The start of 2024 is bringing with it significant growth in volumes at top U.S. ports.

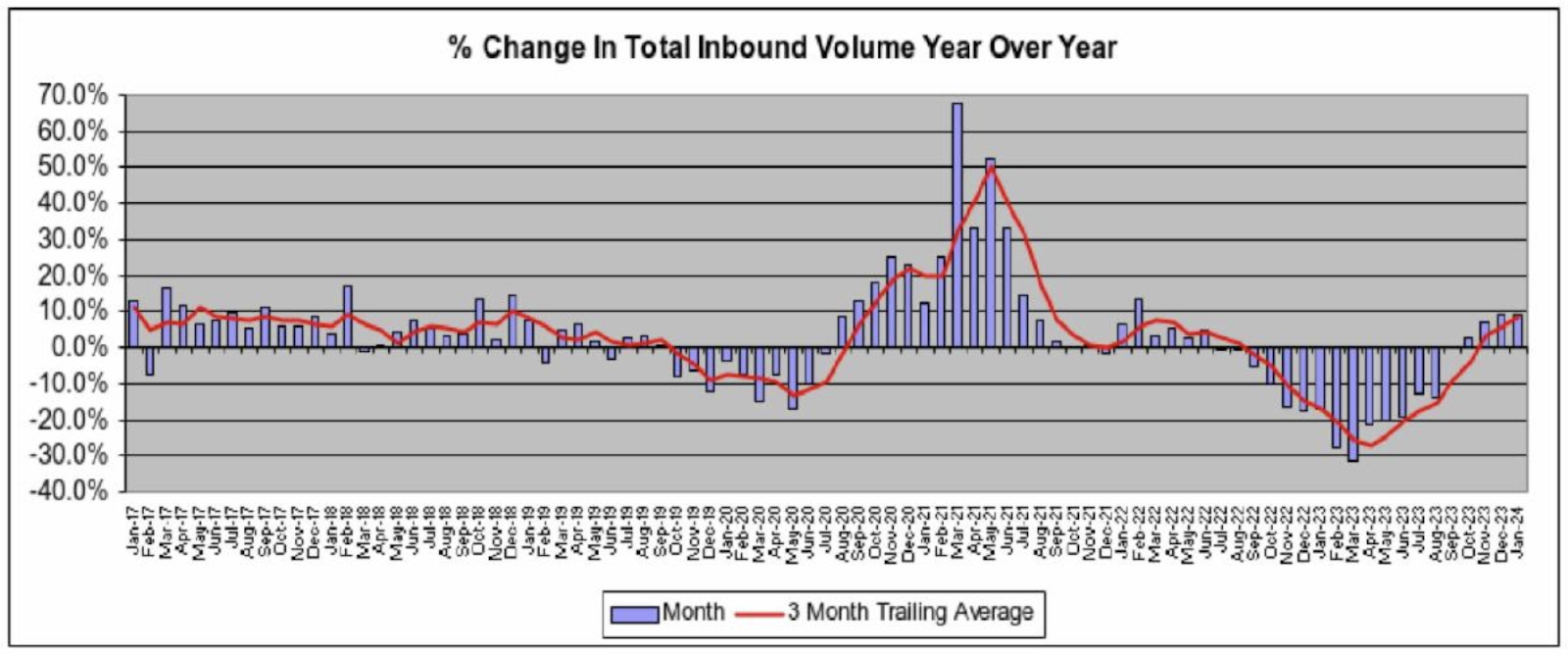

January witnessed a 9.2% year-over-year increase in inbound containers. This rise represents the latest reading in four consecutive months of growth, a beacon of positive momentum after a challenging period dominated by the post-pandemic downturn.

“We are now completely back to year over year changes being driven by underlying economic activity, as we are past the periods where such changes were driven by difficult earlier comparisons,” wrote John D. McCown, an independent analyst who compiles imports data on the top U.S. ports, in his latest monthly report.

For 15 tumultuous months, the top U.S. ports grappled with declines in y/y volume, a direct fallout from the COVID-19 U.S. import surge. The recent jump in inbound volumes suggests a turning tide, with the industry charting a course back toward stability and growth.

The increase in January’s inbound volume, building on an 8.9% rise in December, reflects robust demand for tangible goods and underscores the resilience of the economy in the face of adversity.

