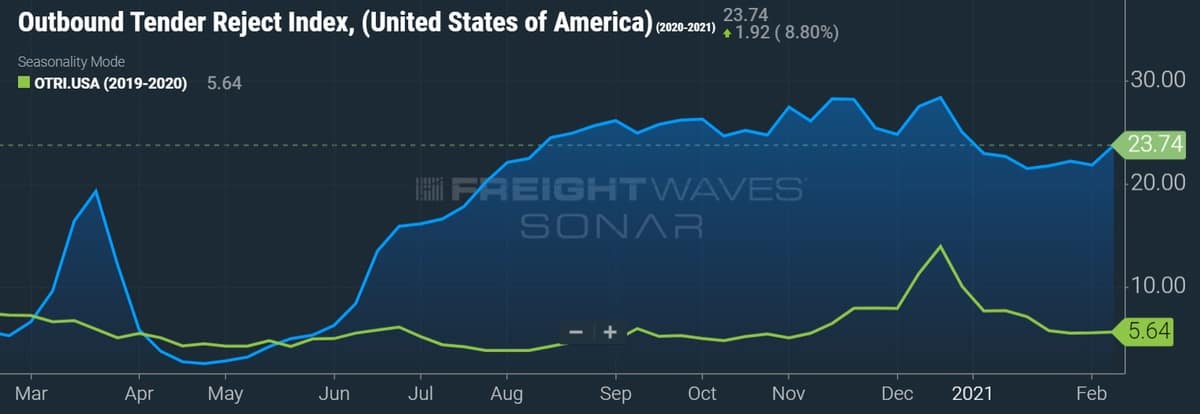

Other than the disruption from weather, truck demand remains “above normal seasonality,” which Leathers indicated will only extend the current demand cycle. Heading into the stretch of adverse weather, Werner’s trucks were oversold on a daily basis. The current weather wrinkle places its capacity in an “extreme oversold environment.”

The runway for inventory restocking will carry demand for “multiple quarters,” according to Werner CFO John Steele. He noted that most retailers reported “really tight inventory conditions” through the end of October, the close of the retail fiscal third quarter. During the period, increases in e-commerce and same-store sales significantly outpaced inventory additions.

“Since that time we had increases in COVID activity that slowed the ability of the suppliers to be able to deliver the merchandise needed,” said Steele.

Capacity ‘cavalry’ isn’t coming

Werner expects to increase earnings year-over-year again in 2021, following an 8% increase last year. Part of that expectation is based on fleet growth of 1% to 3%.

Leathers believes the capacity headwinds facing trucking are structural. Even after four consecutive months of new truck orders above 40,000 units, a level normally considered well into capacity expansion territory, he views the current orderbook as indicative of “replacement-level” demand.

“You start at the production level, the manufacturing level, and you look at OEM comments and public statements and it adds up to roughly replacement-level builds regardless of what the order board says,” Leathers commented. “They’re not going to be able to produce 400,000 trucks this year. They’re not going to be able to produce, in my estimation and their own words, 300,000 trucks this year. You’re looking at replacement level.”

The original equipment manufacturers faced significant downtime during COVID. Raw material and semiconductor shortages, in part due to import delays at the ports, are only adding to the production delays.

Capacity has also been curbed as driver schools produced 40% fewer graduates last year and the Drug & Alcohol Clearinghouse recorded 56,000 driver violations, 82% of which were related to positive drug tests. Leathers expects that number to double in 2021 as only half of the industry’s fleets have been added to the system.

With transportation employment and truck counts still below pre-COVID levels, amid a high-volume environment, Leathers isn’t expecting a capacity correction in the near term. “I don’t believe the cavalry is coming anytime soon. Our job is to do the best we can to increase capacity with the trucks we have.”

The expected shift in consumer spending from goods to services may not impact truck demand during 2021 either. Leathers believes a shift to services will not occur until widespread inoculation has occurred — peak season at the earliest in his view. But that is when most consumers start buying goods ahead of the holidays.

“They’re not going to not buy this year and tell the kids nothing’s under the tree because we are going to go to four concerts instead,” Leathers said.

Werner’s rate guidance calls for contractual pricing to increase by high single to low double digits in its one-way segment with dedicated seeing 3% to 5% rate growth. Leathers said Werner is seeing “those numbers and higher” currently but is sticking with the guidance, which admittedly is “consistent and conservative.”

Janet Yellen

Todd always does a good job with his articles. Keep up the good work, Todd.