An executive order issued by President Joe Biden has the potential to become one of the most important government documents in years directed at carriers and their customers working within the country’s transportation sector.

Key among the provisions of the “Executive Order on America’s Supply Chains,” issued Feb. 24 is a “sectoral supply chain assessment” of six industrial sectors, including transportation. It requires the secretary of transportation, consulting with the heads of the department’s modal agencies, to submit a report to the president within one year of the executive order that assesses “the role of transportation systems in supporting existing supply chains and risks associated with those transportation systems.”

The president’s advisers will have the authority to recommend adjustments to each industrial sector’s base assessment, including adding “digital networks, services, assets, data (‘digital product’), goods, services, and materials” to the scope, and add new assessments as appropriate. “We’re not going to wait for a review to be completed before we start closing the existing gaps,” Biden said before signing the order.

How important is this executive order for freight carriers and their customers? “I think this is going to be a wake-up call and will have a ripple effect across the entire logistics chain,” Jennifer Bisceglie, CEO of Interos, a supply chain monitoring and modeling company, told FreightWaves. “If I’m anywhere in the supply chain I’m taking a look at where I’m connected to this executive order, because it’s ultimately going to affect my business.”

Short-term uncertainty

As important as such a review is following the supply chain disruptions in the wake of the COVID-19 pandemic, the executive order is also vague enough to cause confusion. For example, what exactly is meant by “transportation industrial base?”

“It’s a bit unsettled, because that’s not a defined term,” Elizabeth Lowe, a lawyer with the firm Venable, told FreightWaves. “The expectation is that the Department of Transportation will provide more clarity as part of the review. But I would read it to mean affecting all modes — trucking, rail, air and ocean. Transportation overall is integral to supply chains, which is why the executive order is directed for six sectors, not just transportation.”

Bisceglie agrees that the order is vague, which will have an effect on how the industry tries to figure out how to initially respond to it.

“What normally happens in these cases is a slowdown in terms of executing a business strategy, because companies don’t know if that strategy will shift or change depending on the impact” of such a review, she said.

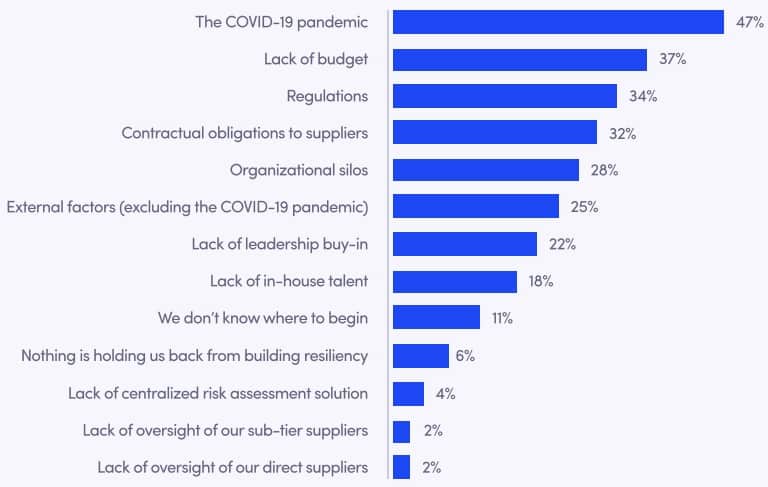

What holds you back from building resiliency into your global supply chain?

If you are a truckload carrier, for example, Bisceglie said those investment decisions can range from fleet assets to cybersecurity of technology systems that are shared with customers. “Knowing that cyber is a big piece of this, there may be regulatory concerns that [a carrier] may need to be aligned with after the review for which they don’t want to make a big investment in today.”

Long-term strategizing

Anna Nagurney, a supply chain and logistics expert at the University of Massachusetts at Amherst, said including all the transportation modes in the review is pivotal.

“The administration realizes that transportation is essential, because the results of the supply chain analyses of the 100-day product review could lead to onshoring and more domestic manufacturing, as well as more domestic exploration of raw materials that go into vaccines and other products,” Nagurney told FreightWaves. “That’s going to impact the transportation networks, where you could see changes in freight flows.”

Nagurney noted that paralleling the review are discussions within the Biden administration and on Capitol Hill about infrastructure investment — and its recent mediocre (C-minus) grade from the American Society of Civil Engineers.

“I was hoping to see the review of transportation services tied into an emphasis in investing in the infrastructure, because not doing so undercuts the investments in transportation assets.” But she also said it was encouraging to see in the order a requirement to identify investment in education and training of workforce skills needed for the transportation sector. “We have a truck driver shortage that needs to be addressed.”

A “just-in-time” directive

The executive order could also prove pertinent as supply chains face more stress in the year ahead. In its latest report released on Monday, the National Retail Federation (NRF), which tracks volume through the nation’s largest container ports, forecast “what could turn out to be record retail sales growth in 2021, and retailers are importing huge amounts of merchandise to meet the demand,” NRF stated.

“Imports at the nation’s largest retail container ports are expected to grow dramatically during the first half of 2021 as increased vaccination and continued in-store safety measures enable additional shopping options,” according to NRF, which sees container volume growing 23.3% during that time compared with the same period in 2020.

“One of the issues not highlighted within the executive order are the current massive backups and delays we’re seeing in U.S. supply chains,” Lowe said. “You have dozens of vessels waiting outside Los Angeles and Long Beach that could be filled with retail goods, [personal protective equipment], pharmaceutical supplies and other critical supplies. If these record imports continue at a time when we already have a backlog, it further underscores the need to address these issues.”

Regulatory changes ahead?

Biden’s directive is still in the early stages, but if you’re a carrier or shipper it’s not too early to start engaging to get ahead of potential policy and regulatory changes, Lowe said.

“While it’s hard to say what transportation companies should do specifically to prepare for this review, they should be proactive in participating so that they have some say in shaping policy. Transportation companies are aware of the risks to supply chains more than anyone so they’re in a good position to help reach the goals of the executive order.”

Lowe recommended reaching out to DOT and its modal agencies — the Federal Motor Carrier Safety Administration or the Maritime Administration, for example — to express interest in participating and providing insight in connection with the review.

“Agencies will likely be reaching out to the industry as this progresses, so if they already have a list of companies and associations saying, ‘I’m here and would like to participate,’ those would likely be some of the first they would reach out to.”

Related articles:

Mike

Everything democrats do is “vague” so they can change it as they go. They will not be satisfied until they control every aspect of our lives. Elections have consequences.

Julie Duerr

I am so tired of those that have no knowledge of transportation making the decisions for trucking regulations. Teamsters should not be influencing HOS regulations. Hell they are the ones holding up my drivers at deliveries!

George Kochanowski

Who exactly is doing the review…?

Where can they be contacted..?