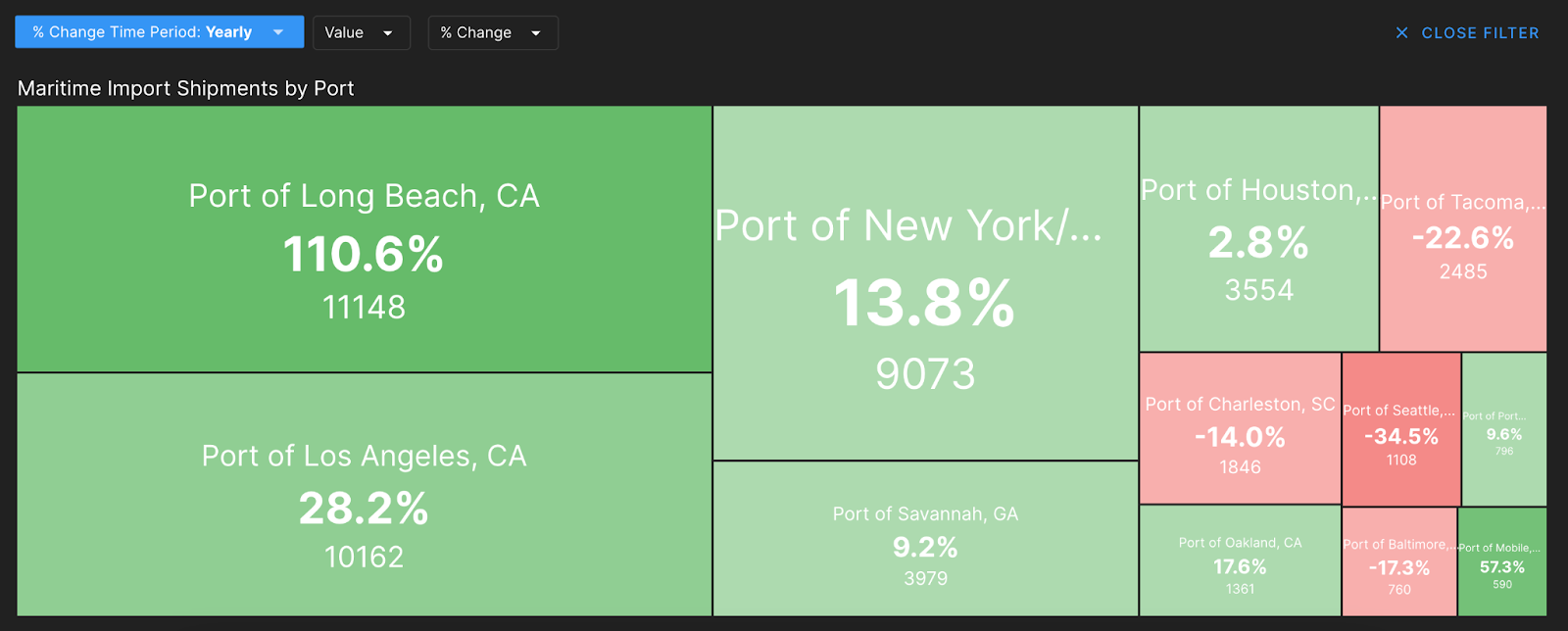

Coastal shifts and performance

The maritime landscape of 2024 has started with a resurgence at West Coast ports, particularly Long Beach, California, which alone heralded a 23.5% surge in January. This significant upswing to a 17.7% increase across the West Coast marks a reversal from the pandemic’s aftermath.

(Note that figures in the chart are for daily y/y changes in late February and are included primarily to show the latest trends. Percent changes should not be relied upon as definitive for how the full month of February will end up.)

RELATED: Port of Los Angeles shines in January

During the height of global disruptions, shippers increasingly favored the East and Gulf coasts in a bid to circumvent the logistical quagmires plaguing the West. However, recent trends indicate a return to pre-pandemic preferences, signaling a robust recovery and renewed confidence in West Coast capabilities.

The East and Gulf coasts painted a different picture, with a modest 2% increase in volume. Notably, Charleston, South Carolina, saw an 8.3% downturn, underscoring the uneven nature of the recovery across the nation’s maritime gateways. This disparity raises important questions about the underlying factors driving these regional performances.

While the West Coast’s rebound could be attributed to a confluence of improved efficiencies and strategic shifts, the East and Gulf coasts’ slower pace suggests potential challenges in maintaining the pandemic-era momentum.

Long-term growth and economic implications

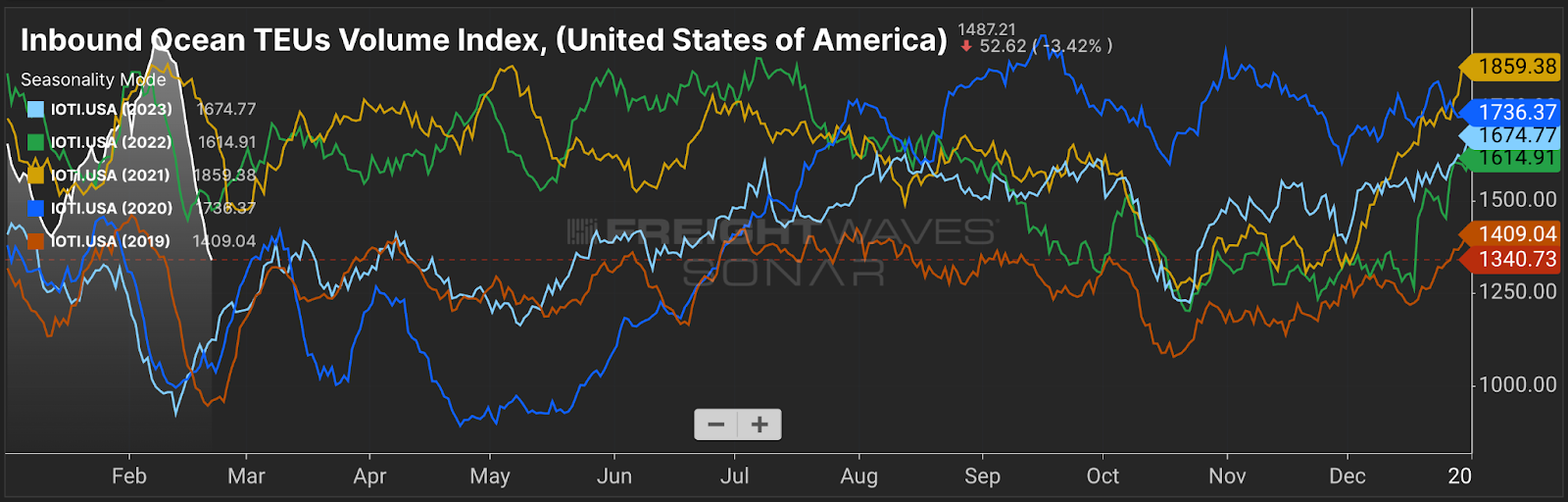

The white line on the chart above, indicating the Inbound Ocean TEUs Volume Index (IOTI.USA) for the United States in 2024, shows significant seasonal demand, even though the drop during this Lunar New Year appears markedly steeper than in previous years.

The overall higher trajectory of the 2024 line, even after the Lunar New Year adjustment, points to a sustained demand for imports, hinting at a hopefully positive outlook for trade volume growth through the year.

RELATED: Despite dim outlook, January imports grew at fastest pace in 7 years

January’s inbound load data, showing a 4% increase over the same month in 2019, marks a significant step toward pre-pandemic trade patterns. This translates to a compounded annual growth rate of 0.8% over five years, which is at least a steady trajectory. Such resilience in trade volumes is a welcome sign for North American freight providers.

The upward trend, however, does unfold within a context of moderated growth expectations. The projected annual future growth of approximately 2.7% signifies a recalibration of the trade sector’s outlook, adjusted for a landscape reshaped by geopolitical tensions, supply chain realignments and evolving market dynamics. It’s a promising rate, but it also trails the pre-pandemic 10-year average growth rate of 3.8%.

RELATED: Are ocean spot rates past their peak?

Ports act as barometers for economic health, with their performance offering insights into broader economic trends and shifts in trade patterns. These trends not only reflect the immediate impacts of pandemic-related disruptions but also signal longer-term structural shifts in trade routes and supply chain strategies.

As trade volumes continue to recover and adapt to these new realities, the focus will increasingly shift toward enhancing port efficiency, diversifying trade routes and investing in sustainable logistics solutions.

Related articles

- Analysis: Expeditors blames pandemic volatility for results but needs to tackle bloat

- Water level projections threaten future Panama Canal transits

- Tanker transits plunge 20% in Red Sea: Lloyd’s List

- Red Sea trouble threatens US freight recovery

- Red Sea turmoil drives Chinese exporters to rail, other alternatives

- Will shippers’ confidence change when carriers regain pricing power?

John D. McCown

Appreciate the thoughtful comments by Joe Antoshak on my latest analysis

Peter Ely

And APL just pulled their contract, away from the Union Parked Railroad for delays.

BNSF is the King of Railroads now

Just a guy in Dallas.

Panama constraints and weight restrictions of 9MT per container will direct cargo via the WC. LBCT is the only port ready and capable. All water routes are unstable, even comparably to recent standards. Pendulum services should be out the window.

Dave Williamson

Don’t you see the trend of shift, back to West Coast due to the Panama canal challenge. So cal is in big trouble we have so many warehouses empty and for lease I have never seen it like this. Everyone is strapped for money, We still pay over 4.29 a gal for gas, Everything is so expensive on the shelves.